So, you’re thinking about starting a Limited Liability Company (LLC) in the beautiful state of Colorado? Awesome! You’re taking a smart step for your business. One of the most important, yet often overlooked, documents for your LLC is the operating agreement. Think of it as the constitution for your company, outlining the rules and regulations for how things will run. It’s not just some legal jargon; it’s a roadmap for success.

Now, while Colorado doesn’t legally *require* you to have an operating agreement, trust me, you absolutely want one. It helps prevent misunderstandings, disagreements, and potential legal headaches down the road. It’s especially crucial if you have multiple members in your LLC, as it clarifies everyone’s roles, responsibilities, and ownership percentages. Imagine trying to build a house without a blueprint – that’s what running an LLC without an operating agreement is like.

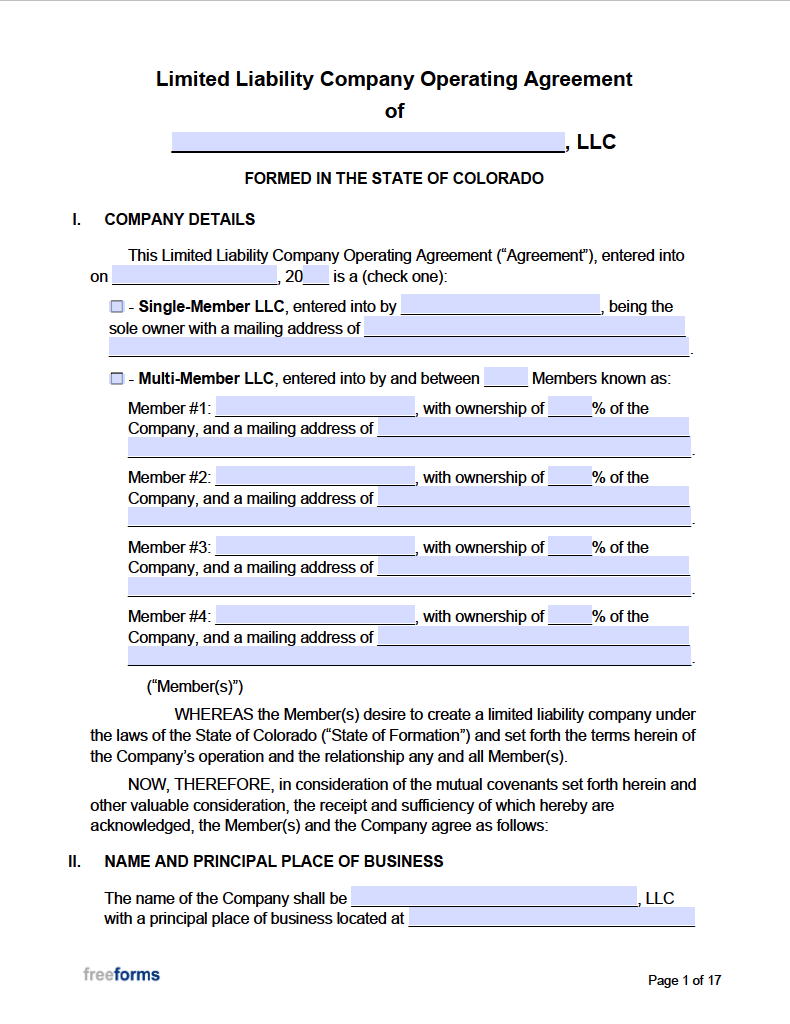

Thankfully, you don’t have to start from scratch. There are plenty of resources available to help you create your own. A Colorado LLC operating agreement template can be a lifesaver, providing a solid foundation that you can customize to fit your specific business needs. Let’s explore what makes a great template and how to use it effectively. It’s all about setting yourself up for success from the get-go!

Why a Colorado LLC Operating Agreement is Essential

Okay, let’s dive deeper into why an operating agreement is such a big deal. Think of it this way: life throws curveballs. Business partnerships, like any relationship, can experience disagreements. An operating agreement acts as a referee, providing clear guidelines and procedures to resolve disputes fairly and efficiently. Without it, you’re relying on Colorado’s default LLC laws, which might not align with what you and your partners actually want.

Beyond conflict resolution, an operating agreement also protects your personal assets. By clearly defining the separation between your personal finances and your LLC’s finances, you reinforce the limited liability aspect of your company. This means that if your LLC incurs debt or faces lawsuits, your personal assets (like your house or car) are generally protected. This protection is crucial, but can be weakened without a solid operating agreement.

Furthermore, a well-drafted operating agreement clarifies member roles and responsibilities. Who’s in charge of what? Who has the authority to make certain decisions? These are all questions that should be answered upfront to avoid confusion and ensure smooth operations. It’s also the place to outline how profits and losses will be distributed among the members. Will it be based on ownership percentage, or will there be other factors involved? Defining these aspects from the start prevents potential resentment and keeps everyone on the same page.

Another important aspect is the process for adding or removing members. What happens if a member wants to leave the LLC? What if you want to bring in a new partner? An operating agreement should outline the procedures for these scenarios, including how the departing member’s ownership interest will be valued and transferred. This provides clarity and avoids potential legal battles later on.

Finally, consider the future. What happens to the LLC if a member dies or becomes incapacitated? An operating agreement can specify what happens to their ownership interest in such situations, ensuring a smooth transition and preventing the LLC from dissolving unexpectedly. Think of it as estate planning for your business. Having this documented early will protect your partners and your business for years to come.

Key Sections of a Colorado LLC Operating Agreement Template

So, what exactly should a Colorado LLC operating agreement template include? While the specific content will vary depending on your business needs, here are some key sections that you should always consider incorporating. Start with the basics: the name and address of your LLC, as well as the names and addresses of all the members. This establishes the fundamental identity of your company.

Next, define the purpose of your LLC. What specific business activities will it engage in? This section should be broad enough to allow for future growth and expansion, but specific enough to provide clarity and avoid ambiguity. Also, clearly state the duration of the LLC. Will it exist for a specific period of time, or will it be perpetual? Most LLCs are formed with a perpetual duration, meaning they will continue to exist until formally dissolved.

Now, let’s talk about capital contributions. How much money or assets will each member contribute to the LLC? This section should detail the initial contributions of each member, as well as any future contributions that may be required. It should also outline the consequences for failing to make required contributions. A well-defined contribution plan ensures everyone is equally invested in the company’s success. You can find a colorado llc operating agreement template to help you understand the different elements of this section and how it relates to your LLC.

One of the most important sections is the allocation of profits and losses. As mentioned earlier, this section should clearly state how profits and losses will be distributed among the members. Will it be based on ownership percentage, or will there be other factors involved? Be as specific as possible to avoid any misunderstandings. If there are specific tasks performed by one partner versus another, consider a different payment structure outlined here to avoid any friction in the future.

Finally, don’t forget about management and decision-making. Will the LLC be member-managed, or will it be manager-managed? If it’s member-managed, all members will participate in the day-to-day operations of the business. If it’s manager-managed, one or more designated managers will be responsible for the operations. Regardless of which structure you choose, clearly outline the roles and responsibilities of each member or manager, as well as the procedures for making important decisions. With a solid colorado llc operating agreement template, it will guide the way and you will have this critical document setup in no time.

Using a colorado llc operating agreement template gives you a solid start in writing this essential document for your Colorado business. By customizing it to fit your specific circumstances, you’ll establish a clear framework for how your LLC will operate.

Ultimately, creating a comprehensive operating agreement is an investment in the long-term success of your Colorado LLC. It’s about proactively addressing potential challenges and ensuring that everyone is on the same page. Don’t skimp on this crucial step.