Navigating the world of commercial real estate can feel like traversing a complex maze. Among the crucial documents you’ll encounter, the commercial building lease agreement stands out as a cornerstone. It’s the legal bedrock upon which landlord-tenant relationships are built, outlining the rights, responsibilities, and expectations of both parties. This agreement ensures a smooth and predictable occupancy of the commercial space. Without a carefully crafted lease, misunderstandings and disputes can easily arise, potentially leading to costly legal battles and strained business relationships.

Whether you’re a seasoned business owner expanding your operations or a first-time entrepreneur setting up shop, understanding the ins and outs of a commercial building lease agreement template is paramount. This document covers everything from rent payments and lease duration to permitted uses of the property and maintenance responsibilities. It’s designed to protect both the landlord’s investment and the tenant’s ability to operate their business effectively.

Think of it as a detailed roadmap for your tenancy. The more thorough and precise the agreement, the less room there is for ambiguity and conflict. This article aims to demystify the process, providing you with the knowledge and insights you need to confidently approach your next commercial lease negotiation. We’ll explore key provisions, common pitfalls, and how a well-structured commercial building lease agreement template can save you time, money, and headaches down the road.

Key Components of a Commercial Building Lease Agreement

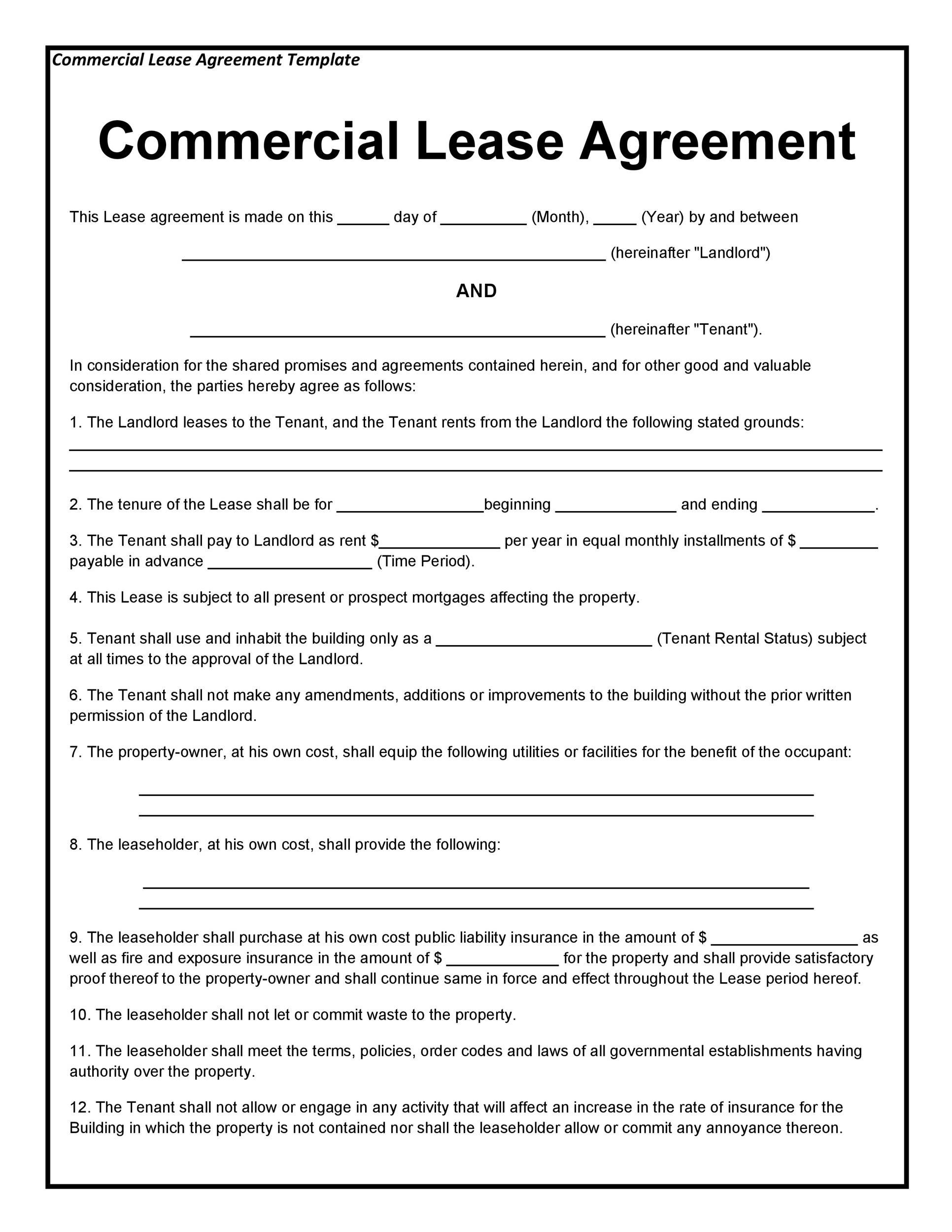

A comprehensive commercial lease agreement covers a wide range of aspects, each playing a crucial role in defining the terms of the tenancy. Let’s break down some of the key components you’ll typically find in a commercial building lease agreement template:

Identification of Parties: The agreement must clearly identify both the landlord (lessor) and the tenant (lessee), including their legal names and addresses. This ensures clarity and avoids any confusion regarding who is bound by the terms of the lease.

Description of the Premises: A precise description of the leased premises is essential. This includes the street address, suite number (if applicable), and a detailed description of the space being leased, including square footage. A floor plan or map may also be included as an exhibit to the lease.

Lease Term: The lease term specifies the duration of the tenancy, including the commencement date and the expiration date. Commercial leases can range from short-term agreements (e.g., one year) to long-term leases (e.g., five years or more), depending on the needs of the parties.

Rent and Payment Terms: This section outlines the amount of rent to be paid, the frequency of payments (e.g., monthly), the due date, and the acceptable methods of payment. It should also address any late payment penalties or grace periods.

Use of Premises: The lease agreement should clearly define the permitted uses of the leased premises. This is crucial for ensuring that the tenant’s business activities are compatible with the building’s zoning regulations and do not interfere with other tenants. For example, a lease may specify that the premises can only be used for retail purposes or office space.

Additional Important Clauses

Beyond the core components, several other clauses are commonly found in commercial leases and deserve careful attention:

Maintenance and Repairs: This section outlines the responsibilities of the landlord and the tenant regarding the maintenance and repair of the leased premises. It should specify who is responsible for repairs to the roof, HVAC system, plumbing, and other building systems.

Insurance: The lease should specify the insurance requirements for both the landlord and the tenant. The tenant typically needs to carry commercial general liability insurance to protect against claims arising from their business operations.

Alterations and Improvements: This clause addresses whether the tenant is permitted to make alterations or improvements to the leased premises. If alterations are allowed, the lease should specify the process for obtaining the landlord’s approval and whether the tenant is required to restore the premises to their original condition at the end of the lease term.

Assignment and Subletting: This section addresses whether the tenant is allowed to assign the lease to another party or sublet the premises to a subtenant. Landlords often restrict assignment and subletting to maintain control over who occupies their property.

Default and Remedies: The lease should outline the events that constitute a default by either the landlord or the tenant, as well as the remedies available to the non-defaulting party. Common defaults include failure to pay rent or failure to comply with other lease provisions.

Avoiding Common Pitfalls in Commercial Leases

Navigating a commercial building lease agreement can be tricky, and there are several common pitfalls to watch out for. Being aware of these potential issues can help you negotiate a lease that protects your interests and avoids future disputes.

Failing to Negotiate: Don’t assume that the initial lease offered by the landlord is the only option. Many terms are negotiable, including rent, lease term, and responsibilities for maintenance and repairs. Be prepared to advocate for your needs and seek legal advice if necessary.

Ignoring Hidden Costs: Rent is just one component of the total cost of leasing commercial space. Be sure to factor in other expenses such as common area maintenance (CAM) charges, property taxes, insurance, and utilities. These costs can significantly impact your overall budget.

Overlooking the Fine Print: Read the entire lease agreement carefully, paying close attention to the fine print. Don’t hesitate to ask questions about anything you don’t understand. It’s better to clarify ambiguities before signing the lease than to face unexpected consequences later on.

Inadequate Due Diligence: Before signing a lease, conduct thorough due diligence on the property and the landlord. This includes verifying the landlord’s ownership, researching the building’s history, and inspecting the premises for any existing problems. A commercial building lease agreement template will help with getting this done.

Not Seeking Legal Advice: Commercial leases are complex legal documents, and it’s always wise to seek legal advice from an experienced attorney before signing one. An attorney can review the lease, identify potential risks, and negotiate terms that are favorable to your interests.

Ultimately, a well-crafted commercial building lease agreement template offers a robust framework for a successful and mutually beneficial landlord-tenant relationship. By understanding the key components, considering the potential pitfalls, and seeking professional advice, you can navigate the complexities of commercial leasing with confidence.

Taking the time to carefully review and understand the terms of a lease is an investment in your business’s future. A clear and comprehensive agreement will minimize the risk of disputes and provide a solid foundation for a productive and profitable tenancy.