So, you’re thinking about taking the plunge and acquiring a commercial property, but maybe you’re not quite ready for a full-blown purchase. Or perhaps you’re a landlord looking to attract a tenant with a unique offer. Enter the commercial lease purchase agreement – a hybrid approach that combines the benefits of leasing and buying. It’s like dating before getting married, but for real estate. This type of agreement can be a fantastic option for both tenants and landlords, providing flexibility and potential long-term gains.

Think of it this way: you’re essentially renting the property with the option to buy it at a later date. A portion of your monthly rent payments might even go towards the eventual purchase price, acting like a built-in savings plan. This can be particularly appealing for businesses that are growing and want to test the waters before committing to a significant investment. It allows you to establish your business in a desirable location while simultaneously building equity.

However, navigating the legal landscape of commercial real estate can be tricky. That’s where a solid commercial lease purchase agreement template comes in handy. It provides a framework for outlining all the essential terms and conditions, ensuring both parties are protected and on the same page. Finding the right template is crucial because it needs to reflect the specifics of your situation and comply with local laws. A well-drafted agreement helps to avoid misunderstandings and disputes down the road, leading to a smoother and more successful transaction.

Understanding the Key Components of a Commercial Lease Purchase Agreement

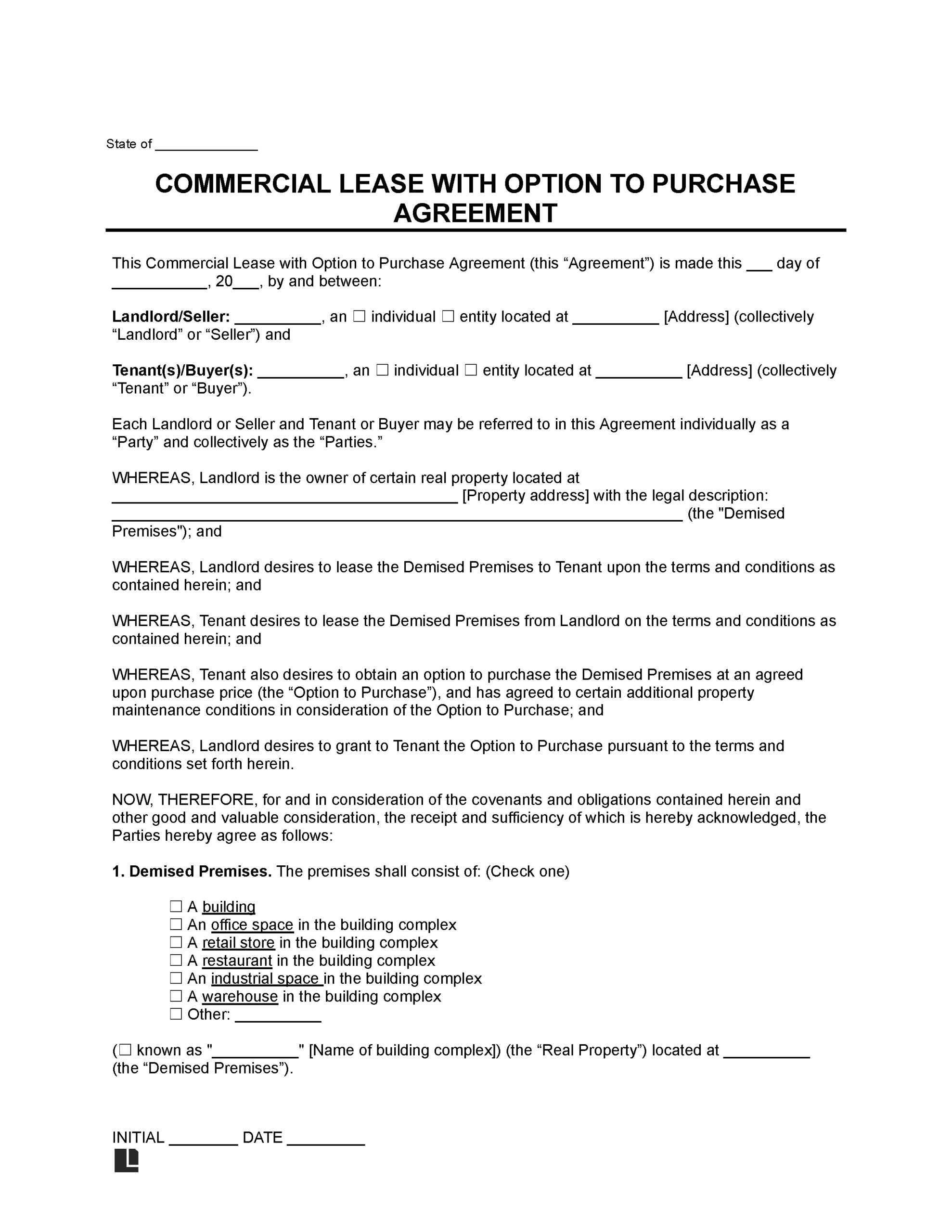

A commercial lease purchase agreement is more than just a standard lease. It’s a legally binding contract that outlines the terms of the lease, as well as the option to purchase the property at a predetermined price and within a specific timeframe. Let’s break down some of the most important components that are typically included in a commercial lease purchase agreement template.

First and foremost, the agreement should clearly identify the parties involved: the landlord (also known as the lessor) and the tenant (also known as the lessee or potential buyer). It should include their full legal names and addresses. The property being leased and potentially purchased needs to be precisely described, including the street address, any suite numbers, and a legal description if available. This ensures that there’s no ambiguity about the property involved in the transaction.

The lease term is another critical element. This section specifies the length of the lease, including the start and end dates. It’s essential to clearly define how long the tenant has to occupy the property under the lease terms before the option to purchase can be exercised. The rent amount, payment schedule, and any late payment penalties should also be clearly stated. Don’t forget to include details on who is responsible for property taxes, insurance, and maintenance. Will the tenant handle certain repairs, or is that the landlord’s responsibility? Being upfront about these obligations can prevent conflict later on.

Now, let’s talk about the purchase option. This is where the magic happens! The agreement needs to clearly define the purchase price of the property, or at least the method for determining the purchase price (e.g., a fair market value appraisal). It should also specify the timeframe within which the tenant must exercise their option to purchase. For example, they might have the option to buy the property anytime during the last year of the lease term. The agreement should also address how the option is exercised – usually through written notice to the landlord.

Important Clauses to Consider

Finally, don’t forget about the crucial clauses that protect both parties. Consider including clauses that address issues like default, termination, assignment, and subletting. What happens if the tenant fails to make rent payments? What happens if the landlord fails to maintain the property? Having clear guidelines for these scenarios can save a lot of headaches. A force majeure clause, which excuses performance due to unforeseen circumstances like natural disasters, is also a smart addition. It is always advised to have your lawyer to review the document.

Benefits of Using a Commercial Lease Purchase Agreement Template

Using a commercial lease purchase agreement template offers several advantages for both landlords and tenants. For tenants, it provides an opportunity to secure a property without the immediate financial burden of a down payment and mortgage. It allows them to test the suitability of the location for their business before committing to a full purchase. Think of it as a trial run before the real deal.

Landlords, on the other hand, can attract tenants who might not otherwise be able to afford a commercial property. It can also provide a steady stream of income while potentially selling the property at a higher price in the future. A well-structured template can help streamline the negotiation process and ensure that all key terms are addressed upfront. By using a pre-built framework, landlords can save time and money on legal fees, while still ensuring that their interests are protected.

Moreover, a commercial lease purchase agreement template can reduce the risk of misunderstandings and disputes. By clearly outlining the responsibilities of both parties, the agreement provides a roadmap for the entire transaction. This can help to foster a positive landlord-tenant relationship and minimize the potential for conflict. A clear agreement makes managing the lease simpler for everyone involved.

Of course, it’s important to remember that a template is just a starting point. It’s always recommended to consult with a qualified attorney to review the template and ensure that it meets your specific needs and complies with all applicable laws. Legal advice can help identify potential risks and ensure that the agreement is tailored to your unique circumstances. While a commercial lease purchase agreement template can be a valuable tool, it should never be used as a substitute for professional legal counsel.

Ultimately, the goal is to create an agreement that is fair, transparent, and legally sound. By carefully considering all the essential components and seeking expert advice, both landlords and tenants can benefit from this flexible and innovative approach to commercial real estate.

Choosing the right commercial property can be a major step for any business, and the structure of the agreement is vital to get right. A lease purchase agreement can be a pathway to ownership, making it a valuable option to explore.

With a clear understanding of the agreement’s components and careful legal guidance, businesses and property owners can successfully navigate this unique real estate transaction and achieve their long-term goals.