Navigating the world of commercial loans can be tricky, especially when you’re trying to secure the best possible terms for your business. That’s where a commercial loan broker comes in – they act as an intermediary between you and various lenders, helping you find the right loan product to meet your specific needs. But before you dive into a relationship with a broker, it’s crucial to have a solid commercial loan broker agreement template in place. This document outlines the responsibilities, fees, and expectations of both parties, ensuring a transparent and legally sound partnership.

Think of it like this: you wouldn’t build a house without blueprints, right? Similarly, you shouldn’t engage a commercial loan broker without a well-defined agreement. This agreement serves as your roadmap, clarifying the scope of the broker’s services, the compensation structure, and what happens if things don’t go according to plan. It provides peace of mind and protects your interests throughout the loan procurement process.

This article will delve into the essential components of a commercial loan broker agreement template, helping you understand what to look for and how to tailor it to your unique situation. We’ll explore key clauses, discuss common pitfalls to avoid, and provide insights on how to ensure a fair and effective agreement that benefits both you and your broker. Let’s get started on building that solid foundation for your commercial loan journey.

Key Elements of a Robust Commercial Loan Broker Agreement Template

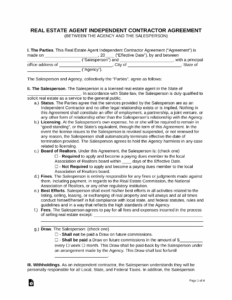

A comprehensive commercial loan broker agreement template should cover several essential aspects to ensure clarity and protect both the borrower and the broker. First and foremost, it needs to clearly define the scope of services the broker will provide. This includes specifying the types of loans the broker is authorized to pursue on your behalf, the geographical area they will operate in, and the specific lenders they are permitted to approach. Leaving this vague can lead to misunderstandings and potentially wasted time and effort.

Compensation is another critical element. The agreement must explicitly state how the broker will be compensated for their services. This could be a flat fee, a percentage of the loan amount, or a combination of both. It’s crucial to understand when the broker’s fee is earned, how it will be calculated, and when it is payable. Transparency in compensation avoids future disputes and ensures that both parties are on the same page regarding financial expectations.

The agreement should also address the broker’s obligations regarding confidentiality and conflicts of interest. The broker will likely have access to sensitive financial information, so it’s important to include a clause that protects the confidentiality of your data. Similarly, the agreement should address how the broker will handle any potential conflicts of interest, such as representing multiple clients who are seeking similar loans from the same lender. A clear process for disclosing and resolving conflicts is essential for maintaining trust and ensuring that the broker is acting in your best interest.

Furthermore, the agreement should outline the term of the agreement and the conditions under which it can be terminated. This includes specifying the length of the agreement and the circumstances under which either party can terminate the relationship, such as breach of contract or failure to perform. Having a clear termination clause provides both parties with an exit strategy if the relationship is not working out as expected.

Finally, consider including clauses that address issues such as indemnification, dispute resolution, and governing law. Indemnification clauses protect each party from liability arising from the other party’s actions. Dispute resolution clauses outline the process for resolving disagreements, such as mediation or arbitration. Governing law clauses specify the jurisdiction whose laws will govern the agreement. These clauses, though often overlooked, can be crucial in resolving any disputes that may arise during the course of the agreement.

Understanding Exclusivity and Non-Exclusivity

Within a commercial loan broker agreement template, the concepts of exclusivity and non-exclusivity play a significant role. An exclusive agreement means you agree to work solely with that broker for a specific period, preventing you from engaging other brokers. This can be beneficial if you’re confident in the broker’s abilities and network. However, it also limits your options. A non-exclusive agreement allows you to work with multiple brokers simultaneously, potentially increasing your chances of finding the best loan terms. Carefully weigh the pros and cons of each option before making a decision.

Avoiding Common Pitfalls in Your Commercial Loan Broker Agreement Template

While having a commercial loan broker agreement template is essential, it’s equally important to ensure that it’s well-drafted and avoids common pitfalls that can lead to disputes or unfavorable outcomes. One common mistake is failing to adequately define the broker’s scope of authority. The agreement should clearly specify what actions the broker is authorized to take on your behalf, such as negotiating loan terms or submitting loan applications. Without a clear definition of authority, the broker could potentially bind you to agreements that you didn’t approve or intend to enter into.

Another pitfall is ambiguous language regarding compensation. The agreement should clearly state the exact amount or percentage of the broker’s fee, as well as the conditions under which it is earned and payable. Avoid vague terms like “reasonable fee” or “customary commission,” as these can be subject to interpretation and lead to disagreements. Instead, use precise language that leaves no room for ambiguity.

Failing to address the issue of due diligence is another common mistake. The agreement should specify whether the broker is responsible for conducting due diligence on the lenders they recommend. This includes verifying the lender’s license, financial stability, and reputation. If the broker is not responsible for due diligence, it’s crucial that you take steps to conduct your own thorough investigation before engaging with any lender.

It’s also important to avoid including clauses that are unduly favorable to the broker. For example, a clause that requires you to pay the broker’s fee even if you don’t ultimately obtain a loan through their efforts could be considered unfair. Similarly, a clause that limits your ability to terminate the agreement without cause could put you at a disadvantage. Carefully review all clauses to ensure that they are fair and reasonable to both parties.

Finally, always seek legal advice before signing a commercial loan broker agreement template. An attorney can review the agreement to ensure that it is legally sound and protects your interests. They can also help you negotiate favorable terms and identify any potential red flags. Investing in legal advice upfront can save you significant time and money in the long run.

Having a properly structured commercial loan broker agreement template is necessary to protect your business during this important financing process. Neglecting this vital step could lead to significant financial and legal repercussions.

Remember that this agreement sets the stage for a professional and mutually beneficial relationship, ensuring both parties understand their roles and responsibilities throughout the commercial loan procurement process. A well-crafted agreement provides clarity, protects your interests, and helps pave the way for a successful financing outcome.