Finding the perfect space for your business can be exciting, but navigating the world of commercial leases can feel daunting. A long-term lease might seem like a big commitment, especially if you’re a startup or your business needs are evolving. That’s where a commercial month to month lease agreement template comes in handy. It offers flexibility and a shorter commitment period, making it an attractive option for many business owners. This type of agreement allows you to lease a commercial property on a monthly basis, providing the freedom to adjust your space as needed without being locked into a lengthy contract.

Think of it as a trial run for your business location. You can assess the suitability of the space, the neighborhood, and the terms of the lease without committing to years of rent payments. This flexibility can be a lifesaver if your business is seasonal, experiencing rapid growth, or simply unsure about its long-term needs. Plus, it gives you the option to renegotiate the lease terms more frequently, adapting to changing market conditions or your business’s financial situation.

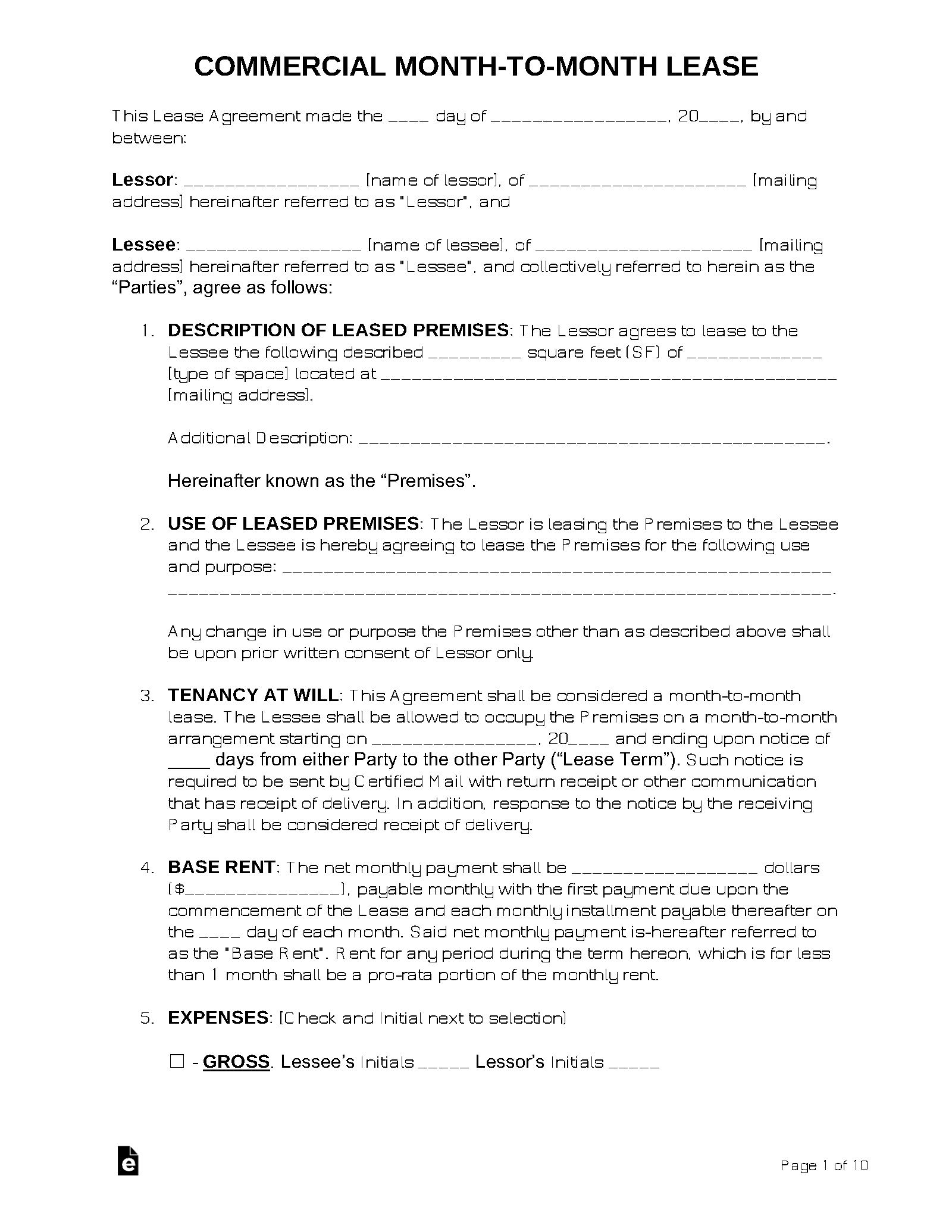

In this article, we’ll explore the ins and outs of commercial month to month lease agreements, covering everything from what to include in your template to the pros and cons of choosing this type of lease. Whether you’re a landlord or a tenant, understanding the nuances of these agreements can help you protect your interests and make informed decisions about your commercial property needs. Let’s dive in and uncover the essentials of a commercial month to month lease agreement template.

Understanding the Commercial Month to Month Lease Agreement

A commercial month to month lease agreement is a rental contract that allows a tenant to occupy a commercial property for one month at a time. Unlike a fixed-term lease, which typically lasts for a year or more, a month to month lease automatically renews each month unless either the landlord or the tenant provides notice of termination. This flexibility makes it an attractive option for businesses that need short-term space or are unsure about their long-term needs. It’s essential to understand the key features and considerations involved in this type of agreement to ensure a smooth and mutually beneficial arrangement.

One of the most important aspects of a commercial month to month lease is the notice period required for termination. Typically, this is 30 days, but it can vary depending on state laws and the specific terms of the agreement. This means that either party must provide written notice at least 30 days before the intended date of termination. Failure to provide adequate notice can result in penalties, such as forfeiture of the security deposit or liability for additional rent payments. It’s crucial to clearly define the notice requirements in the lease agreement to avoid any misunderstandings or disputes.

Another key consideration is the rent amount and any potential rent increases. While a month to month lease offers flexibility, it also allows the landlord to increase the rent more frequently than with a fixed-term lease. Landlords must provide proper notice of any rent increases, typically 30 days, but again, this can vary based on local laws. Tenants should carefully consider their budget and ability to accommodate potential rent increases when deciding whether a month to month lease is the right choice for their business.

The terms of a commercial month to month lease agreement should also clearly outline the responsibilities of both the landlord and the tenant. This includes maintenance and repairs, utilities, insurance, and any restrictions on the use of the property. It’s important to specify who is responsible for which expenses to avoid disputes later on. For example, the lease should state whether the landlord or tenant is responsible for maintaining the HVAC system, landscaping, and snow removal. It should also clarify whether the tenant is allowed to make any modifications to the property, such as painting or installing new fixtures.

Finally, it’s always recommended to consult with an attorney before signing any commercial lease agreement. An attorney can review the terms of the lease, identify any potential risks or ambiguities, and advise you on your legal rights and obligations. This can help you avoid costly mistakes and ensure that the lease agreement protects your interests.

Benefits and Drawbacks of a Commercial Month to Month Lease

Choosing a commercial month to month lease offers a unique set of advantages, particularly for businesses seeking flexibility and adaptability. The most significant benefit is the short-term commitment. This is perfect for startups, seasonal businesses, or companies anticipating growth or change. You’re not locked into a long-term contract, allowing you to adjust your space as your business evolves. This can be incredibly valuable in uncertain economic times or when testing a new market.

However, this flexibility comes with potential drawbacks. The landlord also has the ability to terminate the lease or increase the rent with relatively short notice. This lack of long-term security can be problematic if you need a stable location for your business. Finding and moving to a new location on short notice can be disruptive and expensive. So, while the flexibility is attractive, it’s important to weigh the potential for instability.

Another benefit for tenants is the ability to renegotiate lease terms more frequently. If market conditions change or your business needs evolve, you can discuss potential adjustments with the landlord more easily than with a long-term lease. This can be particularly useful if you’re seeking to expand your space or negotiate a lower rent rate. However, it also means that the landlord can renegotiate terms more frequently, potentially leading to less favorable conditions for the tenant.

For landlords, a commercial month to month lease offers the advantage of higher rental rates. Since the lease is short-term, landlords can often charge a premium compared to long-term leases. This can be attractive if you’re looking to maximize your rental income. However, it also means that you may experience higher vacancy rates as tenants move in and out more frequently. This can lead to increased costs for marketing, property maintenance, and tenant screening.

Ultimately, the decision of whether to pursue a commercial month to month lease depends on your specific circumstances and risk tolerance. It’s essential to carefully consider the pros and cons, weigh the potential benefits against the potential drawbacks, and consult with an attorney or real estate professional before making a decision. Understanding the nuances of this type of lease can help you make an informed choice that aligns with your business goals and financial stability. Searching online for a “commercial month to month lease agreement template” can be a great starting point, but remember to tailor it to your specific needs and local laws.

Choosing the right lease can feel overwhelming, but starting with a clear understanding of your options is key to a successful business venture. The flexibility of a month to month arrangement can be a strategic advantage.

Taking the time to understand the details will empower you to make the best decision for your business’s unique needs, setting you up for success in the long run.