Navigating the world of commercial mortgages can feel like traversing a labyrinth. There are so many lenders, loan products, and terms to consider. That’s where a commercial mortgage broker comes in. These professionals act as intermediaries, connecting borrowers with the right lenders and guiding them through the complex loan application process. But before you engage a broker, it’s crucial to have a clear understanding of their fees and how they’re structured. This is where a commercial mortgage broker fee agreement template becomes your best friend.

Think of a commercial mortgage broker fee agreement template as a roadmap. It outlines the services the broker will provide, the fees they’ll charge, and the circumstances under which those fees are earned. It’s a vital document that protects both the borrower and the broker, ensuring transparency and setting clear expectations from the outset. Without a well-defined agreement, misunderstandings can arise, leading to disputes and potentially jeopardizing the entire loan process.

In this article, we’ll delve into the ins and outs of commercial mortgage broker fee agreement template. We’ll explore what it is, why it’s important, and what key elements it should contain. By understanding these aspects, you can confidently enter into an agreement with a broker, knowing you’re protected and informed throughout the commercial mortgage journey.

Understanding the Commercial Mortgage Broker Fee Agreement

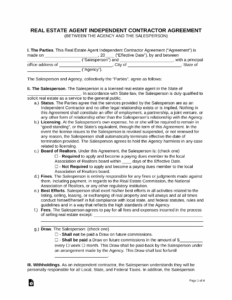

A commercial mortgage broker fee agreement is essentially a legally binding contract that defines the relationship between you, the borrower, and the commercial mortgage broker. It spells out the scope of services the broker will render, the compensation they’ll receive for those services, and the terms governing that compensation. It’s designed to protect all parties involved by clearly articulating expectations and mitigating potential disagreements down the line. This document provides clarity on the crucial question: how does the broker get paid?

The agreement should meticulously detail exactly what the broker will do for you. This might include things like analyzing your financial situation, identifying suitable lenders, preparing loan applications, negotiating loan terms, and assisting with the closing process. The more specific the description of services, the better. This prevents ambiguity and ensures everyone is on the same page regarding the broker’s responsibilities. Think of it like a detailed job description for the broker’s role in securing your commercial mortgage.

One of the most crucial aspects of the agreement is, of course, the fee structure. Commercial mortgage brokers can be compensated in a variety of ways. Some might charge a percentage of the loan amount, while others might use a flat fee or an hourly rate. The agreement should clearly state the exact fee structure, including how the fee is calculated and when it is payable. It’s also important to clarify whether the fee is contingent on the successful closing of the loan. Are you on the hook if the loan falls through for reasons outside your control? The agreement needs to address this.

Furthermore, a good agreement will address potential conflicts of interest. For instance, does the broker have a preferred relationship with certain lenders? If so, the agreement should disclose this information. It’s important to be aware of any potential biases the broker might have, as this could influence their recommendations. Transparency is key to building trust and ensuring that the broker is acting in your best interest.

Finally, the agreement should include clauses covering termination, dispute resolution, and governing law. What happens if you want to terminate the agreement before the loan is closed? How will disputes be resolved if they arise? Which state’s laws will govern the agreement? These are important considerations that should be addressed in the agreement to protect both parties in the event of unforeseen circumstances. Having these points clear from the beginning avoids future headaches.

Key Elements of a Commercial Mortgage Broker Fee Agreement Template

While specific agreements may vary, here are some key elements you should look for in a commercial mortgage broker fee agreement template:

- Identification of Parties: Clearly state the names and addresses of both the borrower and the broker.

- Scope of Services: Define the specific services the broker will provide.

- Fee Structure: Detail the method of compensation, including the amount, calculation, and payment schedule.

- Contingency Clause: Specify whether the fee is contingent on the successful closing of the loan.

- Conflict of Interest Disclosure: Disclose any potential conflicts of interest the broker may have.

- Termination Clause: Outline the conditions under which either party can terminate the agreement.

- Dispute Resolution: Specify the method for resolving disputes, such as mediation or arbitration.

- Governing Law: Indicate which state’s laws will govern the agreement.

Why Use a Commercial Mortgage Broker Fee Agreement Template?

Using a commercial mortgage broker fee agreement template offers numerous advantages for both borrowers and brokers. For borrowers, it provides a clear understanding of the broker’s services, fees, and responsibilities, empowering them to make informed decisions. It also ensures transparency and prevents misunderstandings, reducing the risk of disputes down the road. Knowing exactly what you’re paying for and when eliminates surprises and fosters a more trusting relationship with your broker. The use of a template also gives a sense of security that most important points have been covered.

For brokers, a well-drafted template streamlines the process of onboarding new clients and ensures consistency in their agreements. It protects their interests by clearly defining their scope of work and the compensation they’re entitled to. It also reduces the risk of legal challenges by providing a legally sound framework for their services. Using a template can save time and resources by eliminating the need to draft a new agreement from scratch for each client. It’s simply more efficient for the broker to operate from a reliable starting point.

A commercial mortgage broker fee agreement template also promotes professionalism and builds trust with clients. By presenting a clear and comprehensive agreement, brokers demonstrate their commitment to transparency and ethical business practices. This can enhance their reputation and attract more clients. When prospective borrowers see a well-organized and thorough agreement, it gives them confidence in the broker’s abilities and integrity. This is a competitive advantage.

Moreover, using a template can help ensure compliance with relevant laws and regulations. Commercial mortgage lending is subject to various legal requirements, and a well-drafted agreement can help brokers stay on the right side of the law. By including necessary disclosures and clauses, the agreement can mitigate the risk of legal penalties and protect the broker’s business. This is an important consideration for any broker operating in the commercial mortgage space.

Ultimately, a commercial mortgage broker fee agreement template is a valuable tool for both borrowers and brokers. It promotes transparency, protects interests, streamlines processes, and ensures compliance. By using a template, both parties can enter into the relationship with confidence and peace of mind, knowing that their rights and responsibilities are clearly defined. It’s an investment in a smoother and more successful commercial mortgage transaction.

In summary, a well-crafted commercial mortgage broker fee agreement template is not just a piece of paper; it is a critical instrument that promotes clarity, transparency, and mutual protection. Taking the time to understand and utilize such a template can significantly improve the commercial mortgage process for all parties involved.

This tool is vital for anyone seeking a commercial mortgage and engaging a broker to help navigate the complexities of the market. Consider exploring the available resources and adapting a commercial mortgage broker fee agreement template to your specific needs for a more secure and transparent financial journey.