So, you’re diving into the world of commercial real estate. Exciting times! Whether you’re a seasoned business owner looking to expand or a budding entrepreneur securing your first brick-and-mortar location, understanding the ins and outs of commercial leases is absolutely crucial. And let’s be honest, nobody wants to wade through mountains of legal jargon. That’s where a solid commercial property lease agreement template comes into play. It’s your starting point, your foundation for a secure and successful tenancy.

Think of a commercial property lease agreement template as a roadmap. It outlines the rights and responsibilities of both the landlord and the tenant. It’s a document that anticipates potential issues and provides a clear framework for resolving them. Without it, you’re navigating uncharted territory, potentially opening yourself up to misunderstandings, disputes, and even costly legal battles down the road. Trust me; a well-defined lease is your best friend in this process.

This article will guide you through the essentials of commercial property lease agreement template, highlighting key provisions and offering practical advice on how to use them effectively. We’ll break down the complex language into manageable pieces, empowering you to confidently navigate the leasing process and secure a space that perfectly aligns with your business needs. So, let’s get started on this journey together and explore how a commercial property lease agreement template can protect your interests and set you up for success.

Key Components of a Commercial Property Lease Agreement Template

A commercial property lease agreement template, at its core, is a legally binding document that outlines the terms and conditions under which a tenant can occupy a commercial property. These templates are not one-size-fits-all, and it’s crucial to understand each section to ensure it adequately covers your specific situation. Let’s break down some of the vital components you’ll typically find in a commercial lease agreement template.

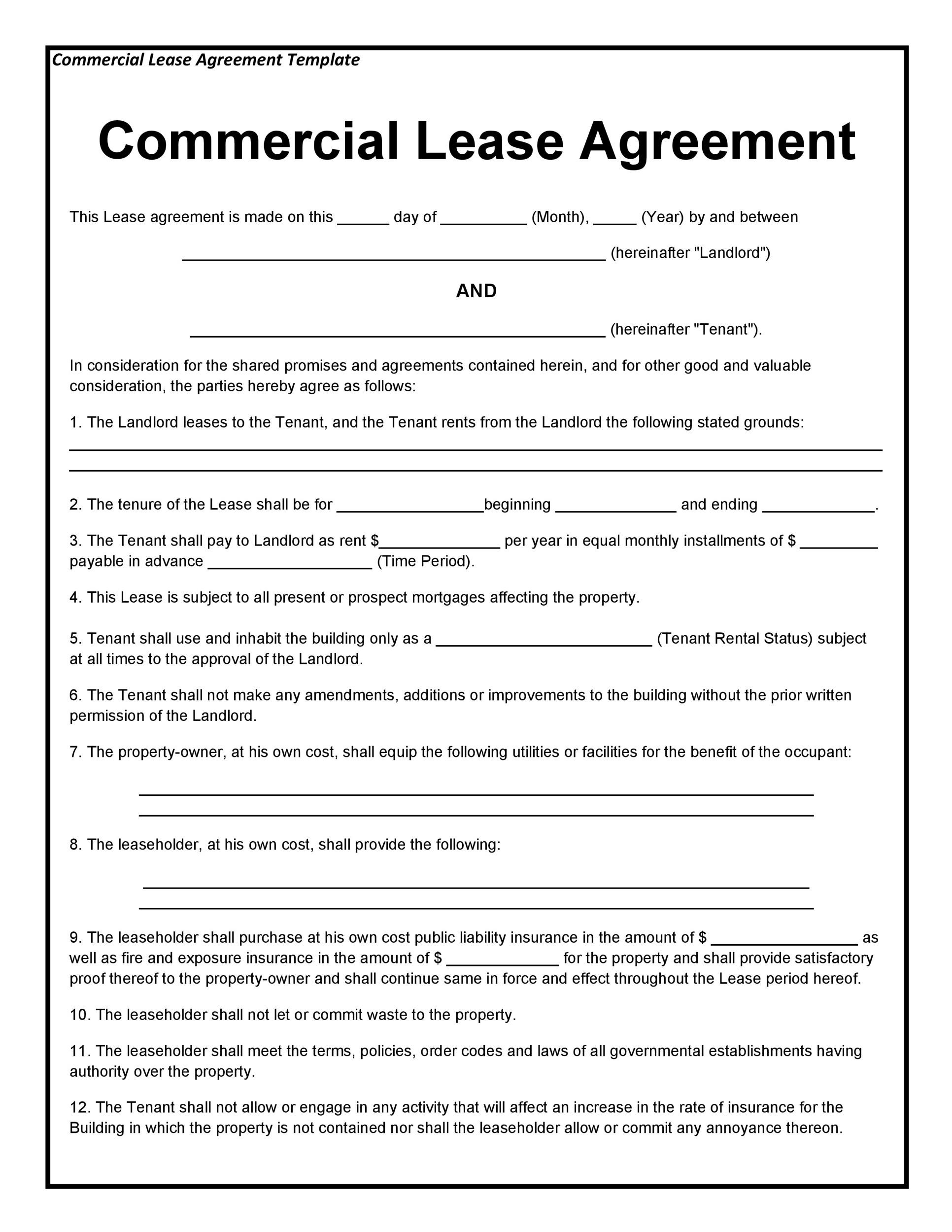

First and foremost, the lease should clearly identify the parties involved – the landlord (lessor) and the tenant (lessee). This section will include their legal names and addresses. Accuracy here is essential, as any errors could lead to confusion and potential legal challenges later on. The template will also describe the property being leased, including its address and a detailed description of the space. This might include square footage, specific rooms or areas, and any common areas the tenant has access to. A clear description minimizes ambiguity and prevents disputes over the property’s boundaries.

Next, the lease term needs to be explicitly stated. This refers to the length of the lease agreement, including the start and end dates. Commercial leases can range from short-term (e.g., a few months) to long-term (e.g., several years), and the term will significantly impact the tenant’s investment and business planning. Rent, of course, is a critical component. The template will specify the amount of rent due, the frequency of payments (usually monthly), and the acceptable methods of payment. It will also outline any late payment penalties or grace periods. Furthermore, the lease should address rent escalations, detailing how and when the rent might increase over the lease term.

Another crucial section covers permitted use. This clause defines how the tenant is allowed to use the leased property. It prevents the tenant from engaging in activities that are prohibited by zoning laws or that could damage the property or disturb other tenants. For example, a lease might specify that the property can only be used for retail sales and not for manufacturing or storage. Maintenance and repairs are also important. The lease should clearly state who is responsible for maintaining the property, including interior and exterior repairs, landscaping, and snow removal. Typically, the landlord is responsible for major structural repairs, while the tenant is responsible for day-to-day maintenance.

Finally, the lease should address insurance requirements, outlining the types and amounts of insurance the tenant must carry. It may also include clauses regarding subletting, assignment, termination, and default. Subletting refers to renting the property to another party, while assignment involves transferring the entire lease to another party. Termination clauses specify the conditions under which either party can terminate the lease before the end of the term, and default clauses outline the consequences of failing to comply with the lease terms. Due diligence in reviewing each of these components within a commercial property lease agreement template ensures both parties are protected.

Negotiating Key Lease Terms

While a commercial property lease agreement template provides a solid foundation, remember that it’s just a starting point. Don’t be afraid to negotiate key terms to better align with your specific business needs and circumstances. Rent is always a negotiable item. Research comparable properties in the area to determine fair market rent, and be prepared to justify your offer based on factors like property condition, location, and amenities. Lease term is another area for negotiation. Consider your long-term business plans and try to secure a lease term that provides stability without locking you into a space that may no longer be suitable in the future. The permitted use clause can also be negotiated. If you anticipate needing flexibility in how you use the property, be sure to negotiate a broad and inclusive use clause.

Navigating Common Pitfalls and Legal Considerations

Entering into a commercial lease agreement is a significant commitment, and it’s essential to be aware of potential pitfalls and legal considerations to avoid costly mistakes. One common mistake is failing to thoroughly review the entire lease document. Don’t just skim through it – read every clause carefully and ask questions about anything you don’t understand. Another pitfall is overlooking hidden costs. In addition to rent, you may be responsible for other expenses, such as property taxes, insurance, and common area maintenance (CAM) fees. Make sure you understand all of these costs and factor them into your budget.

Another common mistake is not understanding the implications of the default clause. This clause outlines the consequences of failing to comply with the lease terms, such as non-payment of rent or violation of the permitted use clause. A default can lead to eviction and legal action, so it’s crucial to understand your obligations and avoid any actions that could trigger a default.

From a legal standpoint, it’s crucial to ensure that the lease agreement complies with all applicable laws and regulations. This includes zoning laws, building codes, and environmental regulations. Failure to comply with these laws can result in fines, penalties, and even the termination of the lease. It’s also important to understand your rights and responsibilities as a tenant. You have the right to quiet enjoyment of the property, meaning the landlord cannot unreasonably interfere with your business operations. You also have the responsibility to maintain the property in good condition and comply with all lease terms.

Engaging legal counsel is extremely beneficial, particularly if you are not familiar with the commercial leasing process. An attorney can review the lease agreement, identify potential risks, and negotiate on your behalf to protect your interests. They can also advise you on your legal rights and responsibilities and ensure that the lease complies with all applicable laws. While legal fees may seem like an added expense, they can be a worthwhile investment that saves you money and headaches in the long run. Utilizing a solid commercial property lease agreement template and seeking professional advice allows you to approach the commercial leasing process with confidence.

Always remember to keep thorough records of all communications with the landlord, including emails, letters, and phone conversations. This documentation can be invaluable in resolving disputes and protecting your rights. Also, make sure to keep a copy of the signed lease agreement in a safe and accessible place.

Taking the time to carefully review a commercial property lease agreement template, understanding your obligations, and seeking professional advice can significantly reduce the risk of misunderstandings and disputes down the road. It’s an investment in your business’s future and ensures a smoother, more successful tenancy. Approaching the commercial leasing process with knowledge and caution is crucial for your business’s success.

Ultimately, securing a commercial property for your business is a big step, and approaching it with the right tools and knowledge makes all the difference. A well-crafted commercial property lease agreement template combined with diligent research and, if needed, expert legal advice, can pave the way for a thriving business environment.