So, you’re diving into the world of commercial real estate? That’s a big step! Buying a commercial property is a significant investment, whether you’re expanding your existing business, starting a new venture, or simply adding to your investment portfolio. But before you pop the champagne and envision your name on the building, there’s a crucial piece of paperwork you need to nail down: the commercial property purchase agreement template.

Think of a commercial property purchase agreement template as the blueprint for the entire transaction. It outlines all the terms and conditions of the sale, ensuring both the buyer and the seller are on the same page. It details everything from the purchase price and payment schedule to the responsibilities of each party and the contingencies that must be met before the deal is finalized. Without a solid agreement, you’re basically navigating a complex maze blindfolded. No one wants that!

This document isn’t just a formality; it’s a legally binding contract that protects your interests. It helps prevent misunderstandings, resolves potential disputes, and provides a clear roadmap for a smooth and successful transaction. In this article, we’ll break down the key components of a commercial property purchase agreement template, helping you understand what to look for and how to use it effectively. Getting this right can save you a lot of headaches, and potentially a lot of money, down the road.

Understanding the Key Elements of a Commercial Property Purchase Agreement Template

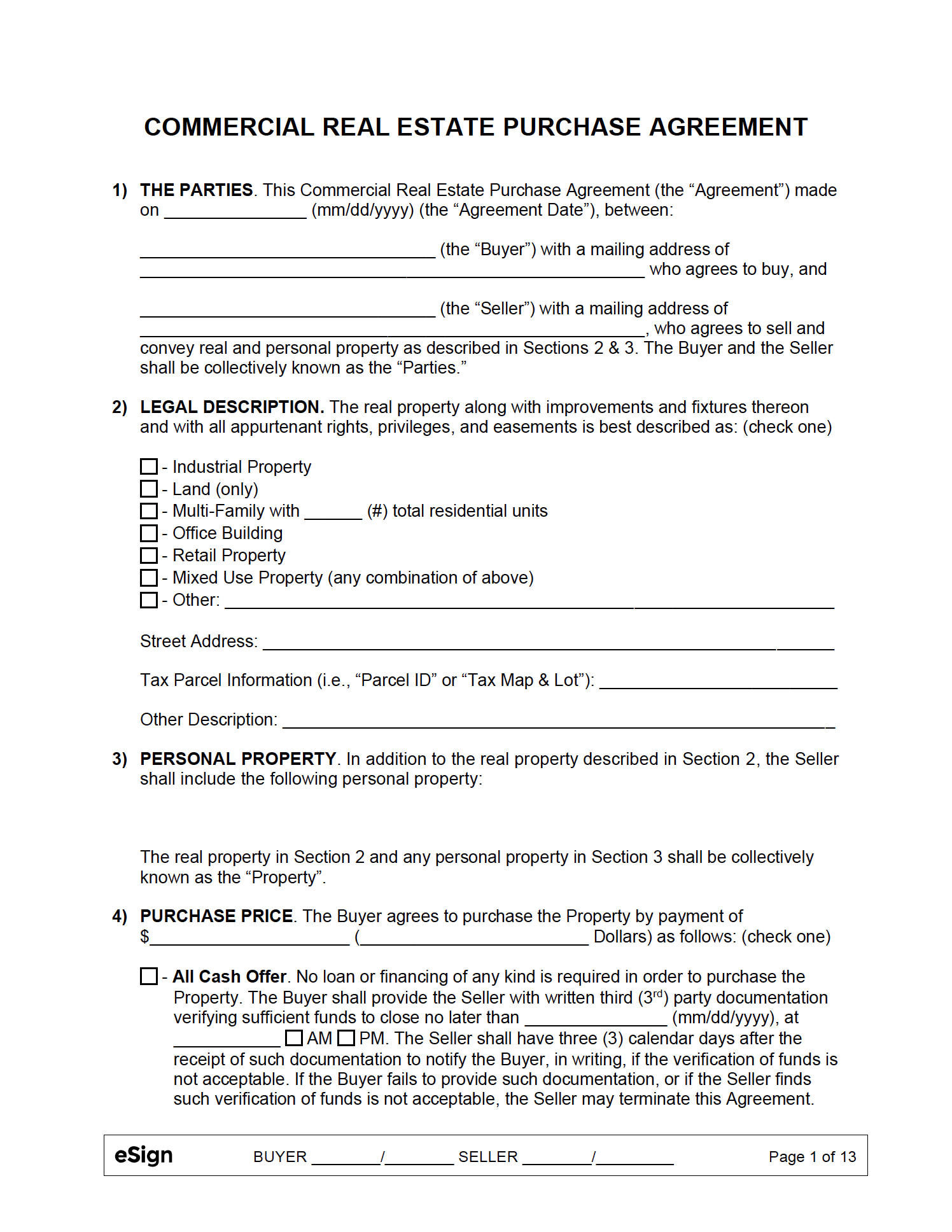

A commercial property purchase agreement template is a comprehensive document, and it’s essential to understand each section to ensure your interests are protected. Let’s explore some of the critical elements you’ll typically find in such a template. First, you’ll encounter the identification of the parties involved. This section clearly states the legal names and addresses of both the buyer and the seller. Accuracy is paramount here, as any discrepancies can lead to legal complications later on.

Next comes a detailed description of the property. This isn’t just the street address; it includes the legal description, which can be found in the property’s deed. This description precisely identifies the boundaries and any easements or rights-of-way associated with the property. It also specifies any fixtures or personal property included in the sale, such as appliances, equipment, or furniture. Leaving any ambiguity here can lead to disputes over what exactly is being purchased.

The purchase price and payment terms are, of course, a central part of the agreement. This section specifies the agreed-upon price for the property, the amount of the earnest money deposit, and the schedule for remaining payments. It also outlines the method of payment, whether it’s cash, financing, or a combination of both. If financing is involved, the agreement may include a contingency that allows the buyer to back out if they are unable to secure financing within a specified timeframe.

Contingencies are conditions that must be met before the sale can be finalized. Common contingencies include inspections, appraisals, and title searches. An inspection contingency allows the buyer to have the property professionally inspected for any structural or environmental issues. An appraisal contingency ensures that the property’s value is in line with the purchase price. A title search contingency verifies that the seller has clear ownership of the property and that there are no liens or encumbrances that could affect the buyer’s rights. If any of these contingencies are not met, the buyer may have the right to terminate the agreement and receive their earnest money back.

Finally, the agreement will include clauses addressing default, remedies, and governing law. The default clause outlines what happens if either party fails to fulfill their obligations under the agreement. The remedies clause specifies the legal recourse available to the non-defaulting party, which may include monetary damages or specific performance (requiring the defaulting party to fulfill their obligations). The governing law clause specifies the jurisdiction whose laws will govern the interpretation and enforcement of the agreement. Understanding these clauses is crucial for knowing your rights and responsibilities throughout the transaction.

Using a Commercial Property Purchase Agreement Template Effectively

Now that you understand the key elements of a commercial property purchase agreement template, let’s talk about how to use it effectively. First and foremost, remember that a template is just a starting point. While it provides a solid framework, it’s essential to customize it to fit the specific details of your transaction. Every commercial property deal is unique, and a one-size-fits-all approach simply won’t cut it. Seek legal counsel to review and adjust the template to protect your specific interests.

Engaging a real estate attorney is crucial when using a commercial property purchase agreement template. An attorney can help you understand the legal implications of each clause, identify potential risks, and negotiate favorable terms. They can also ensure that the agreement complies with all applicable laws and regulations. Don’t underestimate the value of professional legal advice; it can save you significant time, money, and headaches in the long run. Trying to go it alone without the proper expertise can expose you to unnecessary risks.

Before signing the agreement, carefully review every section and make sure you understand all the terms and conditions. Don’t hesitate to ask questions if anything is unclear. Pay particular attention to the contingencies, as these can significantly impact your rights and obligations. Be realistic about the timeframes involved and ensure that you have sufficient time to complete all necessary due diligence, such as inspections, appraisals, and title searches.

Negotiation is a key part of the process. Don’t be afraid to negotiate the terms of the agreement to your advantage. This may involve adjusting the purchase price, modifying the contingencies, or adding clauses that address your specific concerns. Remember that everything is negotiable, and a skilled negotiator can help you achieve a more favorable outcome. Be prepared to compromise, but also stand firm on issues that are critical to your interests.

Finally, keep a well-organized record of all documents related to the transaction, including the purchase agreement, correspondence, inspection reports, and appraisals. This documentation will be invaluable if any disputes arise or if you need to refer back to specific terms of the agreement. Maintaining a clear and complete record will help you navigate the transaction smoothly and protect your interests throughout the process. Using a commercial property purchase agreement template is an important first step, but due diligence and professional guidance are essential for a successful outcome.

Navigating the world of commercial real estate can seem daunting, but with a clear understanding of the processes involved, you can confidently approach your next investment. Remember that the key is to be informed, prepared, and to seek professional guidance when needed. A well-executed deal can lay the foundation for future success.

Commercial real estate offers unique opportunities for growth and investment. By taking the time to understand the details of each transaction and ensuring that your interests are protected, you can position yourself for long-term financial gain. Don’t hesitate to reach out to experienced professionals who can provide valuable insights and support along the way.