Embarking on a commercial venture, whether it’s opening a cozy cafe, a bustling boutique, or a state-of-the-art office, requires a solid foundation. One of the most crucial elements of this foundation is the lease agreement. Think of it as the blueprint for your business’s occupancy, outlining the rights, responsibilities, and expectations of both you, the tenant, and the landlord. It’s a document you’ll want to get right, avoiding potential pitfalls down the road.

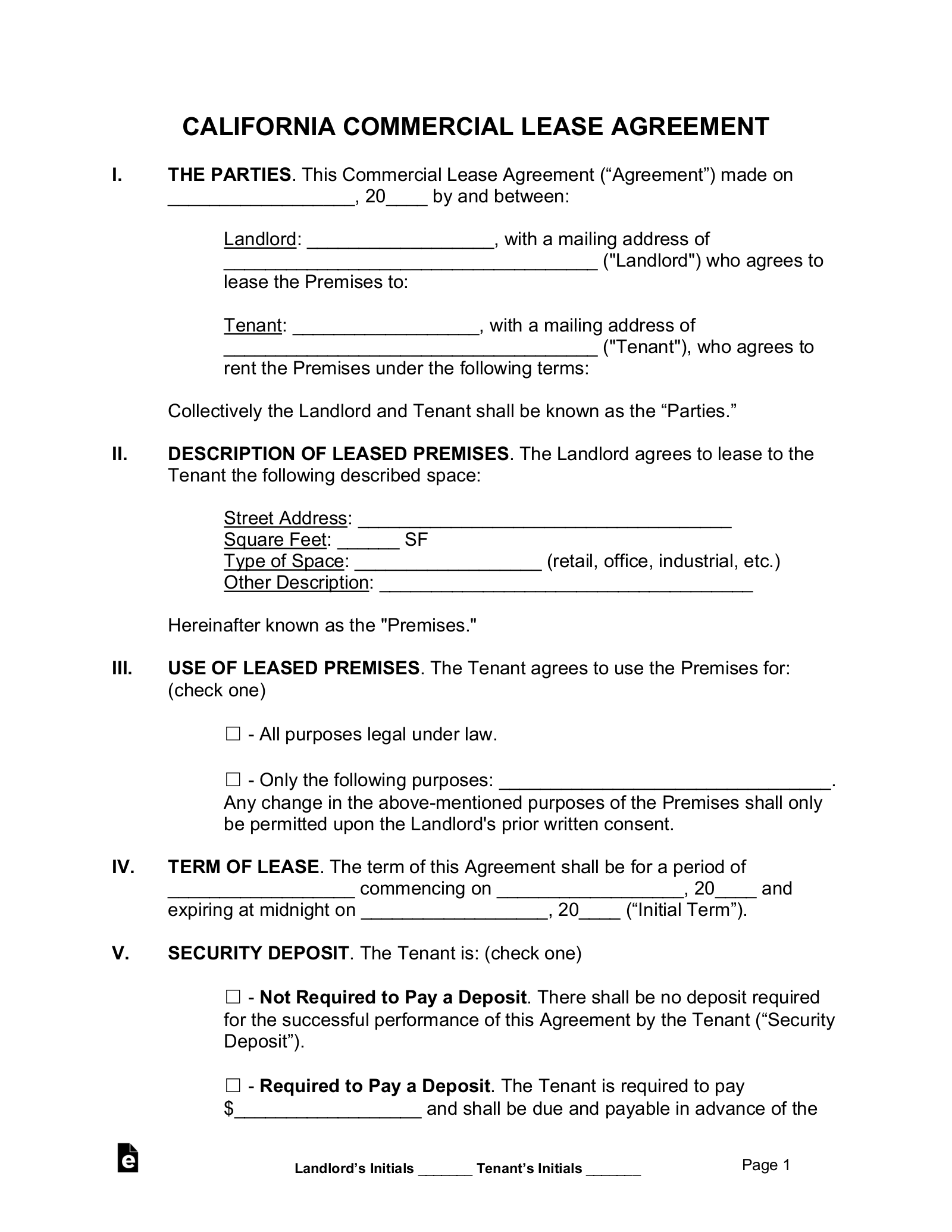

Navigating the world of commercial leases can feel daunting, especially with all the legal jargon involved. That’s where a commercial tenant lease agreement template comes in handy. It provides a pre-structured framework, guiding you through the essential clauses and considerations necessary for a comprehensive agreement. It’s not a one-size-fits-all solution, but it’s a fantastic starting point that can save you time and, potentially, costly legal fees.

This article aims to demystify the commercial lease agreement process. We’ll explore the key components of a commercial tenant lease agreement template, providing insights and guidance to help you tailor it to your specific needs. Understanding the ins and outs of this document will empower you to negotiate effectively and protect your business interests. So, let’s dive in and unlock the secrets of a successful commercial lease!

Understanding the Core Components of a Commercial Tenant Lease Agreement

A commercial tenant lease agreement, while seemingly complex, is essentially a detailed roadmap outlining the terms of your tenancy. It defines the relationship between you and your landlord, specifying everything from the rent amount to the permitted use of the property. Understanding the core components is crucial for ensuring that your business is protected and that you’re entering into an agreement that aligns with your operational needs and financial capabilities.

One of the most fundamental aspects is identifying the parties involved. This includes the full legal names and addresses of both the landlord and the tenant. Clarity here is paramount, as it establishes the legal entities bound by the agreement. Next, the property itself must be clearly defined. This means providing a detailed description of the premises, including the street address, suite number (if applicable), and any common areas included in the lease. A clear description prevents any future disputes about the boundaries of the leased space.

The lease term, or the duration of the tenancy, is another critical element. This specifies the start and end dates of the lease, outlining the period for which you have the right to occupy the space. Understanding the lease term is crucial for long-term business planning and investment decisions. Closely related to the lease term is the renewal option. Does the lease include an option to renew for an additional period? If so, what are the terms and conditions for renewal, such as the renewal rent and the notice period required to exercise the option?

Rent is, of course, a key consideration. The lease agreement should clearly state the base rent amount, the payment schedule (e.g., monthly, quarterly), and the method of payment. It should also address any potential rent increases over the lease term, specifying the formula or mechanism for calculating these increases. Many commercial leases also include provisions for additional rent, such as common area maintenance (CAM) charges, property taxes, and insurance costs. Understanding these additional expenses is essential for accurately budgeting your operating costs.

Finally, the “Use of Premises” clause is exceptionally important. This section dictates the permitted uses of the leased space. It’s crucial to ensure that your intended business activities are explicitly allowed under this clause. For example, if you plan to operate a restaurant, the lease must permit restaurant use. Restrictions on use can significantly impact your business operations and should be carefully reviewed before signing the agreement. Always review a commercial tenant lease agreement template thoroughly.

Exploring Sub-clauses and Additional Considerations

Beyond the core components, several sub-clauses and additional considerations deserve careful attention. These can significantly impact your rights and responsibilities as a tenant.

Assignment and Subletting: Does the lease allow you to assign the lease to another party or sublet the premises? These provisions provide flexibility if your business needs change or if you need to downsize. Repairs and Maintenance: Who is responsible for maintaining the property? The lease should clearly delineate the responsibilities of the landlord and the tenant for repairs and maintenance, including structural repairs, HVAC systems, and landscaping. Insurance: The lease should specify the types and amounts of insurance coverage that both the landlord and the tenant are required to maintain.

Navigating Common Pitfalls and Negotiation Strategies

Commercial lease agreements, while offering a structured framework, can also present potential pitfalls if not carefully reviewed and negotiated. Understanding these pitfalls and employing effective negotiation strategies can protect your business interests and prevent future disputes. One common pitfall is ambiguity. Vague or unclear language in the lease can lead to misunderstandings and disagreements. Ensure that all terms are clearly defined and unambiguous.

Another potential pitfall is overlooking hidden costs. As mentioned earlier, commercial leases often include provisions for additional rent, such as CAM charges, property taxes, and insurance costs. These expenses can significantly impact your operating costs, so it’s crucial to carefully review these provisions and negotiate fair terms. Failing to properly understand the CAM charges is a common oversight, which can be a percentage of the overall costs of the entire building. Be sure to understand the calculation before agreeing to the terms.

Negotiation is a crucial aspect of securing a favorable commercial lease. Before entering negotiations, research comparable lease rates in the area. This will provide you with valuable leverage and a realistic understanding of market values. Be prepared to negotiate on all aspects of the lease, including the base rent, additional rent, lease term, renewal options, and tenant improvement allowances. A tenant improvement allowance is money the landlord gives you to improve your rented space.

Don’t be afraid to ask questions and seek clarification on any terms you don’t understand. Consult with an attorney or real estate professional experienced in commercial leases. Their expertise can help you identify potential risks and negotiate favorable terms. Remember, a well-negotiated commercial tenant lease agreement template can be a valuable asset for your business.

Furthermore, consider the implications of early termination. What are the penalties for breaking the lease before the end of the term? Negotiate a clear and reasonable early termination clause that protects your business interests in unforeseen circumstances. Finally, always get everything in writing. Verbal agreements are difficult to enforce. Ensure that all agreed-upon terms are clearly documented in the lease agreement.

Securing a good location for your business to thrive can be a lengthy process, but it’s worth it. From start to finish, be prepared to review all options and negotiate for the best terms. A well structured commercial tenant lease agreement template can be the first step.

The journey of securing a commercial space is a significant step. By taking the time to understand the nuances of the lease agreement, you are setting the stage for a successful and sustainable business venture. This proactive approach empowers you to navigate the complexities with confidence, ensuring that your lease serves as a solid foundation for your business aspirations.