Navigating the world of company finances can feel like traversing a maze, especially when it involves employee spending. One crucial tool in managing this area effectively is a well-crafted company credit card agreement. This agreement outlines the rules, responsibilities, and limitations associated with using company-issued credit cards, ensuring transparency and accountability across your organization. Without a clear agreement, you risk misunderstandings, misuse of funds, and potential financial liabilities. Think of it as the guardrail that keeps everyone on the right track when it comes to company spending.

A comprehensive company credit card agreement template provides a framework for defining acceptable spending habits, setting credit limits, and detailing the procedures for reporting expenses. It helps prevent unauthorized purchases, clarifies the consequences of policy violations, and streamlines the reconciliation process. By having a formal agreement in place, you empower your employees with clear expectations and provide your finance team with the necessary documentation for accurate financial reporting. It’s a win-win situation that fosters a culture of responsible spending.

This article aims to guide you through the essential elements of a company credit card agreement template, providing insights and practical tips to help you create a robust policy that meets your organization’s specific needs. We will cover key components such as eligibility criteria, spending limits, expense reporting procedures, and consequences for non-compliance. Whether you are a small business or a large corporation, understanding the intricacies of a company credit card agreement is vital for maintaining financial control and mitigating potential risks.

Key Components of a Robust Company Credit Card Agreement

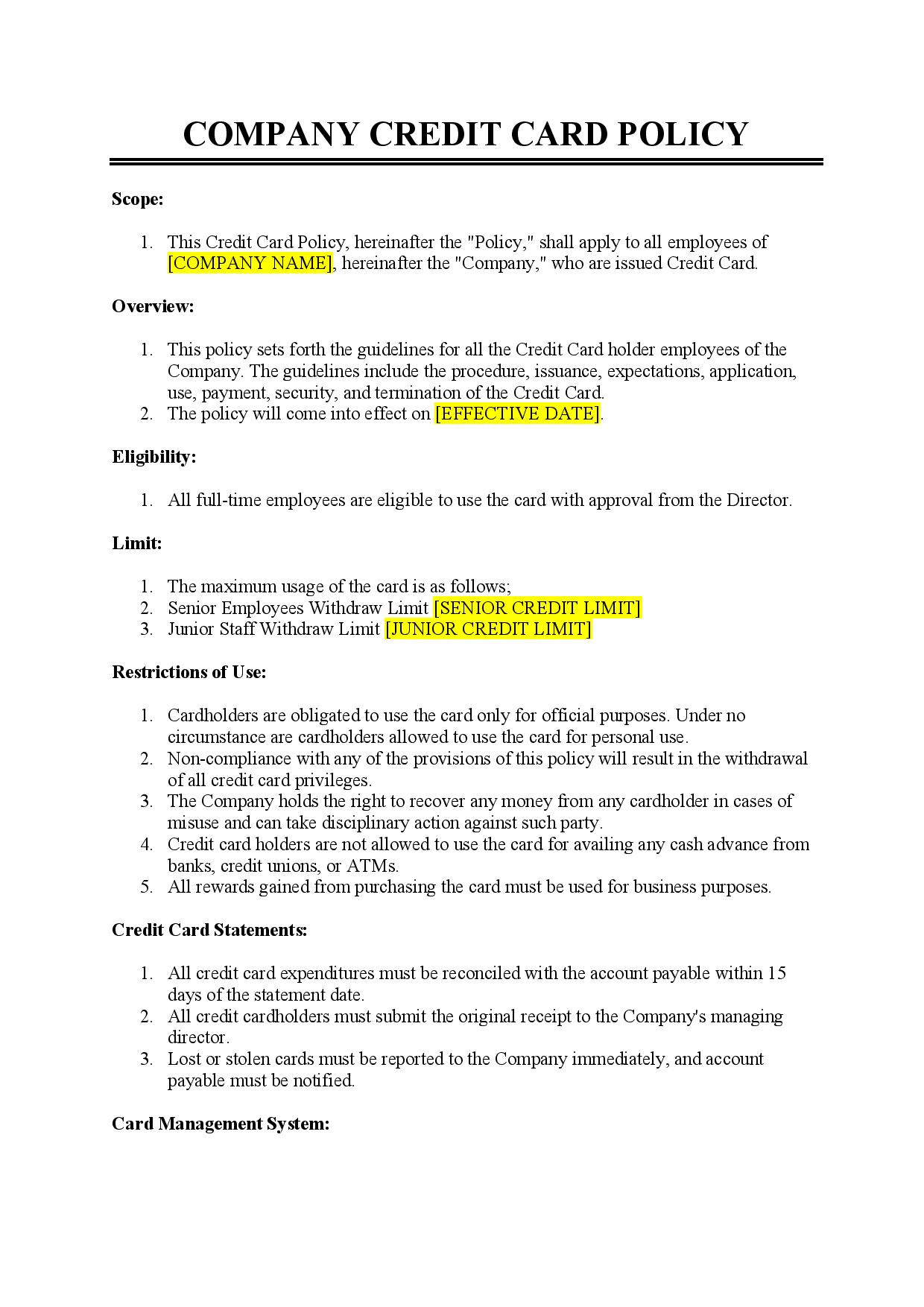

Creating a company credit card agreement template isn’t just about filling in the blanks; it’s about establishing a clear set of guidelines that protect your company’s interests and ensure responsible spending practices. The agreement should cover several critical areas, starting with clearly defining who is eligible for a company credit card. Typically, this includes employees who frequently travel for business, manage significant projects, or require access to funds for authorized company expenses. However, the eligibility criteria should be clearly outlined, considering factors like job title, department, and level of responsibility.

Next, your agreement must specify spending limits. These limits can vary depending on the employee’s role and the nature of their expenses. You might set a monthly spending limit or a per-transaction limit. Consider also defining what types of expenses are authorized. For example, the agreement might explicitly state that company credit cards can be used for travel expenses, client entertainment, or office supplies but not for personal use or unauthorized purchases. Having clear guidelines on allowable expenses minimizes the risk of misuse and ensures that employees understand the boundaries.

A crucial aspect of the company credit card agreement template is the expense reporting procedure. The agreement should outline the process for submitting receipts and reconciling expenses. This might involve using expense reporting software, submitting paper receipts with expense reports, or a combination of both. The agreement should also specify the timeframe for submitting expense reports. Late or incomplete expense reports can create administrative headaches and potentially lead to inaccurate financial records, so enforcing deadlines is essential.

The consequences of violating the company credit card agreement should also be clearly stated. This could include warnings, suspension of credit card privileges, disciplinary action, or even termination of employment, depending on the severity of the violation. Clearly outlining the consequences serves as a deterrent and reinforces the importance of adhering to the company’s spending policies. Consistency in enforcing these consequences is crucial to maintain fairness and credibility.

Finally, your agreement should address the issue of lost or stolen credit cards. The agreement should outline the steps employees should take immediately upon discovering that their card is missing. This includes reporting the loss to the card issuer and notifying the company’s finance department. Timely reporting can prevent unauthorized charges and minimize potential financial losses.

Implementing and Managing Your Company Credit Card Agreement

Once you have a comprehensive company credit card agreement template, the next step is to implement and manage it effectively. This involves communicating the agreement to all employees who are eligible for company credit cards and ensuring that they understand its contents. Consider conducting training sessions or providing written materials that explain the agreement in detail. Encourage employees to ask questions and seek clarification on any points they may not understand.

Effective management also includes regularly reviewing the agreement to ensure that it remains relevant and up-to-date. As your company grows and evolves, your spending policies may need to be adjusted accordingly. For instance, you might need to increase spending limits, add new categories of allowable expenses, or update the expense reporting procedures. Regularly reviewing the agreement allows you to adapt to changing business needs and maintain financial control.

Monitoring employee spending is another essential aspect of managing your company credit card program. This involves regularly reviewing credit card statements and expense reports to identify any unusual or unauthorized transactions. You can use expense reporting software to automate this process and flag potential issues for further investigation. Proactive monitoring can help you detect and address potential problems before they escalate.

It’s also crucial to establish a system for auditing compliance with the company credit card agreement. This might involve randomly selecting expense reports for review or conducting periodic audits of all company credit card transactions. Audits can help you identify areas where employees may be violating the agreement or where the agreement itself may need to be strengthened. The results of these audits should be used to improve the effectiveness of your company credit card program.

Finally, remember that a company credit card agreement is not a static document. It should be a living, breathing document that is continuously refined and improved based on your company’s experience and feedback from employees. By embracing a culture of continuous improvement, you can ensure that your company credit card program remains effective and efficient.

By implementing a carefully considered company credit card agreement, you not only safeguard your finances but also foster a culture of accountability and responsibility within your organization. This, in turn, contributes to a more efficient and financially sound operation.

Investing the time and effort to create and maintain a strong company credit card agreement will undoubtedly pay dividends in the long run, providing peace of mind and ensuring responsible spending practices across your entire organization.