So, you’re looking to formalize a loan between two companies, huh? That’s a smart move! Lending or borrowing money within the business world isn’t uncommon, but relying on a handshake agreement simply isn’t enough. You need something solid, something that clearly outlines the terms and protects both parties involved. That’s where a well-crafted company to company loan agreement template comes in. Think of it as the roadmap for the entire transaction, ensuring everyone stays on the same page and minimizing potential disputes down the road.

This kind of agreement isn’t just about protecting your investment; it’s about building trust and maintaining a strong business relationship. It details the loan amount, interest rate, repayment schedule, and what happens if things go sideways. Imagine lending a significant sum without specifying these key factors! It would be a recipe for misunderstandings and potentially a damaged partnership. Using a solid template provides a framework to address all those crucial details, ensuring clarity and minimizing risks.

Creating this agreement from scratch can feel daunting. You’ll need to understand the legal jargon and ensure all necessary clauses are included. But don’t worry, you don’t have to be a lawyer to draft a comprehensive agreement. Using a well-structured company to company loan agreement template can simplify the process significantly. These templates provide a foundation you can customize to your specific situation, saving you time and money while offering peace of mind.

Why a Company to Company Loan Agreement is Crucial

The importance of a written agreement in any business transaction, especially a loan, cannot be overstated. It’s the difference between a clear, predictable arrangement and a potential legal nightmare. When two companies decide to engage in a loan transaction, several aspects need to be carefully documented to protect the interests of both the lender and the borrower. Let’s dive into why this type of agreement is so critical.

Firstly, a formal agreement establishes a clear record of the loan amount, interest rate, and repayment schedule. This eliminates any ambiguity regarding how much money is being loaned, what interest rate is applicable, and when the borrower is expected to repay the loan. These are fundamental elements that need to be agreed upon and explicitly stated to prevent disputes down the line. A verbal agreement or a vague understanding simply won’t suffice, especially when significant sums of money are involved.

Secondly, the agreement should outline the consequences of default. What happens if the borrower fails to make timely payments? Are there late payment penalties? What recourse does the lender have if the borrower is unable to repay the loan altogether? These are difficult but necessary questions to address upfront. The agreement should clearly define the conditions that constitute a default and the actions the lender can take, such as demanding immediate repayment of the outstanding balance or taking legal action to recover the funds. By addressing these scenarios beforehand, both parties understand the potential risks and responsibilities.

Beyond the core financial terms and default provisions, a comprehensive company to company loan agreement can also include clauses related to governing law, dispute resolution, and confidentiality. The governing law clause specifies which jurisdiction’s laws will govern the agreement, which is especially important if the two companies are located in different states or countries. The dispute resolution clause outlines the process for resolving any disagreements that may arise, such as mediation or arbitration, potentially avoiding costly and time-consuming litigation. A confidentiality clause protects sensitive information exchanged between the parties during the loan process.

Finally, consider that having a clear, legally sound loan agreement can also be beneficial for accounting and tax purposes. It provides documentation to support the loan transaction and ensures that the loan is treated correctly on both companies’ financial statements. It also simplifies the process of claiming deductions for interest expenses or writing off bad debt if the loan becomes uncollectible. The right company to company loan agreement template will guide you through these important details.

Key Elements to Include in Your Template

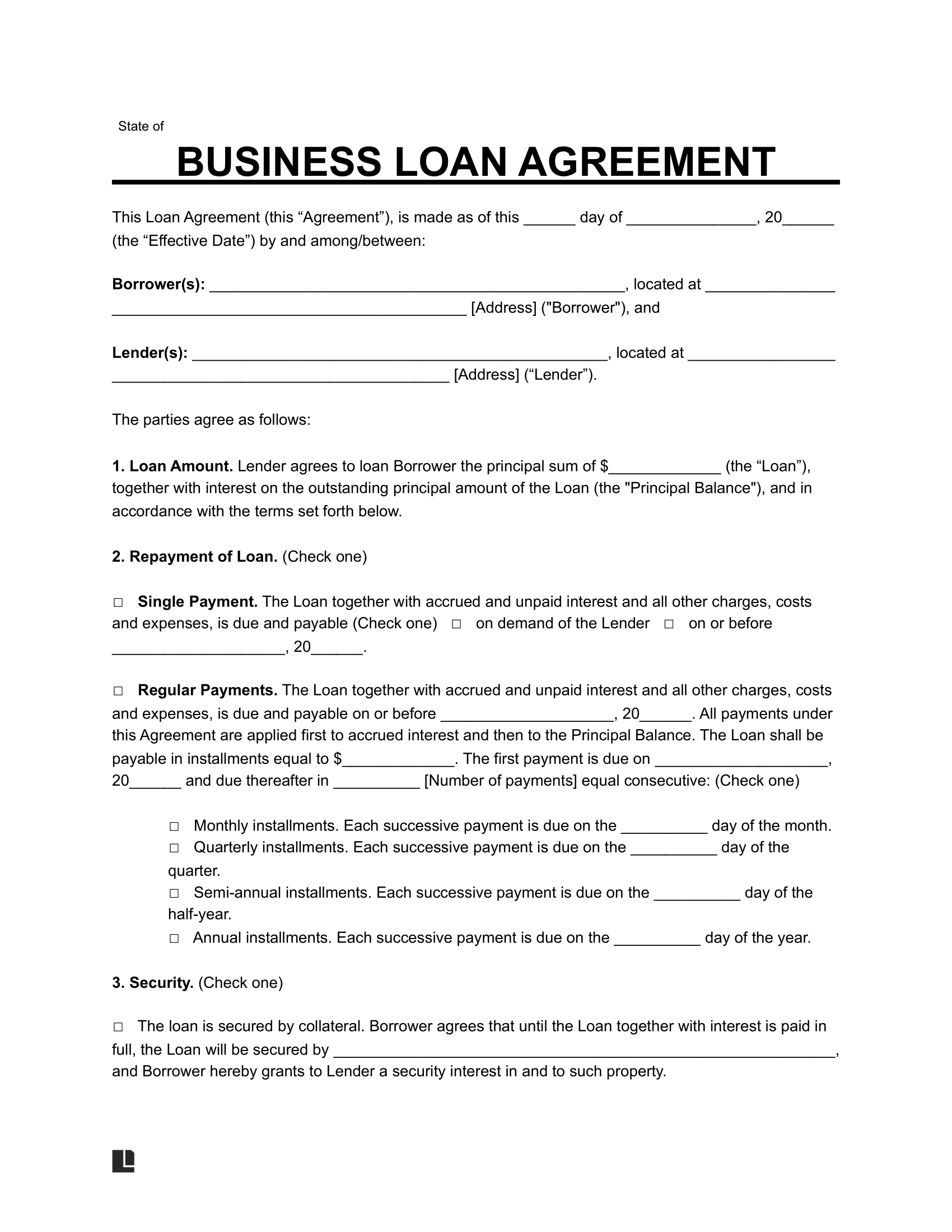

Okay, so you’re convinced you need a company to company loan agreement template. Great! But what exactly should be in it? Let’s break down the essential components you’ll want to include to ensure your agreement is comprehensive and legally sound.

First and foremost, you need to clearly identify the parties involved. This means including the full legal names and addresses of both the lending company and the borrowing company. Don’t just use the trade names; use the official legal names as registered with the relevant authorities. This may seem obvious, but it’s crucial for establishing the legal validity of the agreement. Be absolutely certain to check your facts.

Next, the agreement must explicitly state the loan amount, the interest rate (if applicable), and the repayment schedule. The loan amount should be expressed in a specific currency (e.g., USD, EUR). The interest rate should be clearly stated as a percentage per annum. The repayment schedule should outline the frequency of payments (e.g., monthly, quarterly), the amount of each payment, and the date on which the first payment is due. For example, “The borrower shall repay the principal sum of $50,000, together with interest at a rate of 5% per annum, in 12 equal monthly installments of $4,368.44, commencing on January 31, 2024.”

Consider adding provisions for early repayment and prepayment penalties. Does the borrower have the option to repay the loan early without penalty? Or will there be a fee for doing so? Clearly outlining these terms upfront can prevent misunderstandings and disputes later on. You might also want to include information on security or collateral. Is the loan secured by any assets of the borrowing company? If so, the agreement should clearly identify the assets and outline the lender’s rights in the event of default.

Another essential element is a clear definition of default and the remedies available to the lender. What constitutes a default? Is it simply a failure to make a payment on time, or does it include other events, such as a breach of contract or the borrower’s insolvency? What actions can the lender take if the borrower defaults? Can the lender demand immediate repayment of the outstanding balance, or can the lender take possession of the collateral? Having a well-defined default clause protects the lender’s interests and ensures that the lender has recourse in the event of a breach of the agreement.

Finally, don’t forget to include standard clauses such as governing law, dispute resolution, and severability. As mentioned earlier, the governing law clause specifies which jurisdiction’s laws will govern the agreement. The dispute resolution clause outlines the process for resolving any disagreements that may arise. The severability clause states that if any provision of the agreement is deemed invalid or unenforceable, the remaining provisions will remain in full force and effect. These clauses are often overlooked, but they can be crucial for ensuring the enforceability of the agreement.

Drafting a solid agreement requires some work, but the peace of mind it provides is invaluable. Taking the time to get it right is an investment in a stronger and more secure business partnership.

Having a meticulously crafted loan agreement can be a game-changer. It provides clarity, promotes transparency, and safeguards the interests of both companies involved. A well-structured document fosters a stronger, more trustworthy business relationship.