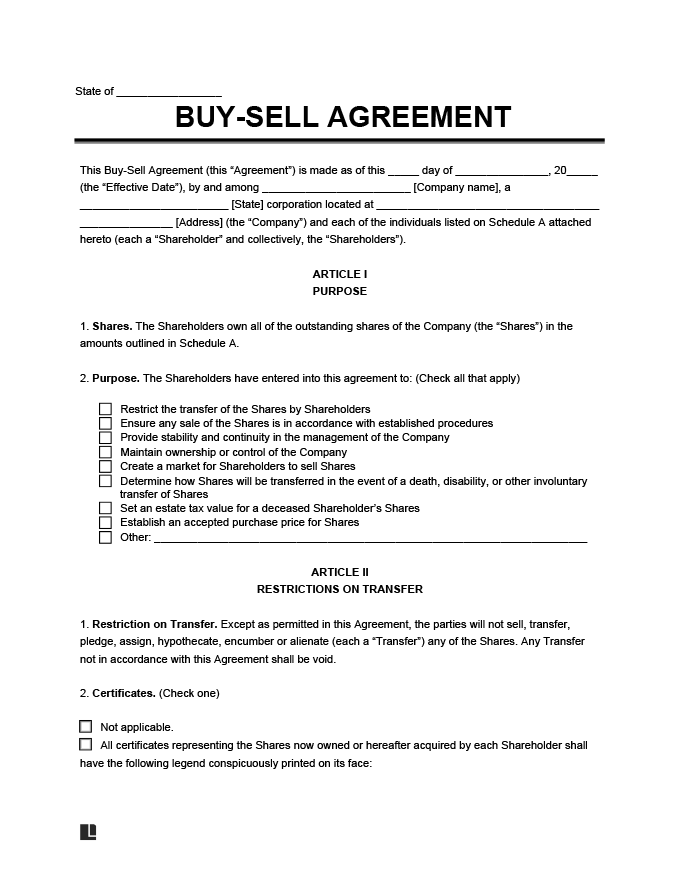

Ever wondered what happens to your share of the business if you decide to retire, or worse, pass away? A corporate buy sell agreement template is your business’s insurance policy, guaranteeing a smooth transition and preventing future headaches among owners. It’s a legally binding contract that predetermines what happens to a shareholder’s interest in a company upon the occurrence of certain triggering events. Think of it as a prenup for your business, setting the rules before things get complicated.

In essence, a corporate buy sell agreement template outlines the specific events that trigger the sale of a shareholder’s interest, who can buy those shares (typically the remaining shareholders or the company itself), how the shares will be valued, and the payment terms. It’s a crucial document for any closely held corporation, providing clarity and stability in the face of uncertainty. Without it, you risk shareholder disputes, family feuds, and potentially even the dissolution of your business.

This agreement is not a one-size-fits-all solution. Its terms need to be carefully tailored to the specific circumstances of the corporation and its shareholders. It’s always wise to consult with legal and financial professionals to ensure your agreement accurately reflects your intentions and complies with all applicable laws. It’s an investment in the long-term health and security of your business. But where do you even start?

Understanding the Core Components of a Buy Sell Agreement

A comprehensive buy sell agreement contains several key components that need to be carefully considered and clearly defined. These components work together to ensure a fair and efficient transfer of ownership interests when a triggering event occurs. Let’s dive into some of the more important aspects.

First and foremost, the agreement must clearly define the triggering events. These events typically include death, disability, retirement, resignation, termination of employment, divorce, bankruptcy, or an offer from an outside party to purchase a shareholder’s interest. The definition of each triggering event should be as precise as possible to avoid ambiguity and potential disputes later on. For example, “disability” should be clearly defined, perhaps by referencing a specific standard for long-term disability.

Next, the agreement needs to specify who is eligible to purchase the shares. This could be the corporation itself (redemption), the remaining shareholders (cross-purchase), or a combination of both. The choice of purchaser can have significant tax implications, so it’s crucial to consult with a tax advisor. The agreement should also outline the order in which potential purchasers have the right to buy the shares. For example, the corporation might have the first right of refusal, followed by the remaining shareholders.

Valuation is another critical element. The agreement must establish a method for determining the fair market value of the shares being transferred. Common valuation methods include a fixed price, a formula based on earnings or book value, or an independent appraisal. The valuation method should be reviewed periodically to ensure it remains accurate and fair. Using a formula, for example, is attractive when it is difficult to have formal appraisals.

Finally, the agreement must outline the payment terms. This includes the amount to be paid for the shares, the timing of payments, and the form of payment (e.g., cash, promissory note). The agreement should also address the issue of security for the payment of the purchase price, especially if payments are made over time. For example, the selling shareholder might retain a security interest in the shares until the purchase price is fully paid. These details are absolutely paramount to protecting you and your business.

Funding the Buy Sell Agreement

It’s great to have a buy sell agreement, but how do you fund it when a triggering event occurs? Life insurance is a common funding mechanism, particularly for death or disability. The corporation or the shareholders purchase life insurance policies on each other, and the proceeds are used to buy out the deceased or disabled shareholder’s interest. Other funding options include cash reserves, loans, or a sinking fund.

Why You Absolutely Need a Corporate Buy Sell Agreement

Without a buy sell agreement, a corporation can face a host of problems when a shareholder leaves the business. The most common issue is that the remaining shareholders may not want to be in business with the deceased shareholder’s heirs or the departing shareholder’s estranged spouse. This can lead to disputes, litigation, and even the forced sale of the business. A buy sell agreement helps to prevent these problems by providing a clear roadmap for the transfer of ownership interests.

Consider the scenario where a shareholder dies without a buy sell agreement in place. Their shares pass to their heirs, who may have no experience or interest in the business. The remaining shareholders are now forced to work with someone they may not know or trust, and the business could suffer as a result. A buy sell agreement can prevent this by giving the remaining shareholders the right to purchase the deceased shareholder’s shares at a fair price.

Another significant benefit of a buy sell agreement is that it can provide liquidity for the departing shareholder or their estate. Selling a minority interest in a closely held corporation can be difficult and time-consuming. A buy sell agreement guarantees that the shares will be purchased at a predetermined price, providing the departing shareholder or their estate with the cash they need. This can be particularly important for the family of a deceased shareholder, who may need the funds to pay for living expenses or estate taxes.

Moreover, a buy sell agreement can help to maintain control of the business. By restricting the transfer of shares to outside parties, the agreement ensures that the ownership remains within the existing group of shareholders. This can be especially important for businesses where the shareholders have a close working relationship and a shared vision for the future. The buy sell agreement gives you a sense of comfort.

Finally, implementing a corporate buy sell agreement template can also help to avoid disputes over the value of the shares. Without an agreement in place, determining the fair market value of the shares can be a contentious process, potentially leading to costly litigation. The corporate buy sell agreement template establishes a clear valuation method, reducing the risk of disputes and ensuring a smoother transition of ownership.

Creating and implementing a buy sell agreement is a really good move for the health of a business and its continuity. It also guarantees that the business will continue to thrive as intended, even when the unexpected happens. Think of it as a safety net for the company.

Ultimately, a corporate buy sell agreement template is an essential tool for any closely held corporation. It provides clarity, stability, and peace of mind, ensuring that the business can continue to thrive even in the face of unforeseen circumstances. Don’t leave the future of your business to chance – invest in a comprehensive buy sell agreement today.