Ever found yourself in that awkward situation of chasing down payments? Whether you’re running a subscription service, managing recurring appointments, or offering services that unfold over time, keeping a credit card on file can be a game-changer. It streamlines the payment process, reduces late payments, and ultimately, makes life easier for both you and your clients. But before you dive headfirst into this convenience, it’s crucial to have a solid agreement in place. That’s where a credit card on file agreement template comes in handy. It sets the ground rules, protects your business, and builds trust with your customers.

Think of a credit card on file agreement template as a roadmap. It clearly outlines how you’ll be using and protecting your customer’s credit card information. It spells out the payment schedule, the circumstances under which charges will be made, and the customer’s rights to dispute charges or cancel the agreement. It’s all about transparency and ensuring everyone is on the same page. Using a template not only saves you time and legal fees, but also ensures you haven’t overlooked any important legal or ethical considerations.

So, if you’re considering using credit cards on file for your business, buckle up. We’re about to explore why a credit card on file agreement template is non-negotiable, what it should include, and how to use it effectively to create a seamless and secure payment experience for your valued customers. Getting it right from the start can save you headaches, prevent misunderstandings, and foster long-term relationships built on trust and reliability.

Why You Absolutely Need a Credit Card On File Agreement Template

Let’s face it, dealing with money can sometimes be… well, sticky. Having a credit card on file agreement template isn’t just a nice-to-have; it’s a shield protecting both you and your customers. Without a clear agreement, you risk misunderstandings, disputes, and even legal trouble. Think of it as building a strong foundation before constructing a payment system. A solid agreement builds confidence and ensures that everyone knows the rules of the game from the outset. It establishes trust and professionalism, key ingredients for a successful business.

One of the most crucial reasons to have an agreement is to protect yourself from chargebacks. Chargebacks occur when a customer disputes a charge with their credit card company. A well-written agreement, signed by the customer, provides strong evidence that the customer authorized the charges. This dramatically increases your chances of winning a chargeback dispute and avoiding financial loss. This is especially important for businesses that offer recurring services or subscription models.

Furthermore, a properly constructed credit card on file agreement template helps you comply with data privacy regulations. These regulations, such as the Payment Card Industry Data Security Standard (PCI DSS), are designed to protect sensitive credit card information. Your agreement should clearly outline how you collect, store, and protect customer data, demonstrating your commitment to data security and compliance.

Think about the customer experience too. A clear and concise agreement shows that you value their business and respect their financial information. It puts them at ease, knowing that their credit card will only be charged according to the agreed-upon terms. This level of transparency builds trust and loyalty, leading to long-term customer relationships.

Ultimately, a credit card on file agreement template is about risk management, compliance, and fostering positive customer relationships. It’s a small investment that can save you a lot of trouble down the road. Don’t leave it to chance; take the time to create a comprehensive agreement that protects your business and your customers.

Key Elements of an Effective Credit Card On File Agreement Template

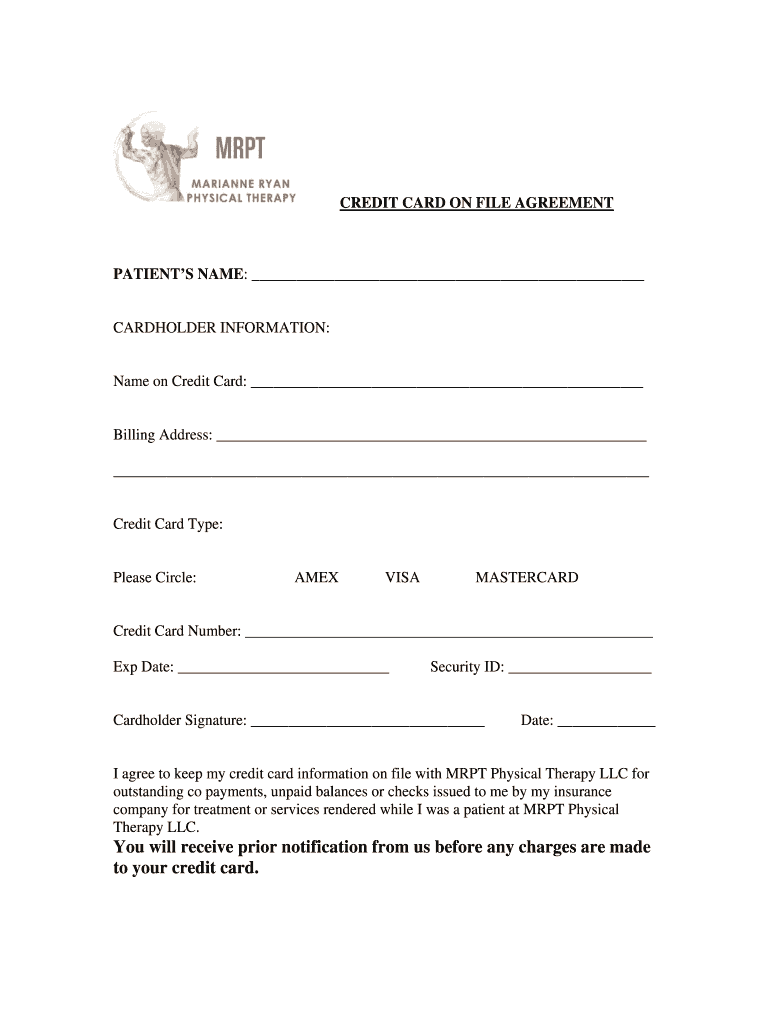

Creating a robust credit card on file agreement template requires careful consideration of several key elements. First and foremost, you need to clearly identify the parties involved: your business and the customer. Include full legal names and contact information. This might seem obvious, but it’s a foundational step in ensuring the agreement is legally sound.

Next, you must explicitly state the purpose of the agreement. Why are you keeping the credit card on file? Is it for recurring payments, a retainer fee, or security against potential damages? Be specific and avoid vague language. For example, instead of saying “for services rendered,” say “for monthly subscription fees for [specific service] as outlined in the service agreement dated [date].”

Payment terms are critical. Detail the amount to be charged, the frequency of charges (e.g., monthly, quarterly), and the date on which charges will be processed. Clearly state the accepted credit card types and any applicable fees, such as late payment fees or transaction fees. Also, outline the process for handling failed payments and how the customer will be notified.

Data security is another crucial element. Describe the measures you take to protect customer credit card information, including compliance with PCI DSS standards. Reassure customers that their data is stored securely and will not be shared with third parties without their consent. A brief statement on data encryption and access controls can go a long way in building trust.

Finally, include clauses addressing dispute resolution, termination, and governing law. Outline the process for customers to dispute charges or cancel the agreement. Specify the notice period required for termination (e.g., 30 days). And state which jurisdiction’s laws will govern the agreement. This comprehensive approach to creating a credit card on file agreement template minimizes risk and fosters transparency.

Putting these pieces together allows you to confidently request to keep a credit card on file.

A well-structured agreement helps maintain smooth sailing.