Ever been stuck in a situation where you just can’t agree? Imagine that feeling, but amplified and playing out in the context of a business you own with others. That’s where a deadlock clause in a shareholder agreement comes in. It’s like an escape hatch, a pre-agreed upon solution to navigate those inevitable disagreements that can arise between shareholders. Without it, you could be facing expensive legal battles and a business grinding to a halt.

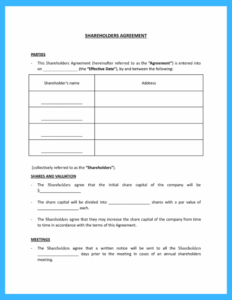

Think of your shareholder agreement as the constitution for your company. It lays out the rules of the game, defining the rights and responsibilities of each shareholder. A deadlock clause is a vital part of that constitution, specifically addressing what happens when shareholders reach an impasse on key decisions. It’s preventative medicine for business gridlock. It’s much easier, and cheaper, to agree on a solution before a problem arises than to try and figure things out when everyone’s already frustrated and digging in their heels.

So, what does a deadlock clause actually *do*? It outlines a process for resolving disagreements. This process can involve anything from mediation to arbitration, or even a forced sale of shares. The specific steps depend on what the shareholders agree is the best way to break the tie and get the company moving forward again. The goal is always the same: to find a fair and efficient way to resolve disagreements and prevent them from derailing the business.

Why You Absolutely Need a Deadlock Clause in Your Shareholder Agreement

Imagine this scenario: You and your business partner are at loggerheads over a crucial investment decision. You think it’s a brilliant opportunity, while they believe it’s too risky. You both hold 50% of the shares, meaning neither of you can unilaterally force the decision through. Without a deadlock clause in your shareholder agreement, you’re stuck. The company stagnates, opportunities are missed, and the relationship between you and your partner deteriorates. This is a recipe for disaster, and it’s exactly what a well-drafted deadlock clause is designed to prevent.

A deadlock clause provides a clear and predetermined path for resolving such disagreements. It takes the emotion out of the equation and provides a framework for finding a solution. This framework might involve a third-party mediator to help facilitate discussions and find common ground. Alternatively, it could specify arbitration, where a neutral arbitrator hears both sides of the argument and makes a binding decision. In more extreme cases, the clause might outline a process for one shareholder to buy out the other, or even for the company to be sold entirely. The key is that the process is agreed upon in advance, when everyone is still on good terms and thinking rationally.

The beauty of a deadlock clause is that it offers flexibility. You can tailor it to fit the specific needs and circumstances of your business. For example, you might include a specific process for resolving disagreements over strategic decisions, while using a different process for financial matters. You can also set time limits for each step of the resolution process, ensuring that disagreements are resolved quickly and efficiently. This avoids dragging out the conflict and minimizing the disruption to the business.

Furthermore, a deadlock clause can protect the interests of minority shareholders. Even if one shareholder holds a larger percentage of the shares, a deadlock clause can ensure that their voice is still heard and that their interests are taken into consideration. This is particularly important in situations where there are significant power imbalances between shareholders. It promotes fairness and prevents one shareholder from dominating the decision-making process.

Ultimately, a deadlock clause in a shareholder agreement provides peace of mind. It’s a safety net that protects the company and its shareholders from the potentially devastating consequences of unresolved disagreements. It’s a sign of good governance and a commitment to fairness and transparency. Investing the time and effort to draft a comprehensive deadlock clause is one of the smartest things you can do to protect your business. A deadlock clause shareholder agreement template can be a good starting point for drafting the specific clause you need.

Key Elements of a Robust Deadlock Clause

So, you’re convinced you need a deadlock clause – great! But what should it actually include? A good deadlock clause isn’t just a vague statement about resolving disagreements; it’s a detailed roadmap that guides you through the process. Let’s break down some key elements you should consider.

First, clearly define what constitutes a deadlock. This might seem obvious, but it’s crucial to be specific. Is it any disagreement between shareholders, or only disagreements on certain key decisions? For example, you might specify that a deadlock occurs only when shareholders cannot agree on matters such as the appointment of directors, the approval of annual budgets, or the sale of significant assets. By clearly defining what constitutes a deadlock, you avoid ambiguity and prevent frivolous claims of deadlock.

Next, outline a clear and sequential process for resolving the deadlock. This process should typically involve several steps, starting with less formal methods and progressing to more drastic measures. A common approach is to start with mediation, where a neutral third party attempts to facilitate a resolution. If mediation fails, the clause might then specify arbitration, where a neutral arbitrator makes a binding decision. Finally, if all else fails, the clause might outline a process for a forced sale of shares or even dissolution of the company. The key is to have a well-defined process that everyone understands and agrees to.

Consider including a “shotgun clause” or “buy-sell agreement” as part of your deadlock resolution process. This allows one shareholder to offer to buy out the other shareholder’s shares at a specified price. The other shareholder then has the option of either accepting the offer or buying out the offering shareholder’s shares at the same price. This creates a strong incentive for both shareholders to make a reasonable offer, as they risk being bought out at a price they don’t like. The shotgun clause can be a very effective way to break a deadlock and allow one shareholder to take control of the company.

Finally, remember to consult with an attorney to ensure that your deadlock clause is legally sound and enforceable. Laws vary from state to state, so it’s important to have an attorney review your clause to ensure that it complies with applicable laws. An attorney can also help you tailor the clause to the specific needs of your business and avoid any potential pitfalls. A deadlock clause shareholder agreement template provides a solid structure, but a legal professional can customize it for your situation.

Remember, a well-drafted deadlock clause is an investment in the future of your business. It protects you and your fellow shareholders from the potentially devastating consequences of unresolved disagreements. By taking the time to carefully consider these key elements, you can create a deadlock clause that provides peace of mind and helps your company thrive.

It all boils down to planning and foresight. A carefully crafted agreement with a robust deadlock clause can be the difference between a thriving business and a costly, drawn-out legal battle.

Ultimately, the goal is to create a framework that allows the business to continue operating smoothly, even when shareholders disagree. By anticipating potential conflicts and establishing a clear process for resolving them, you can protect the long-term interests of the company and its stakeholders.