Ever borrowed money and had the lender ask for more than just your promise to pay it back? In the world of loans and secured transactions, sometimes lenders want extra reassurance that they’ll get their money. That’s where a Deposit Account Control Agreement, often abbreviated as DACA, comes into play. Think of it as a special agreement that gives a lender control over a borrower’s deposit account, like a checking or savings account. This agreement is a common practice and often is a critical point of negotiation.

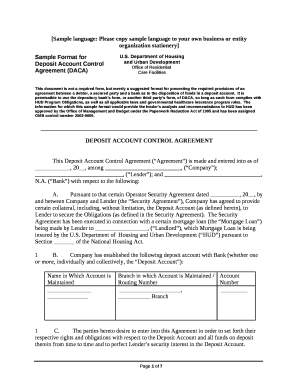

Basically, it’s a three-party agreement involving the borrower, the lender, and the bank where the account is held. It outlines who has control over the funds in the account and under what circumstances. For borrowers, it’s essential to understand the implications of signing a DACA, as it can restrict access to their own funds. For lenders, it provides a crucial form of security for the loan, ensuring they have recourse if the borrower defaults. Finding the right deposit account control agreement template is a key first step.

While the concept might sound complex, the core idea is relatively straightforward: it’s about securing a lender’s interest in a deposit account. This agreement helps to clarify the rights and responsibilities of everyone involved, helping to mitigate potential disputes down the line. In the following sections, we’ll delve deeper into the workings of a DACA, explore its key provisions, and explain why it’s such an important document in the world of finance. Understanding these agreements is key for securing your business and finances.

Understanding the Nitty-Gritty of a Deposit Account Control Agreement

A Deposit Account Control Agreement, or DACA, is a legal document that establishes control of a deposit account for the benefit of a secured party. It is a crucial component in many secured lending transactions. In essence, it allows a lender to gain priority over the funds held in a specific deposit account, even if the borrower retains the ability to access the funds under normal circumstances. Think of it as a safety net for the lender, providing assurance that the funds will be available to repay the debt if necessary.

The agreement typically involves three parties: the debtor (borrower), the secured party (lender), and the depositary bank (the bank where the deposit account is held). Each party plays a specific role, and the DACA clearly defines their respective rights and obligations. The borrower agrees to grant the lender control over the deposit account, while the bank acknowledges the lender’s control and agrees to comply with the lender’s instructions regarding the funds in the account. This is a pivotal point that requires clear definition.

One of the key elements of a DACA is the “control” provision. This defines the specific circumstances under which the lender can exercise control over the deposit account. Typically, this occurs when the borrower defaults on the loan or violates other terms of the loan agreement. The DACA will outline the procedures the lender must follow to exercise control, such as providing written notice to the bank.

Another important aspect of a DACA is the bank’s obligation to comply with the lender’s instructions. The bank must agree to act solely upon the instructions of the lender regarding the funds in the deposit account, without further consent from the borrower, once the lender has properly exercised control. This is a crucial provision that ensures the lender can access the funds in a timely manner should the need arise. It’s important for the borrower to fully understand the implications.

It’s important to note that there are different types of control agreements. A “blocked account” DACA typically restricts the borrower’s access to the funds in the account, whereas a “springing control” DACA allows the borrower to continue using the account until a default occurs. The specific type of control agreement will depend on the lender’s risk assessment and the terms of the loan agreement.

Key Provisions to Look For

When reviewing a deposit account control agreement template, be sure to pay close attention to the following key provisions: the definition of “control,” the procedures for exercising control, the bank’s obligations, any limitations on the lender’s control, and the termination provisions. A well-drafted DACA will clearly address all of these issues, providing clarity and certainty for all parties involved. Seeking legal counsel is always recommended when dealing with complex financial documents like these.

Why a Deposit Account Control Agreement is Crucial

In the world of commercial lending, security is paramount. Lenders need to minimize their risk and ensure they can recover their funds if a borrower defaults. A Deposit Account Control Agreement is a key tool in mitigating that risk. It offers a layer of protection that a simple promissory note cannot provide. Without a DACA, a lender might be just another unsecured creditor in a bankruptcy proceeding, significantly reducing the chances of full recovery.

For lenders, the primary benefit of a DACA is the enhanced security it provides. By gaining control over a borrower’s deposit account, the lender effectively creates a perfected security interest in the funds held in that account. This means that the lender has priority over other creditors who may have a claim to those funds. This priority is particularly important in the event of a borrower’s bankruptcy, as it can significantly increase the lender’s chances of recovering the outstanding debt.

However, the benefits of a DACA aren’t solely for the lender. For borrowers, a DACA can be a way to secure financing that might not otherwise be available. By offering a DACA, a borrower can provide the lender with the comfort level needed to approve a loan. This is particularly true for borrowers who may have a limited credit history or who are seeking financing for a high-risk venture. This type of agreement can be a means to growth for the business.

Furthermore, a well-drafted DACA can also help to avoid disputes between the borrower, the lender, and the bank. By clearly defining the rights and obligations of each party, the DACA can prevent misunderstandings and disagreements from arising in the future. This can save all parties time and money in the long run, as it reduces the likelihood of costly litigation.

Ultimately, a Deposit Account Control Agreement is a crucial document in secured lending transactions. It provides a mechanism for lenders to secure their interests in a borrower’s deposit account, while also allowing borrowers to access financing that might otherwise be unavailable. A comprehensive deposit account control agreement template, when properly executed, benefits all involved by providing transparency and security in the lending relationship.

Navigating the financial landscape often requires understanding complex agreements and protocols. The more you understand these intricate details, the better prepared you will be to make informed decisions.

With a thorough understanding of these agreements, businesses and individuals can navigate financial transactions with confidence and security.