Ever felt like you’re walking a tightrope while trying to balance your income with your sales performance? Many salespeople face this exact challenge, especially in roles where compensation is heavily reliant on commissions. That’s where a draw against commission agreement comes in handy. It’s essentially a financial safety net that provides a guaranteed advance on future commissions. Think of it as a loan against your potential earnings, offering a predictable income stream while you build your sales pipeline. This agreement is a valuable tool, especially in the initial stages of a new role or during periods of market fluctuation where sales may be unpredictable.

But navigating the world of draw against commission agreements can be tricky. It’s not just about getting the money; it’s about understanding the terms, conditions, and potential implications. A well-structured agreement protects both the employer and the employee, ensuring clarity and avoiding future disputes. Getting the details right from the start is crucial for a healthy and productive working relationship. A poorly drafted agreement can lead to misunderstandings, financial strain, and even legal battles.

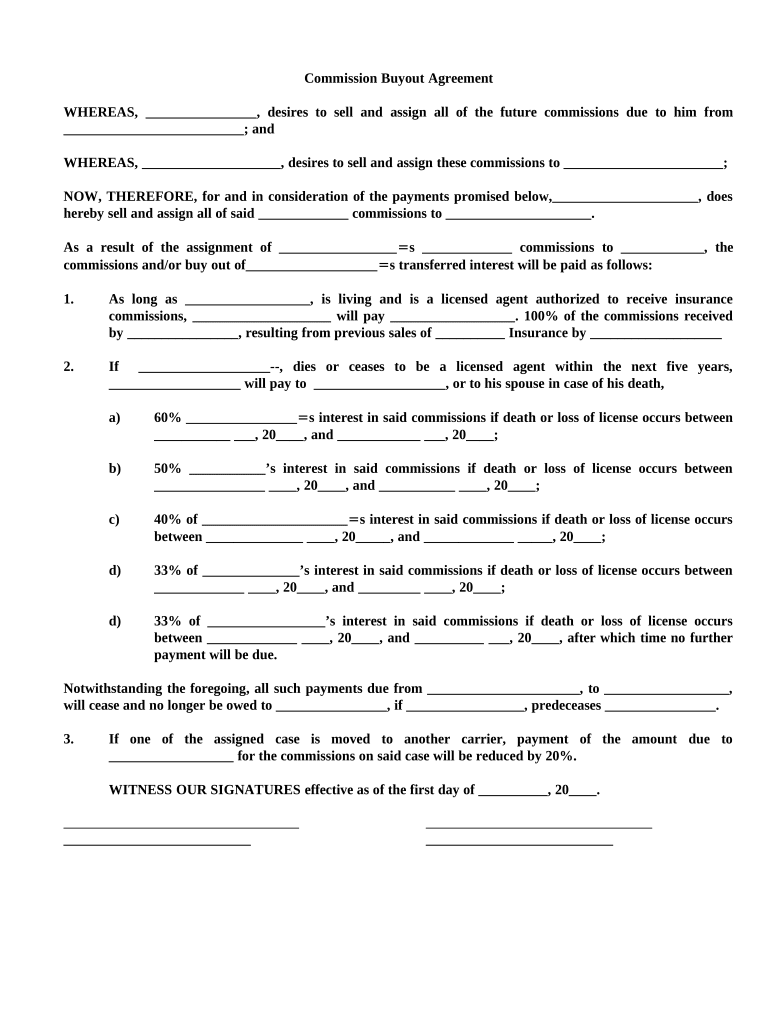

This is where a robust draw against commission agreement template becomes invaluable. It provides a standardized framework that outlines all the necessary components, from the draw amount and repayment terms to the circumstances under which the draw can be terminated. This article will walk you through the essentials of this type of agreement, highlighting key considerations and offering insights to help you create a document that works for everyone involved. Whether you’re an employer looking to attract top talent or a salesperson seeking financial stability, understanding the intricacies of a draw against commission agreement is essential.

Understanding Draw Against Commission Agreements: A Comprehensive Guide

A draw against commission agreement is a written contract between an employer and a salesperson that allows the salesperson to receive a predetermined amount of money (the draw) on a regular basis. This draw is then “paid back” through the commissions the salesperson earns. It’s not a salary in the traditional sense, but rather an advance on future commission earnings. Think of it like this: you’re getting paid upfront, but you’re obligated to earn enough in commissions to cover that payment. This system can be especially helpful for new sales hires who are building their client base or for industries where sales cycles are long and unpredictable.

The key element is the ‘against commission’ part. The draw is not simply free money. It’s an advance that needs to be offset by the commissions earned. The specifics of how this offset happens are crucial and should be clearly detailed in the agreement. For example, the agreement should specify the percentage of commission that will be used to repay the draw each period. If the salesperson’s commissions don’t cover the draw in a particular period, the agreement will outline how the remaining balance is handled. It might be carried over to the next period, or in some cases, treated as a debt that the salesperson is obligated to repay even if they leave the company.

One critical aspect to consider is the reconciliation period. How often will the draw be reconciled against the commissions earned? Is it monthly, quarterly, or annually? The frequency of reconciliation impacts cash flow and can affect both the salesperson’s earnings and the company’s accounting practices. A shorter reconciliation period can provide more immediate feedback on performance and prevent large accumulated debts. A longer period might offer more flexibility but also increase the risk of significant shortfalls.

Furthermore, the agreement needs to address what happens if the salesperson terminates their employment or is terminated by the company. Is the outstanding draw balance immediately due, or is there a repayment schedule? Some agreements stipulate that any outstanding draw balance is forgiven upon termination, while others treat it as a debt that must be repaid. The specific terms in this section are vital for protecting both parties in the event of separation. A clear understanding of the termination clause can prevent costly legal disputes down the line.

Ultimately, a well-defined draw against commission agreement template should create a win-win scenario. It provides salespeople with a predictable income stream while motivating them to generate sales. For the employer, it’s a way to attract and retain talent, knowing that the draw is an investment that will be recouped through increased sales revenue. However, it’s essential to remember that this type of agreement is only effective if it’s fair, transparent, and clearly understood by everyone involved.

Key Components of a Draw Against Commission Agreement

A comprehensive draw against commission agreement should cover several essential aspects to ensure clarity and protect the interests of both the employer and the salesperson. First and foremost, the agreement must explicitly state the amount of the draw. This should be a fixed amount paid periodically (e.g., weekly, bi-weekly, monthly) and should be clearly defined. The agreement should also specify the duration of the draw period, whether it’s for a fixed term (e.g., six months) or ongoing, and how it can be renewed or terminated.

Next, the agreement must detail the commission structure. This includes the percentage of commission earned on each sale, the types of sales that qualify for commission, and any minimum sales targets that must be met before commissions are paid. The agreement should also clarify when commissions are considered “earned” (e.g., upon completion of the sale, upon receipt of payment from the customer) and the payment schedule for commissions. It’s crucial to align the commission structure with the overall business objectives and ensure it incentivizes the desired sales behaviors.

Another critical section is the repayment terms. This section needs to clearly explain how the draw will be repaid from the commissions earned. Will a fixed percentage of each commission be applied to the draw, or will there be a different mechanism? What happens if the salesperson’s commissions in a given period are less than the draw amount? Will the deficit be carried over to the next period, or will it be treated as a debt that must be repaid immediately? These details must be explicitly defined to avoid confusion and potential disputes.

The agreement should also address expense reimbursements. Will the salesperson be reimbursed for any expenses incurred while performing their duties, such as travel, client entertainment, or marketing materials? If so, the agreement should outline the types of expenses that are reimbursable, the procedures for submitting expense reports, and the timeline for reimbursement. Clear guidelines on expense reimbursement can help prevent misunderstandings and maintain transparency.

Finally, the agreement must include clauses regarding termination, both by the employer and the salesperson. What happens to the outstanding draw balance if the employment is terminated? Is it forgiven, or is it treated as a debt that must be repaid? The agreement should also address any non-compete or non-solicitation provisions that may apply after termination. A well-drafted termination clause is essential for protecting both parties and avoiding potential legal disputes. Using a draw against commission agreement template as a starting point ensures that all of these critical components are addressed.

Ultimately, a well-constructed agreement can be a game-changer for both the salesperson and the company. It fosters a transparent and mutually beneficial relationship.

So, before you dive into any commission-based role, make sure you understand all the details of the agreement. Knowing your rights and responsibilities can help ensure a smoother and more successful career.