Life throws curveballs, and sometimes those curveballs come with unexpected expenses. As an employer, you might find yourself in a position where a trusted employee needs a little financial help to tide them over. That’s where an employee cash advance comes in. It’s essentially a short-term loan from the company to the employee, repaid through deductions from their future paychecks. But, to protect both you and your employee, it’s crucial to have a clear, written agreement in place. This agreement outlines the terms of the advance, ensuring everyone is on the same page and minimizing potential misunderstandings down the road.

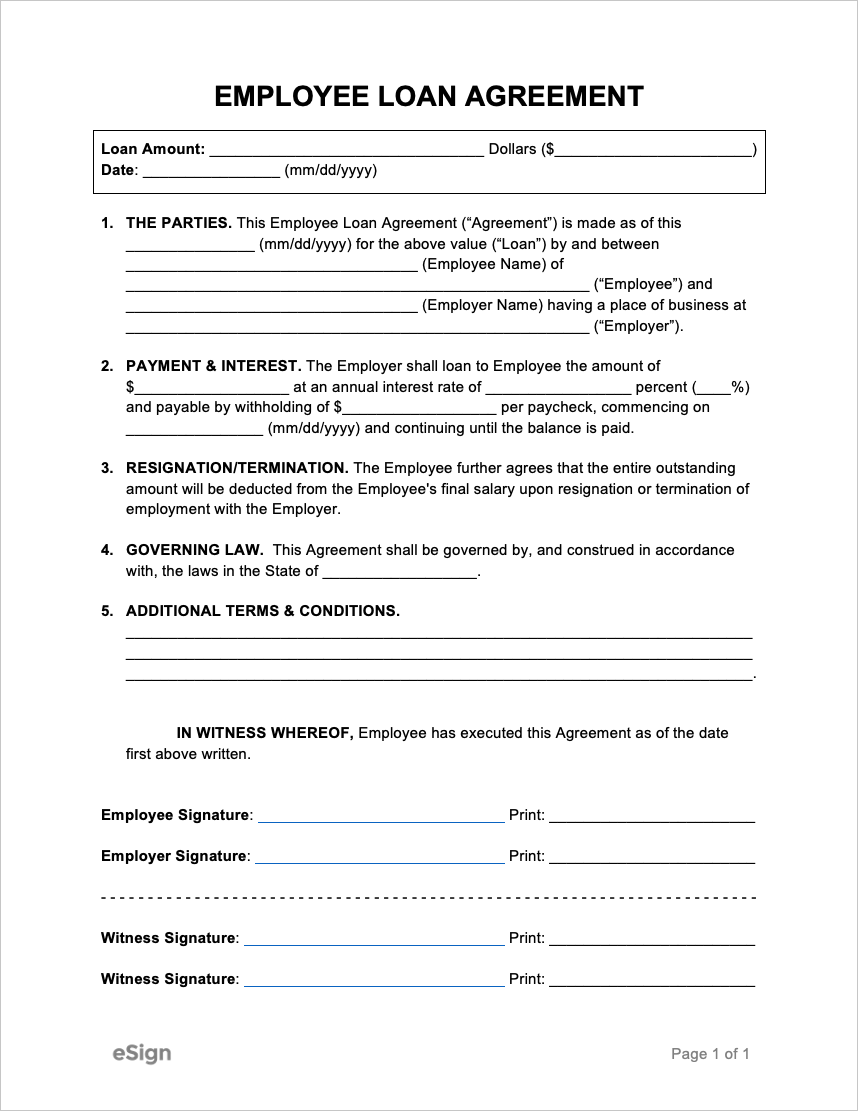

Think of an employee cash advance agreement as a friendly reminder for everyone involved. It details the amount of the advance, the repayment schedule, the interest rate (if any), and what happens if the employee leaves the company before the advance is fully repaid. Without this document, you might find yourself in a sticky situation trying to recover the funds, or the employee might feel unfairly treated if the repayment terms are unclear. It’s a win-win tool that fosters trust and transparency within the workplace.

Creating a comprehensive agreement might sound daunting, but it doesn’t have to be. We’ll walk you through the key elements that should be included in an employee cash advance agreement template, so you can easily create a document that suits your company’s specific needs. Remember, a well-crafted agreement not only protects your financial interests but also demonstrates your commitment to supporting your employees in times of need.

Why Use an Employee Cash Advance Agreement Template?

You might be wondering, “Why bother with a template? Can’t I just wing it?”. While you *could*, doing so is generally a bad idea. An employee cash advance agreement template provides a structured framework to ensure you cover all the necessary bases. It prompts you to consider important details you might otherwise overlook, preventing potential disputes and legal headaches down the line.

Think of it as a checklist. A good template will guide you through essential clauses, such as the amount of the advance, the purpose of the advance (while not always legally required, it can provide context), the repayment schedule (frequency and amount of deductions), the interest rate (if applicable), and consequences of default (what happens if the employee fails to repay). It also includes clauses regarding the employee’s acknowledgement of the debt and their agreement to the repayment terms.

Furthermore, using a template demonstrates professionalism. It shows your employees that you take their financial needs seriously and that you have a fair and consistent process for handling cash advances. This can improve employee morale and build a stronger employer-employee relationship. A standardized template also ensures that all employees are treated equally, minimizing the risk of discrimination claims.

The beauty of an employee cash advance agreement template is that it’s customizable. While it provides a solid foundation, you can tailor it to fit your specific company policies and the unique circumstances of each individual situation. You can add clauses that address specific concerns or adapt the repayment schedule to accommodate the employee’s financial situation.

Ultimately, an employee cash advance agreement template is a tool that protects both you and your employees. It provides clarity, minimizes risk, and fosters a more transparent and trustworthy work environment. It’s a small investment of time that can save you significant headaches in the long run.

Key Elements of an Effective Employee Cash Advance Agreement

So, what exactly should be included in your employee cash advance agreement? Here’s a breakdown of the essential elements to ensure your document is comprehensive and legally sound.

First and foremost, clearly state the parties involved. This includes the full legal name and address of both the employer (your company) and the employee receiving the advance. This may seem obvious, but it’s a crucial detail for legal enforceability.

Next, specify the amount of the cash advance. Be precise. Use both numerical and written forms (e.g., $500.00 – Five Hundred Dollars). This eliminates any ambiguity about the exact amount being loaned. You should also describe the purpose of the advance, even if it’s not legally mandatory. While privacy is important, knowing the general reason can help you assess the employee’s situation and tailor the repayment plan accordingly.

A critical element is the repayment schedule. Clearly outline the frequency of deductions (e.g., bi-weekly), the amount to be deducted each pay period, and the date the first deduction will begin. Be realistic when setting the repayment schedule, considering the employee’s earnings and other financial obligations. If you are charging interest, clearly state the interest rate and how it will be calculated. Also, include a statement that the employee authorizes the deduction of these amounts from their paycheck.

Another essential clause addresses what happens if the employee leaves the company before the advance is fully repaid. Will the remaining balance become due immediately? Will you offer a payment plan? Clearly define your company’s policy on this matter to avoid any surprises or disputes. You can also add a clause outlining the consequences of default, such as late payment fees or legal action.

Finally, include a clause stating that the employee has read and understands the agreement, and that they voluntarily agree to its terms. Both the employer and employee should sign and date the agreement, and each party should retain a copy for their records. Consider having the agreement reviewed by an attorney to ensure it complies with all applicable state and federal laws. Using an employee cash advance agreement template can significantly simplify this process, ensuring you cover all the necessary aspects to protect both your business and your employees.

Ultimately, providing employee cash advances can be a valuable benefit, but it’s crucial to manage them responsibly. A well-crafted agreement protects your company’s finances and fosters trust with your employees.

Remember that open communication and a willingness to work with employees facing financial challenges are essential components of a supportive and positive work environment. An employee cash advance agreement is just one tool to help you achieve that.