So, you’re thinking about letting your employees borrow company equipment? That’s a fantastic way to boost morale and productivity, showing you trust them to handle company assets responsibly. Maybe it’s a laptop for working from home, a camera for capturing marketing materials, or even specialized tools for a particular project. Whatever the reason, lending equipment can be a win win situation. However, it’s crucial to protect your company’s investments and avoid misunderstandings with a solid agreement in place.

That’s where an employee equipment loan agreement template comes in handy. Think of it as a friendly yet formal understanding between you and your employee, outlining the terms and conditions of the loan. It clearly defines who’s responsible for what, preventing potential disputes and ensuring everyone is on the same page. This document covers everything from the duration of the loan to the responsibility for repairs or replacement if something goes wrong. It’s about setting clear expectations and building a culture of accountability within your organization.

This article will guide you through the essential elements of an employee equipment loan agreement template, explaining why it’s so important and how to create one that works for your specific needs. We’ll break down the key clauses, providing practical tips and considerations to help you protect your company’s assets and maintain positive employee relations. After all, a well drafted agreement can save you headaches and legal issues down the road, allowing you to focus on growing your business.

Why You Need an Employee Equipment Loan Agreement

Simply put, an employee equipment loan agreement is your safety net. Without it, you’re relying on good faith and verbal promises, which can easily lead to misinterpretations or disputes down the line. Imagine lending a laptop to an employee who then damages it. Without a clear agreement, who is responsible for the repair costs? What if the equipment is lost or stolen? These scenarios can become messy and potentially damage your relationship with your employee.

An agreement clarifies the responsibilities of both parties. It outlines the employee’s obligation to take care of the equipment, use it responsibly, and return it in good working order. It also specifies what happens if the equipment is damaged, lost, or stolen, including who bears the financial responsibility. This clarity minimizes the risk of misunderstandings and ensures that both you and your employee are protected.

Furthermore, an employee equipment loan agreement serves as a legal record of the loan. In the event of a dispute, this document provides evidence of the agreed upon terms and conditions. This can be invaluable if you need to take legal action to recover the equipment or seek compensation for damages. It’s always better to have a written agreement than to rely on verbal assurances, especially when dealing with potentially valuable company assets.

Beyond legal protection, an agreement also promotes professionalism and transparency within your organization. It demonstrates that you value your company’s assets and that you take employee responsibility seriously. By implementing a formal loan process, you create a culture of accountability and respect, which can improve employee morale and productivity. It shows you trust your employees, but also that you have safeguards in place to protect your company.

Think of the agreement as an investment in preventing future problems. Taking the time to create a comprehensive and well written employee equipment loan agreement template is a small price to pay for the peace of mind and legal protection it provides. It ensures that everyone is on the same page and that your company’s assets are secure. You can easily find an employee equipment loan agreement template online.

Key Elements of an Employee Equipment Loan Agreement Template

A solid employee equipment loan agreement should cover several key areas to ensure it’s comprehensive and legally sound. Let’s break down the essential components:

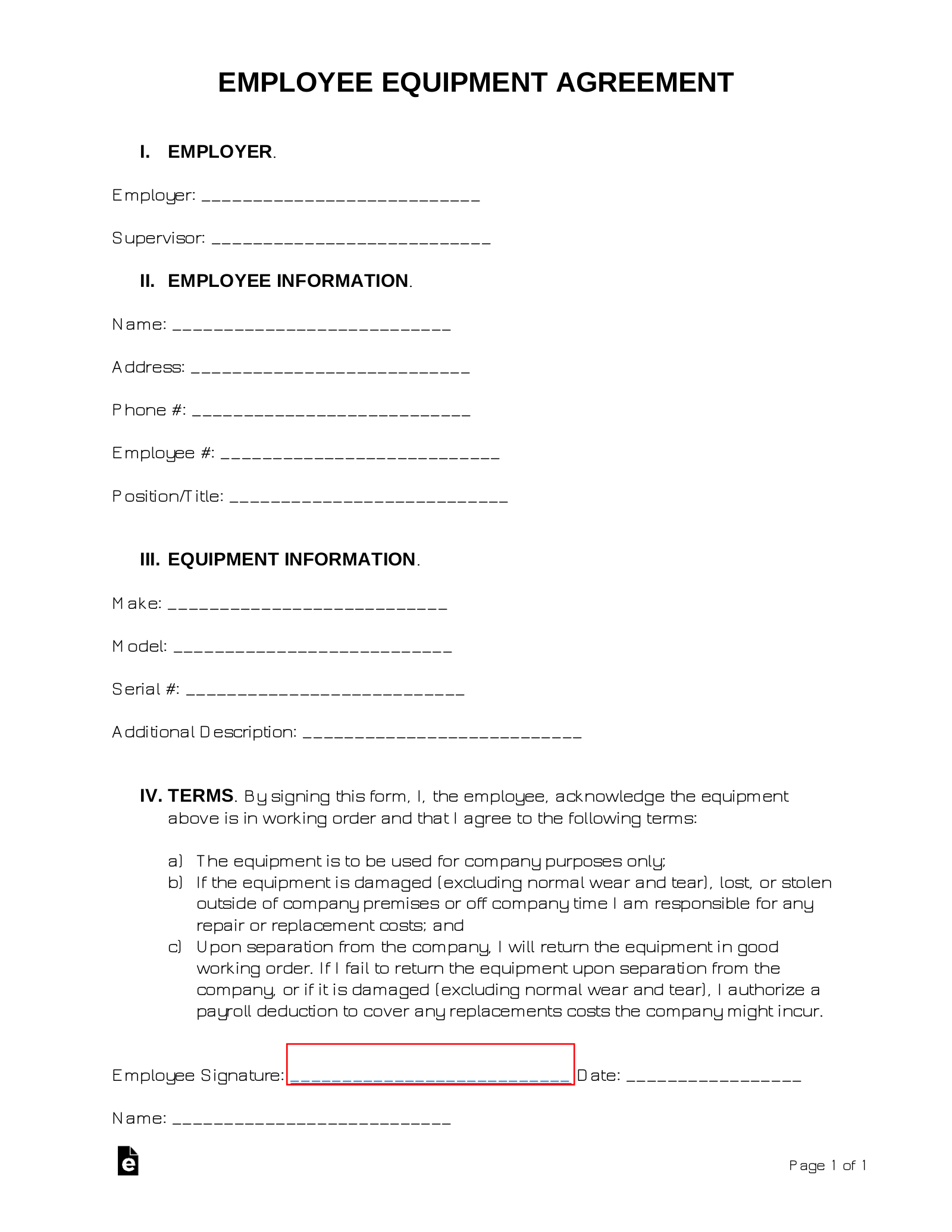

Identification of Parties: Clearly identify both the employer (the lending party) and the employee (the borrowing party). Include full legal names, addresses, and contact information. This ensures there is no ambiguity about who is bound by the agreement.

Description of Equipment: Provide a detailed description of the equipment being loaned, including the make, model, serial number, and any other identifying features. This eliminates any confusion about what exactly is being loaned. You might even include photos as attachments for further clarity.

Loan Period: Specify the start and end dates of the loan period. Be clear about when the equipment is expected to be returned. You might also include a clause outlining the procedure for extending the loan period if needed.

Responsibility for Damage or Loss: This is a critical section. Clearly state who is responsible for the equipment if it is damaged, lost, or stolen during the loan period. Will the employee be responsible for covering the repair costs or the replacement value? Be specific about the process for reporting damage or loss and the steps that will be taken to resolve the issue.

Permitted Use: Outline the permitted uses of the equipment. For example, can the employee use the laptop for personal use outside of work hours? Are there any restrictions on the types of software that can be installed? Defining permitted use helps prevent misuse or damage to the equipment.

Return of Equipment: Specify the condition in which the equipment must be returned. Should it be clean and in good working order? Outline the process for returning the equipment, including the location and the person to whom it should be returned. Include a clause stating that the employee acknowledges that the equipment remains the property of the company.

By including these key elements in your employee equipment loan agreement template, you can create a comprehensive document that protects your company’s assets and minimizes the risk of disputes. Remember to consult with legal counsel to ensure that your agreement complies with all applicable laws and regulations.

It’s about fostering a relationship built on trust and mutual respect, even when it comes to lending out equipment. A well-defined agreement is not about distrust, but rather about clarity and accountability, which ultimately benefits both the employer and the employee.

With the right agreement in place, you’re setting the stage for a smooth and successful loan process, allowing your employees to utilize company equipment effectively while protecting your valuable assets. It’s a win-win strategy that contributes to a more productive and secure work environment.