So, you’re looking into an equipment lease to own agreement template? That’s a smart move! Whether you’re a budding entrepreneur needing some serious machinery or an established business upgrading your gear, this type of agreement can be a real game-changer. It gives you the flexibility to use the equipment you need now while working towards owning it outright later. It’s like test driving a car before deciding to buy, but for bigger, more business-critical assets.

Think of it as a structured rental agreement with a built-in purchase option. You make regular payments, and a portion of those payments goes towards the eventual purchase price. This can be incredibly helpful for managing cash flow, especially for startups or businesses with tight budgets. Instead of shelling out a large sum upfront, you can spread the cost over time. Plus, depending on your tax situation, you might even be able to deduct your lease payments as business expenses.

But before you jump in, it’s crucial to understand exactly what you’re signing up for. An equipment lease to own agreement template isn’t one-size-fits-all. The specifics of the agreement, like the lease term, payment schedule, and purchase option, can vary significantly. That’s why having a well-drafted, comprehensive template is essential. Let’s dive into what makes a good template and what you should look for when using one.

What to Include in Your Equipment Lease to Own Agreement Template

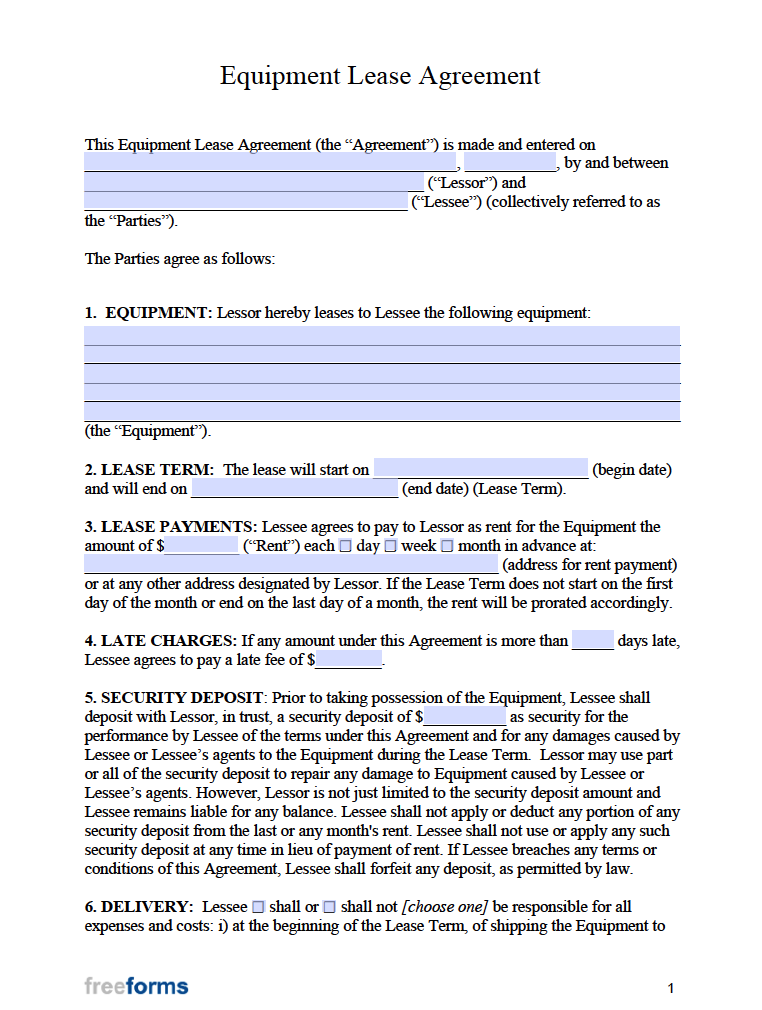

A solid equipment lease to own agreement template should be more than just a fill-in-the-blanks form. It needs to clearly outline the rights and responsibilities of both the lessor (the owner of the equipment) and the lessee (the person leasing it). Think of it as a detailed roadmap for the entire lease period, ensuring everyone is on the same page and minimizing the potential for misunderstandings or disputes down the line. Let’s break down some key components.

First and foremost, the agreement needs to clearly identify the parties involved. This includes the full legal names and addresses of both the lessor and the lessee. It should also include a detailed description of the equipment being leased. Don’t just say “a tractor.” Specify the make, model, serial number, and any accessories included. The more detailed you are, the better. This prevents any confusion about what exactly is being leased and what condition it should be in at the start of the lease.

The heart of the agreement lies in the payment terms. This section should spell out the amount of each payment, the frequency of payments (e.g., monthly, quarterly), and the due date. It should also specify the method of payment (e.g., check, electronic transfer) and any late payment penalties. Clarity here is crucial to avoid any disputes about payment schedules or amounts. Don’t forget to address what happens if a payment is missed or if the lessee wants to prepay the lease. Include information on late fees, grace periods, and any penalties for early termination.

The purchase option is what truly sets an equipment lease to own agreement template apart from a regular lease. This section should clearly define the terms under which the lessee can purchase the equipment at the end of the lease term. This includes the purchase price, the date on which the purchase option can be exercised, and any conditions that must be met for the purchase to go through. Is the purchase price a fixed amount, or is it based on the fair market value of the equipment at the time of purchase? Is there a deadline for exercising the purchase option? These are all important details to clarify.

Finally, the agreement should address issues like maintenance, insurance, and default. Who is responsible for maintaining the equipment during the lease term? Who is responsible for insuring the equipment against loss or damage? What happens if the lessee defaults on the lease agreement? These are all potential pitfalls that need to be addressed in a comprehensive agreement. Clear guidelines here can prevent costly disputes and ensure that both parties are protected.

Key Considerations When Using an Equipment Lease to Own Agreement

So, you’ve found a potential equipment lease to own agreement template, great! But before you put pen to paper (or fingers to keyboard), there are a few crucial things to consider. Don’t treat this as a simple formality; it’s a legally binding document that can have significant financial implications. Taking the time to review the template carefully and adapt it to your specific needs can save you a lot of headaches down the road.

First, carefully evaluate the total cost of the lease. While the monthly payments may seem appealing, be sure to calculate the total amount you’ll pay over the entire lease term, including any interest or fees. Compare this to the cost of purchasing the equipment outright. Sometimes, despite the initial higher cost, buying outright could be cheaper in the long run. Understand the effective interest rate you’re paying on the lease, and consider if you could secure a more favorable interest rate through a traditional loan.

Second, thoroughly inspect the equipment before signing the agreement. Make sure it’s in good working order and meets your needs. Have a qualified technician inspect the equipment if necessary. Document any existing damage or defects in writing and include them as part of the agreement. This will protect you from being held responsible for damage that was already present when you took possession of the equipment. It also provides a benchmark for determining the equipment’s condition upon return, should you choose not to exercise the purchase option.

Third, understand your rights and responsibilities under the agreement. Read the fine print carefully and don’t hesitate to ask questions if anything is unclear. Consult with an attorney or financial advisor if needed. Ensure you understand the implications of defaulting on the lease and what options you have if the equipment malfunctions or becomes obsolete during the lease term. What recourse do you have if the lessor fails to uphold their end of the agreement?

Finally, make sure the equipment lease to own agreement template complies with all applicable laws and regulations in your jurisdiction. Laws governing leasing agreements can vary from state to state, so it’s important to ensure that your agreement is legally sound and enforceable. Consider having an attorney review the agreement to ensure compliance and protect your interests.

Taking these considerations into account will help you make an informed decision about whether an equipment lease to own agreement is the right choice for your business and ensure that you enter into the agreement with your eyes wide open.

Ultimately, the goal is to obtain the equipment you need on terms that are favorable and sustainable for your business. By carefully considering all aspects of the lease agreement and seeking professional advice when needed, you can set yourself up for success. There are many types of equipment to consider leasing depending on your industry.

Navigating the world of business equipment can feel overwhelming, but with the right tools and information, you can make informed decisions that benefit your bottom line. Understanding how to use an equipment lease to own agreement template is a significant step toward achieving your business goals.