So, you’re thinking about starting a family LLC? That’s fantastic! It’s a great way to manage assets, plan for the future, and keep things organized within your family. But before you jump in, there’s a crucial piece of the puzzle you need: the operating agreement. Think of it as the roadmap for your LLC, outlining how things will run, who’s responsible for what, and what happens if disagreements arise. It might seem a bit daunting, but don’t worry, it’s totally manageable, especially with a solid family llc operating agreement template to guide you.

Creating a family LLC isn’t just about the legal paperwork; it’s about setting clear expectations and open communication within your family. A well-crafted operating agreement can prevent future conflicts and ensure that everyone is on the same page regarding the LLC’s purpose, management, and distribution of profits. It’s like creating a family constitution for your business ventures. Plus, having a formal document demonstrates to lenders and other businesses that you’re serious about your venture.

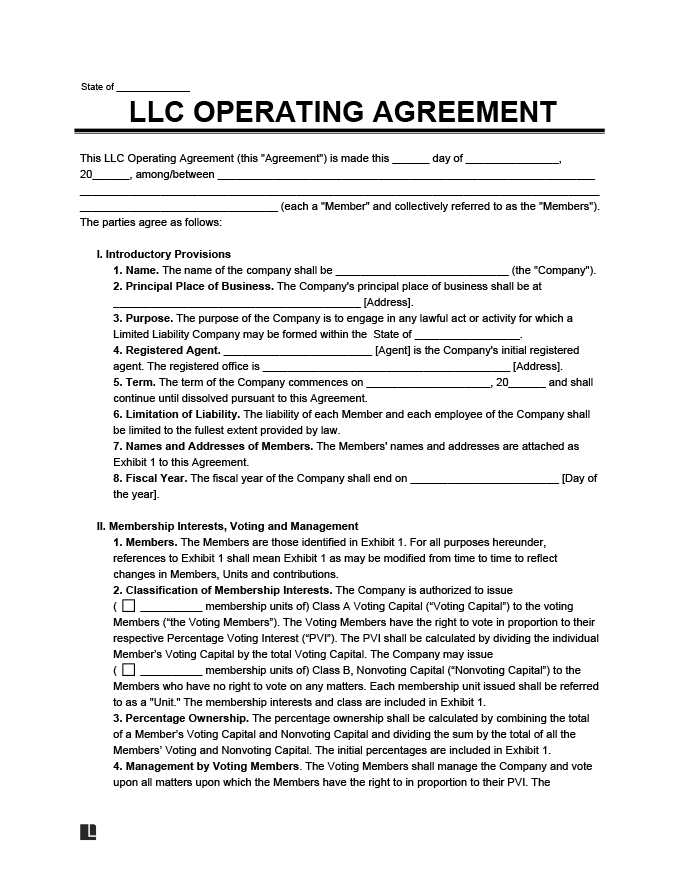

This is where a family llc operating agreement template comes in handy. It provides a framework to build upon, ensuring you cover all the necessary legal and practical considerations. Finding the right template can save you time and money compared to hiring a lawyer to draft one from scratch. In this article, we’ll explore what an operating agreement is, why it’s so important for family LLCs, and how to use a template effectively.

Why a Family LLC Operating Agreement is Essential

Imagine trying to bake a cake without a recipe. You might end up with something edible, but chances are, it won’t be as good as it could be with clear instructions. A family LLC operating agreement is your recipe for success. It provides a documented framework for how your LLC will function, preventing misunderstandings and potential disputes down the line. It’s more than just a legal formality; it’s a tool for promoting harmony and transparency within your family business.

One of the primary reasons to have a detailed operating agreement is to establish clear roles and responsibilities. Who is in charge of day-to-day operations? Who makes the big decisions? How are profits and losses distributed? Addressing these questions upfront prevents ambiguity and ensures that everyone knows their place and what is expected of them. This is especially important in family businesses where personal relationships can sometimes cloud business judgment.

Furthermore, an operating agreement helps protect your personal assets. By formally establishing your LLC as a separate legal entity, you limit your personal liability for the business’s debts and obligations. This means that if the LLC is sued or incurs debt, your personal assets, such as your home and savings, are generally protected. However, this protection only holds if you operate the LLC according to the guidelines outlined in the operating agreement and comply with all legal requirements.

The agreement also addresses what happens when a member wants to leave the LLC or passes away. It outlines the process for transferring ownership interests, valuing those interests, and resolving any disputes that may arise. This is crucial for ensuring the long-term stability and continuity of the family business. Without a clear plan in place, the departure of a member could lead to significant legal and financial complications.

Finally, a comprehensive operating agreement demonstrates to lenders, investors, and other stakeholders that your family LLC is professionally managed and well-organized. This can increase your credibility and make it easier to secure financing or partnerships. It shows that you’ve taken the time to think through the important aspects of your business and that you’re committed to its success. A solid agreement based on a family llc operating agreement template can make the difference.

Key Components of a Family LLC Operating Agreement

Alright, let’s dive into the nitty-gritty. What exactly should you include in your family LLC operating agreement? While every LLC is unique, there are certain essential provisions that should be covered to ensure that your agreement is comprehensive and legally sound. Think of these as the core ingredients in your business recipe.

First and foremost, you’ll need to clearly identify the members of the LLC, their respective ownership percentages, and their initial contributions to the business. This section should also specify how profits and losses will be allocated among the members. Will it be based strictly on ownership percentage, or will there be other factors involved, such as the amount of time and effort each member contributes?

Next, you’ll need to outline the management structure of the LLC. Will it be member-managed, where all members participate in the day-to-day operations, or manager-managed, where one or more designated managers are responsible for running the business? If it’s manager-managed, the operating agreement should clearly define the roles and responsibilities of the managers and how they are selected and removed.

Another critical component is the voting rights of the members. How will decisions be made? Will each member have one vote, or will voting power be proportional to their ownership percentage? The operating agreement should also specify the types of decisions that require a majority vote versus a unanimous vote. This helps to prevent gridlock and ensures that important decisions can be made efficiently.

The operating agreement should also address the process for adding new members to the LLC and transferring ownership interests. What happens if a member wants to sell their shares? Do the other members have the right of first refusal? How will the value of the shares be determined? Having clear guidelines in place can prevent disputes and ensure a smooth transition of ownership.

Finally, the agreement should include provisions for dissolving the LLC. Under what circumstances will the LLC be dissolved? How will the assets be distributed? Addressing these issues upfront can save a lot of headaches and legal fees if the family decides to wind down the business in the future. Using a well-structured family llc operating agreement template will help guide you through all of these important considerations.

Creating a family LLC and using a family llc operating agreement template is a significant step towards securing your family’s future and streamlining business operations. Remember to review the document regularly and update it as needed to reflect changes in your business or family circumstances.

Taking the time to create a comprehensive and well-thought-out operating agreement is an investment in the long-term success and harmony of your family LLC. It’s a foundation upon which you can build a thriving family business, secure in the knowledge that you have a clear roadmap to guide you.