Let’s face it, borrowing money from family can be a tricky situation. On one hand, it can be a lifesaver when banks aren’t willing to lend or when you need funds quickly. On the other, it can strain relationships if not handled properly. That’s where a family loan agreement template Australia comes in handy. It’s all about setting clear expectations and ensuring everyone is on the same page, turning a potentially awkward situation into a formal, professional arrangement.

Think of it as creating a financial safety net, not just for the borrower, but also for the lender. A well-structured family loan agreement clarifies the terms of the loan, including the amount, interest rate (if any), repayment schedule, and what happens if things don’t go according to plan. It’s not about mistrust; it’s about respecting each other and acknowledging that even the best intentions can sometimes be derailed by unforeseen circumstances.

Using a family loan agreement template Australia provides a structured framework, prompting you to consider all the important aspects of the loan. It helps avoid misunderstandings down the line and protects both parties involved. After all, maintaining strong family bonds is far more valuable than any amount of money. So, let’s dive into why you might need one and how to make it work for your family.

Why You Need a Family Loan Agreement

Sometimes, a handshake and a verbal promise just aren’t enough, especially when money is involved. While you might trust your family implicitly, life can throw curveballs. A written agreement serves as a clear record of the loan terms, preventing future disputes and ensuring everyone remembers what was agreed upon. It’s about transparency and accountability.

Imagine this scenario: Your sibling needs help with a down payment for a house and you decide to lend them a significant sum. Without a written agreement, memories can fade, understandings can differ, and resentment can build if repayment expectations aren’t met. A family loan agreement documents the details, providing a point of reference for both parties and maintaining harmony within the family.

Furthermore, if you’re lending a substantial amount, you might need to consider the tax implications. Interest paid on a legitimate loan is often taxable income for the lender. A formal agreement provides evidence to the Australian Taxation Office (ATO) that the loan is genuine and not simply a gift disguised as a loan. This is particularly important if you’re charging interest that’s significantly below market rates.

It also protects the borrower. Having a clear repayment schedule and documented terms can provide peace of mind and help the borrower manage their finances responsibly. It transforms what could be a stressful and uncertain obligation into a structured and manageable debt. Knowing exactly what’s expected allows the borrower to budget and plan accordingly, reducing the risk of late payments or defaults.

In essence, a family loan agreement is about protecting relationships. It ensures that financial transactions don’t damage the bonds that are so important. It provides a framework for open communication and helps to prevent misunderstandings that can lead to resentment and conflict. It allows families to help each other financially without jeopardizing their personal connections.

Key Elements of a Family Loan Agreement

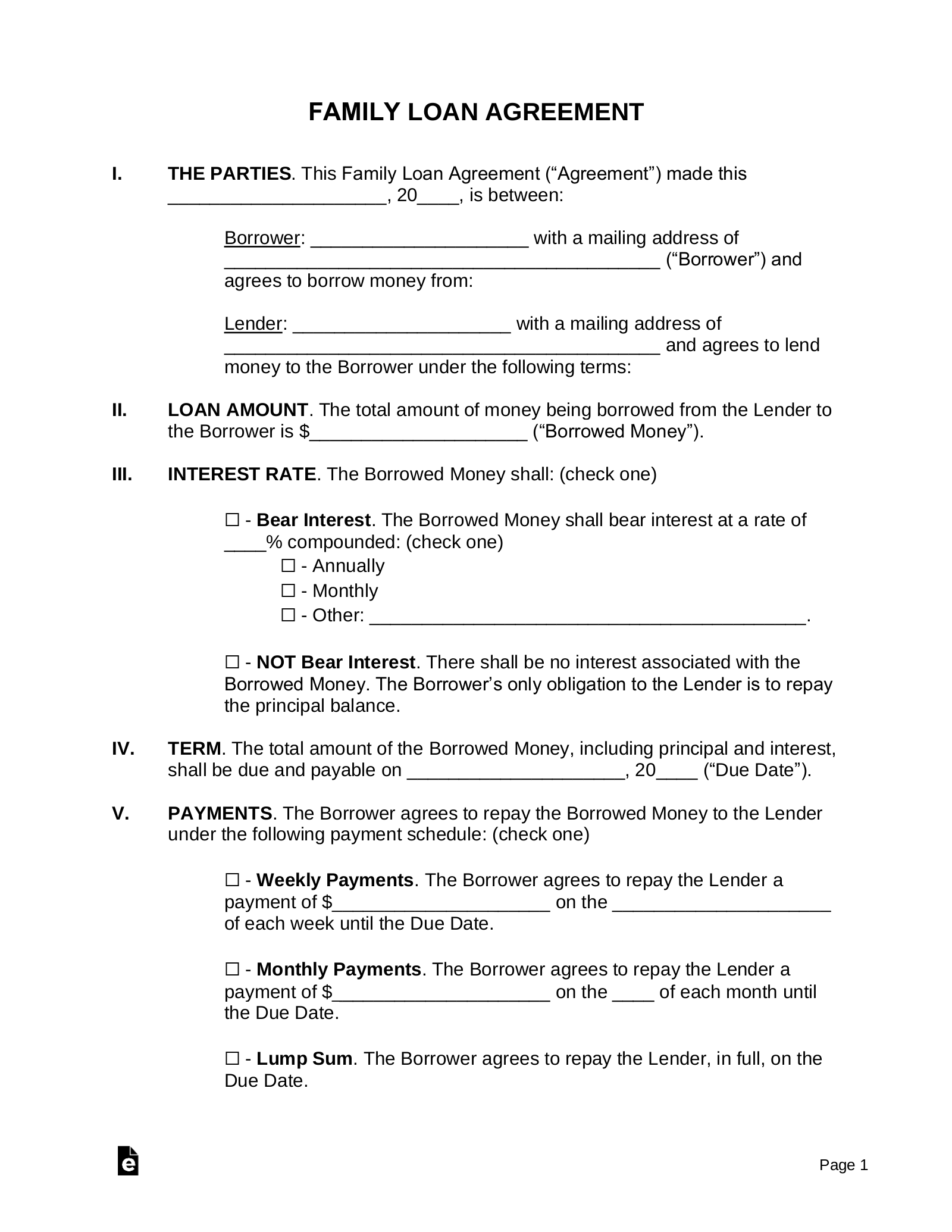

A comprehensive family loan agreement template Australia should include several essential components. First and foremost, it should clearly identify the lender and the borrower, including their full legal names and addresses. This seems basic, but it’s crucial for legal clarity. This is the base of any good contract. You need to identify who is involved!

The agreement should specify the principal amount of the loan. This is the total amount of money being lent. It’s important to state this clearly and unequivocally. Next, the interest rate, if any, should be defined. Even if you’re offering a loan with no interest, it’s wise to state that explicitly in the agreement. If there is interest, specify how it will be calculated (e.g., simple or compound) and when it will be applied.

The repayment schedule is another critical element. This section should outline how often payments will be made (e.g., weekly, monthly, quarterly), the amount of each payment, and the date on which the first payment is due. It’s also helpful to specify the method of payment (e.g., direct deposit, check). Be clear if there are any late penalties if payments are made later than the due date.

Consider including a clause that addresses what happens if the borrower defaults on the loan. This might involve setting out a process for renegotiating the repayment schedule or taking legal action to recover the debt. While it’s uncomfortable to think about, it’s important to have a plan in place in case things go wrong. Think of these as the worst case scenario, and have a plan in place.

Finally, the agreement should be dated and signed by both the lender and the borrower. It’s also advisable to have the signatures witnessed by a third party, who can attest to the authenticity of the signatures. Having a witness isn’t strictly necessary but can add an extra layer of security to the agreement and protect you in the future.

Drafting a good family loan agreement template Australia ensures clarity, protects relationships, and formalizes a transaction that might otherwise lead to future conflict. It’s a simple step that can save a lot of heartache.

Taking the time to document your arrangement thoroughly not only clarifies expectations but also reinforces trust within the family. This proactive approach can strengthen bonds rather than strain them.

Ultimately, a well-crafted agreement serves as a testament to the mutual respect and commitment shared between family members, ensuring that financial assistance enhances rather than hinders their cherished relationships.