So, you’re thinking about lending money to a family member, or maybe you’re the one asking for the loan? It’s a common situation, and honestly, it can be a really great way to help each other out. But let’s face it, mixing family and finances can sometimes get a little sticky. That’s where a family loan agreement template UK comes in handy. Think of it as a safety net, a way to protect both the lender and the borrower, and keep those family ties strong.

A formal agreement might seem a bit cold or unnecessary when dealing with loved ones. You might be thinking “We’re family, we trust each other!” and that’s wonderful. However, life happens, circumstances change, and memories can sometimes fade or differ. Having a written agreement clarifies the terms of the loan upfront, so everyone is on the same page and understands their responsibilities. It prevents misunderstandings and potential arguments down the line.

This article is designed to walk you through the ins and outs of using a family loan agreement template UK. We’ll cover why it’s important, what it should include, and where you can find one. We’ll even touch on some of the common pitfalls to avoid when lending money to family. By the end, you’ll be well-equipped to navigate this process with confidence and keep your relationships intact.

Why You Need a Family Loan Agreement Template UK

Okay, let’s dive into why a family loan agreement template UK is actually a brilliant idea, even if it feels a bit formal. The key word here is “clarity.” When you loan money to a family member, you’re not just giving them cash; you’re entering into a financial agreement. Just like any other financial agreement, it’s essential to have clear terms and conditions that everyone understands. Without a written agreement, memories can be selective, and assumptions can lead to disagreements and resentment. This is why a family loan agreement template UK is so essential.

Imagine this: You lend your brother some money to help him start a business. You both vaguely agree that he’ll pay you back when he’s “on his feet.” Six months later, he’s doing well, but you haven’t seen a penny. You bring it up, and he says he thought you meant he’d pay you back “someday.” Suddenly, a friendly conversation turns into an awkward confrontation. A written agreement would have prevented this entirely.

Beyond family harmony, a loan agreement also has legal implications. If, unfortunately, things go south and the borrower defaults on the loan, a formal agreement can be used as evidence in court. While hopefully, you’ll never need to go down that road, it’s good to have that protection in place. In addition, if the loan is significant, it may have tax implications for both the lender and the borrower. A properly documented loan agreement can help you comply with tax regulations and avoid potential penalties.

Furthermore, having a written agreement encourages open communication. It forces both parties to discuss the details of the loan upfront, including the amount, interest rate (if any), repayment schedule, and what happens if the borrower can’t make a payment. This conversation can be uncomfortable, but it’s vital for establishing realistic expectations and ensuring that everyone is on the same page.

Think of it this way: a family loan agreement template UK isn’t about distrusting your family member. It’s about being responsible and proactive. It’s about protecting your relationship by establishing clear boundaries and expectations. It’s about ensuring that a financial transaction doesn’t turn into a family feud. Using a family loan agreement template UK is about being smart.

What to Include in Your Family Loan Agreement

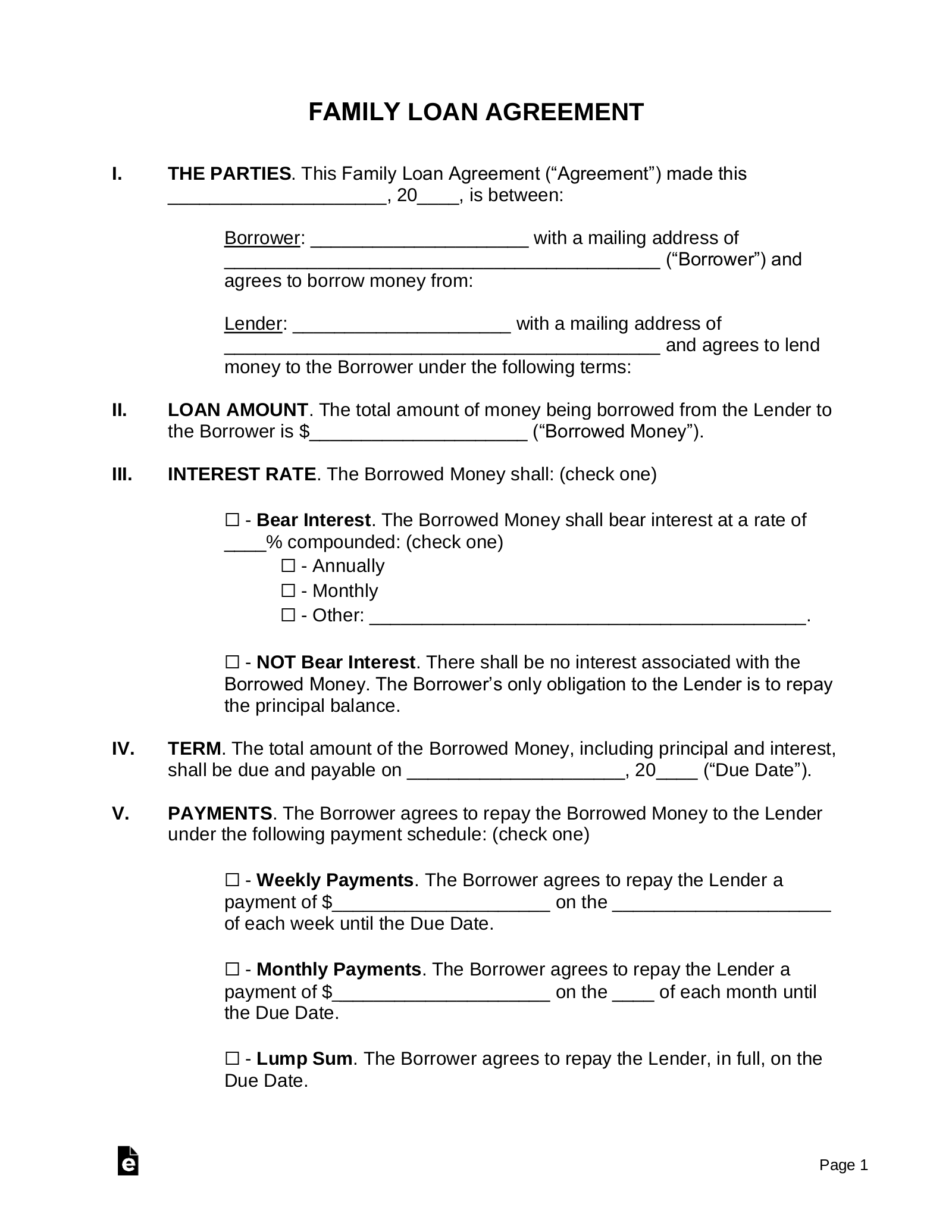

So, you’re convinced that a family loan agreement is a good idea. Excellent! Now, let’s talk about what should actually go into it. A well-drafted agreement will cover all the essential details of the loan, leaving no room for ambiguity. Here’s a breakdown of the key components:

- The Parties Involved: Clearly state the full legal names and addresses of both the lender (the person giving the loan) and the borrower (the person receiving the loan).

- The Loan Amount: Specify the exact amount of money being loaned. There should be no question about the principal sum.

- Interest Rate (if any): Decide whether you’ll charge interest on the loan. If so, clearly state the interest rate and how it will be calculated. Remember, charging a market-rate interest can have tax implications, so do your research.

- Repayment Schedule: This is crucial. Outline how the loan will be repaid. Will it be in monthly installments? Quarterly payments? A lump sum at a specific date? Include the amount of each payment and the due date.

- Late Payment Penalties: What happens if the borrower misses a payment? Will there be a late fee? How many days grace period are they afforded? Be fair but firm.

- Default Clause: Define what constitutes a default on the loan. This might include missing multiple payments, filing for bankruptcy, or failing to meet other obligations. Outline the consequences of default, such as the lender’s right to demand immediate repayment of the entire loan balance.

- Security (if applicable): If the loan is secured by collateral (e.g., a car, a house), clearly describe the collateral and outline the lender’s rights if the borrower defaults.

- Governing Law: State which jurisdiction’s laws will govern the agreement. In this case, it would likely be the laws of England and Wales.

- Entire Agreement Clause: This clause states that the written agreement represents the entire understanding between the parties and supersedes any prior verbal agreements or understandings.

- Signatures: Both the lender and the borrower should sign and date the agreement in the presence of a witness.

You can find various family loan agreement template UK examples online to help you structure your document. Remember to tailor the template to your specific circumstances and needs. A lawyer can also help you draft a custom agreement that meets your unique requirements.

Remember that communication is key, if anything changes over the course of the loan, such as a needed payment date adjustment, always document this in writing by amending the family loan agreement template UK, with both parties signing to show their agreement to the change.

Protecting yourself and your loved ones by putting everything in writing is a great way to ensure smooth sailing. You can never be too careful.

Using this information as a guide, you are now better informed on lending to a relative. Remember to seek professional legal and financial help to ensure the agreement is sound and beneficial for all parties involved.