Running a medical office is a juggling act. You’re focused on providing the best possible care to your patients, navigating insurance complexities, and keeping the lights on. One often overlooked but crucial element of a successful practice is a clear and comprehensive financial agreement. Think of it as setting expectations upfront, so everyone is on the same page about payment responsibilities and what happens if, well, things don’t go exactly as planned. A well-drafted financial agreement template for medical office can significantly reduce misunderstandings, minimize billing disputes, and streamline your revenue cycle.

Imagine a scenario where a patient undergoes a series of treatments, assuming their insurance will cover everything, only to find out later that certain procedures were out-of-network or subject to a high deductible. Without a proper financial agreement in place, this situation could lead to frustration, non-payment, and damaged patient relationships. A good template acts as a guide, outlining all potential costs, payment options, and policies regarding missed appointments or late payments.

This article will delve into the importance of having a solid financial agreement template, what key elements to include, and how it benefits both your practice and your patients. We’ll explore how it can reduce financial stress for both parties, improve cash flow for your office, and ultimately, contribute to a more positive and trusting patient experience. Let’s get started!

Why a Detailed Financial Agreement is Essential for Your Medical Office

Let’s face it, money can be a sensitive topic, especially when it comes to healthcare. Patients are often dealing with the stress of their health conditions, and the last thing they want is confusion or surprises regarding their medical bills. A detailed financial agreement acts as a transparent and upfront communication tool, ensuring that patients understand their financial responsibilities from the get-go. This clarity helps to build trust and avoid potential disputes down the line. Think of it as laying all the cards on the table before treatment even begins.

Beyond patient relations, a well-defined financial agreement is vital for the financial health of your practice. It provides a clear framework for billing and collections, reducing the likelihood of unpaid bills and improving your cash flow. By outlining your payment policies, including acceptable payment methods, late fees, and procedures for handling outstanding balances, you create a consistent and enforceable system. This not only protects your revenue but also saves valuable time and resources that would otherwise be spent chasing down payments.

Furthermore, a comprehensive financial agreement helps to mitigate legal risks. In the event of a dispute over payment, having a signed agreement that clearly outlines the terms and conditions provides legal protection for your practice. It serves as evidence that the patient was informed of their financial obligations and agreed to them. This can be particularly important in cases involving complex procedures or lengthy treatment plans.

In today’s ever-changing healthcare landscape, insurance coverage can be complex and confusing. A good financial agreement should address common insurance-related scenarios, such as deductibles, co-pays, co-insurance, and out-of-network charges. It should also explain how your office handles insurance claims and what steps patients need to take to ensure their claims are processed correctly. By proactively addressing these issues, you can minimize confusion and prevent misunderstandings that could lead to billing disputes.

Creating a financial agreement template for medical office may seem like a daunting task, but it’s an investment that will pay off in the long run. It’s about establishing clear expectations, promoting transparency, and protecting the financial interests of both your practice and your patients. Consider seeking legal advice to ensure your template complies with all applicable laws and regulations in your area.

Key Elements to Include in Your Financial Agreement Template

Crafting an effective financial agreement requires careful consideration of various aspects. Here’s a breakdown of the essential elements you should include to create a robust and patient-friendly document:

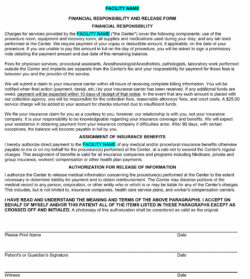

Patient Identification and Contact Information: Start with the basics. Clearly state the patient’s full name, date of birth, address, phone number, and insurance information. This ensures accurate billing and communication.

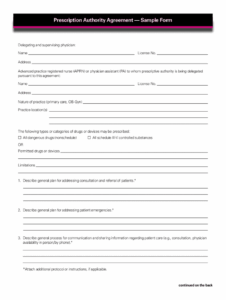

Description of Services: While you don’t need to list every single service you offer, provide a general overview of the types of services covered by the agreement. For example, you might specify “general medical care,” “specialty consultations,” or “surgical procedures.”

Payment Policies: This is the heart of your agreement. Clearly outline your payment expectations, including accepted payment methods (cash, check, credit card, etc.), due dates, and any discounts offered for prompt payment. Be specific about late fees or interest charges for overdue balances. State clearly how you handle insurance claims, pre-authorization requirements, and patient responsibilities for co-pays, deductibles, and co-insurance.

Cancellation and No-Show Policy: Define your policy regarding missed appointments and late cancellations. Specify the amount of notice required to avoid a fee and the amount of the fee itself. This helps to minimize lost revenue due to unused appointment slots.

Financial Hardship Policy: Consider including a statement about how you handle patients who are experiencing financial difficulties. This could involve offering payment plans, reduced fees, or referrals to financial assistance programs. Demonstrating empathy and understanding can go a long way in building trust with your patients.

Assignment of Benefits: This section authorizes your office to bill the patient’s insurance company directly. It also clarifies that the patient is ultimately responsible for any charges not covered by insurance.

Signature and Date: Ensure that the agreement includes a space for both the patient and a representative of your office to sign and date the document. This signifies that both parties have read, understood, and agreed to the terms.

By including these key elements in your financial agreement template for medical office, you can create a comprehensive and effective document that protects both your practice and your patients.

Using a financial agreement template for medical office offers so much assurance for the clinic and the patients. It promotes transparency and trust.