Let’s face it, talking money can be awkward. Sharing sensitive financial information? Even more so. Whether you’re discussing a potential investment, exploring a business partnership, or even just considering a loan, you need a way to protect those private details. That’s where a financial non disclosure agreement template comes in handy. It’s like a digital handshake, ensuring everyone’s on the same page about keeping things confidential.

Think of it as a secret-keeper for your financial data. This legally binding document outlines exactly what information is considered confidential, who’s receiving it, and what they can (and definitely can’t) do with it. It’s about building trust and creating a safe space for open and honest discussions, without the fear of your financial future being compromised. No one wants their competitive edge leaked to a rival or their personal information splashed across the internet.

So, if you’re about to share financial information with someone, taking the time to use a financial non disclosure agreement template is a smart move. It’s a proactive step that can save you headaches, legal battles, and potential financial loss down the road. Let’s dive into what makes a good template and how it can help you protect your valuable data.

Understanding the Importance of a Financial NDA

A financial non disclosure agreement, often called a financial NDA, is a legally enforceable contract that ensures the confidentiality of financial information. This is incredibly important in various situations. Imagine you are a startup seeking venture capital funding. You’ll need to share your financial projections and strategies with potential investors. Without a financial NDA in place, those investors could share your plans with competitors, giving them a huge advantage. Or perhaps you’re a business owner exploring a merger or acquisition. The due diligence process requires you to reveal sensitive financial data to the other party. A financial NDA will protect you if the deal falls through, preventing the other company from using your data to their own benefit.

Beyond business, financial NDAs are also relevant in personal situations. For example, if you’re going through a divorce, you and your spouse will need to disclose your assets and liabilities. A financial NDA can help ensure that this information remains private and isn’t used against you during the proceedings. Even simple lending arrangements between friends or family members can benefit from a financial NDA, especially if significant sums of money are involved. It establishes clear boundaries and protects both the lender and the borrower.

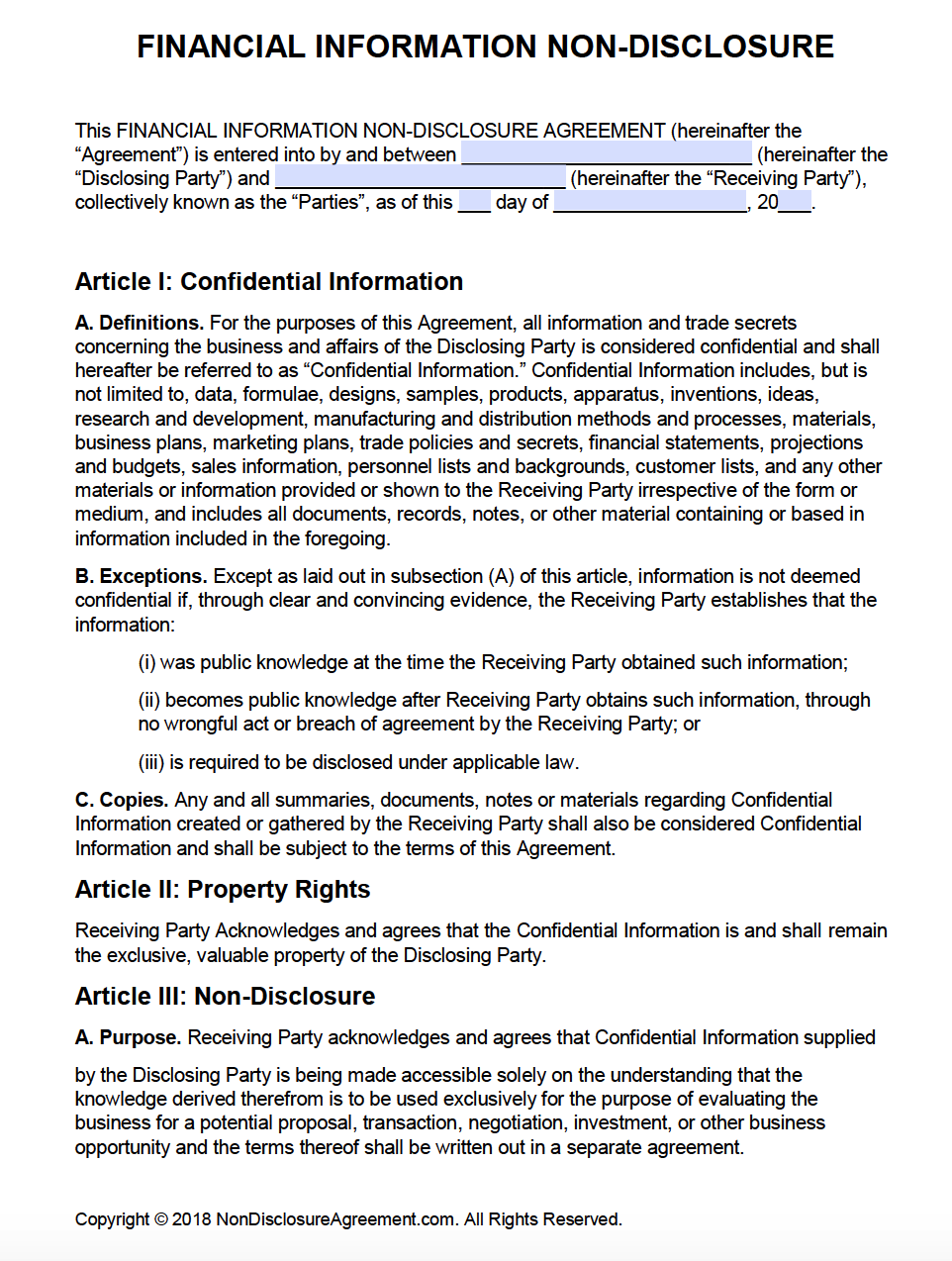

The core function of a financial NDA is to define exactly what constitutes confidential information. This might include financial statements, customer lists, pricing strategies, investment plans, or any other data that could be valuable to competitors or harmful if disclosed. The agreement will also specify who is receiving the information (the “receiving party”) and what they are allowed to do with it. Typically, the receiving party can only use the information for the specific purpose outlined in the agreement, such as evaluating a potential investment or conducting due diligence.

It’s important to note that a financial NDA isn’t a one-size-fits-all document. The specific terms and conditions should be tailored to the particular circumstances of the situation. For example, an NDA for a merger and acquisition will be different from an NDA for a venture capital investment. This is why using a financial non disclosure agreement template can be a good starting point, but you should always review and modify it to ensure it meets your specific needs.

Failing to have a financial NDA in place when sharing sensitive information can have serious consequences. You could lose your competitive advantage, suffer financial losses, or even face legal action. Therefore, it’s always better to be safe than sorry and take the time to create and implement a solid financial NDA before sharing any confidential financial data. Consider consulting with an attorney to ensure that the agreement is legally sound and provides adequate protection.

Key Elements to Include in Your Financial NDA Template

A comprehensive financial non disclosure agreement template should include several key elements to ensure it’s legally sound and effectively protects your confidential information. First, clearly identify the parties involved: the disclosing party (the one sharing the information) and the receiving party (the one receiving the information). Include their full legal names and addresses. This might seem obvious, but it’s crucial for clarity and enforceability.

Next, define what constitutes “confidential information.” Be as specific as possible. Don’t just say “financial information”; instead, list examples such as financial statements, business plans, customer lists, pricing strategies, and any other data you want to protect. The more detailed you are, the less room there is for ambiguity or misinterpretation. Also, specify any exceptions to what is considered confidential. For example, information that is already publicly available or independently developed by the receiving party shouldn’t be covered by the NDA.

The agreement should also outline the permitted use of the confidential information. Clearly state that the receiving party can only use the information for the specific purpose outlined in the agreement. For example, if you’re sharing financial data with a potential investor, the agreement should state that they can only use the information to evaluate the investment opportunity and not for any other purpose.

Another crucial element is the term of the agreement. Specify how long the confidentiality obligation will last. This could be a fixed period, such as five years, or it could be tied to a specific event, such as the completion of a project. Consider the nature of the information and how long it’s likely to remain valuable when determining the appropriate term. Furthermore, include provisions for remedies in case of a breach of the agreement. This should outline the legal options available to the disclosing party if the receiving party violates the confidentiality obligations. This may include seeking an injunction to stop further disclosure or pursuing monetary damages.

Finally, don’t forget to include standard legal clauses such as a governing law clause (specifying which state’s laws will govern the agreement), a severability clause (stating that if one part of the agreement is found to be unenforceable, the rest of the agreement remains in effect), and an integration clause (stating that the agreement represents the entire understanding between the parties). Taking the time to include these key elements in your financial non disclosure agreement template will help ensure that it’s a strong and effective tool for protecting your valuable financial information. Using a financial non disclosure agreement template will also save time and money by providing a solid foundation for your agreement.

Sharing financial data requires a balance. You need to be transparent to facilitate a deal or relationship, but you also need to protect yourself from potential misuse of that information. A financial non disclosure agreement template provides that balance.

Ultimately, using a financial non disclosure agreement template is a sign of good business practice and demonstrates a commitment to protecting sensitive information, fostering trust and setting the stage for successful collaborations.