Let’s face it, sometimes life throws you curveballs. Unexpected expenses pop up, bills pile high, and suddenly you’re staring down the barrel of a financial challenge. It’s a situation many of us have been in, and one of the most effective ways to navigate it is by creating a clear and concise financial payment plan agreement template. Think of it as a roadmap to getting back on track, a formal agreement between you (the debtor) and the person or company you owe money to (the creditor).

This isn’t just about admitting you need help; it’s about proactively taking control of your financial situation. A well-structured payment plan shows the creditor that you’re committed to resolving the debt, and it provides you with a manageable schedule to follow. It takes the guesswork out of repayment and fosters a sense of mutual understanding and trust. And that’s valuable for both parties.

This article walks you through the ins and outs of creating a solid financial payment plan agreement template. We’ll explore the essential components, offer practical tips, and help you understand how this agreement can be a powerful tool in regaining your financial footing. So, let’s get started and turn that financial challenge into a manageable plan.

Why You Need a Financial Payment Plan Agreement Template

Imagine trying to build a house without a blueprint. That’s essentially what attempting to repay a debt without a clear plan feels like – chaotic and likely to fall apart. A financial payment plan agreement template serves as that blueprint, providing structure, clarity, and legal protection for both the debtor and the creditor. It’s a documented agreement outlining how you intend to repay your debt over a specific period.

One of the key benefits is that it minimizes confusion and misunderstandings. It explicitly states the amount owed, the repayment schedule, the interest rate (if applicable), and any late payment penalties. By putting all of this in writing, you eliminate the potential for disagreements down the line. This is especially crucial when dealing with significant sums of money or ongoing debts.

Furthermore, a formal agreement demonstrates your commitment to fulfilling your financial obligations. This can improve your relationship with the creditor and potentially prevent them from taking further action, such as sending your debt to collections or pursuing legal recourse. It shows that you’re taking responsibility and working towards a solution.

From a legal standpoint, a written agreement provides valuable protection for both parties. In the event of a dispute, the agreement serves as evidence of the terms and conditions agreed upon. This can be crucial in resolving any disagreements fairly and efficiently. It’s a record that can be referred to if memories fade or interpretations differ.

Beyond the practical and legal benefits, a payment plan can also offer peace of mind. Knowing that you have a structured plan in place can alleviate stress and anxiety associated with debt. It allows you to focus on making consistent payments and achieving your financial goals, rather than constantly worrying about the overwhelming weight of the debt.

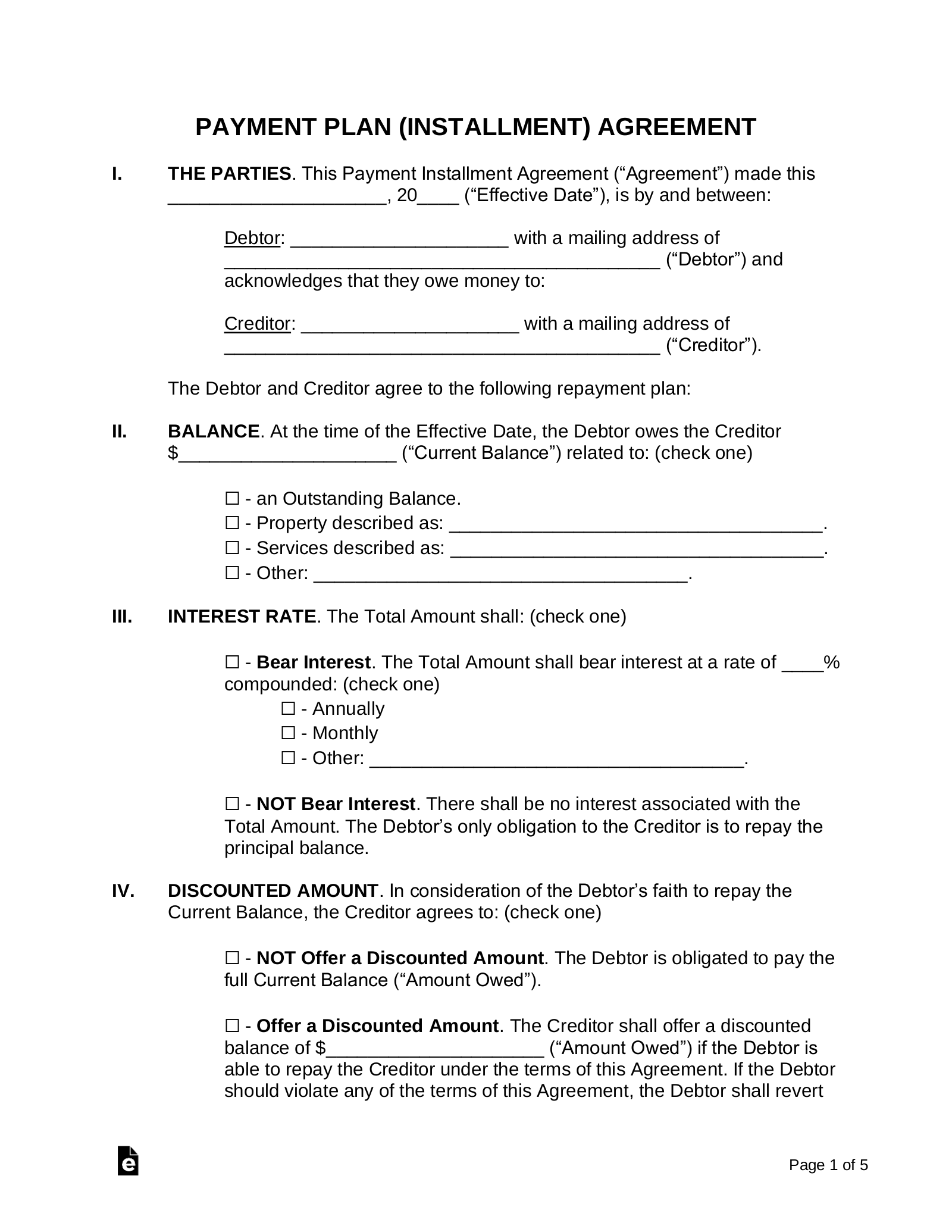

What to Include in Your Financial Payment Plan Agreement Template

When crafting your financial payment plan agreement template, certain elements are essential for ensuring clarity and enforceability. These include:

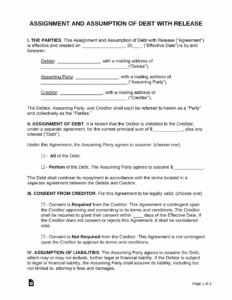

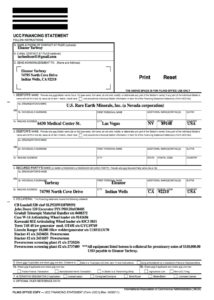

- Parties Involved: Clearly identify both the debtor (the person owing the money) and the creditor (the person or entity owed the money), including their full legal names and addresses.

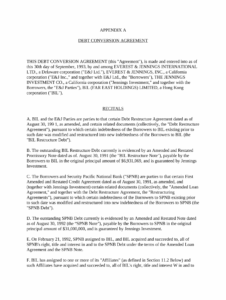

- Original Debt Amount: State the original amount of the debt owed before any interest or fees were added.

- Outstanding Balance: Specify the current outstanding balance, including any accrued interest or late fees.

- Repayment Schedule: Outline the payment frequency (e.g., weekly, bi-weekly, monthly), the payment amount, and the due date for each payment.

- Interest Rate (if applicable): If interest is being charged, clearly state the interest rate and how it is calculated.

- Late Payment Penalties: Specify any penalties for late payments, such as late fees or increased interest rates.

- Default Clause: Define what constitutes a default on the agreement and the consequences of defaulting.

- Governing Law: Indicate which state’s laws will govern the agreement.

- Signatures: Include spaces for both the debtor and the creditor to sign and date the agreement.

Key Considerations When Creating a Payment Plan

Creating a financial payment plan agreement template isn’t just about filling in the blanks. It’s about crafting a realistic and sustainable plan that works for both you and the creditor. Here are some key considerations to keep in mind.

First, be honest with yourself about your ability to repay the debt. Don’t overpromise on payment amounts that you can’t realistically afford. It’s better to propose a smaller, more manageable payment that you can consistently make than to agree to a larger payment that you’ll inevitably struggle with. Consider your income, expenses, and any other financial obligations you have.

Second, communicate openly and honestly with the creditor. Explain your financial situation and why you’re seeking a payment plan. Be willing to negotiate and compromise on the terms of the agreement. Remember, the creditor wants to get paid, and they’re often willing to work with you to find a solution that benefits both parties. Clear communication builds trust and increases the likelihood of a successful agreement.

Third, carefully review the terms of the agreement before signing it. Make sure you understand all of the provisions, including the repayment schedule, interest rate, late payment penalties, and default clause. If you’re unsure about anything, don’t hesitate to ask for clarification or seek legal advice. It’s better to be fully informed before committing to the agreement.

Fourth, stick to the payment plan once it’s agreed upon. Make your payments on time and in the agreed-upon amount. If you encounter any unexpected financial challenges that make it difficult to meet your obligations, contact the creditor immediately to discuss your options. Don’t wait until you’ve missed a payment to communicate. Open communication is key to maintaining a positive relationship and avoiding default.

Finally, keep a copy of the signed agreement for your records. This will serve as evidence of the terms and conditions agreed upon and can be useful in resolving any disputes that may arise in the future. It’s a good idea to set reminders for upcoming payments, too.

Using a financial payment plan agreement template can be a powerful tool for managing debt and regaining financial control. By understanding the essential components, communicating openly with the creditor, and sticking to the plan, you can work towards a debt-free future. It requires discipline and commitment, but the reward of financial stability is well worth the effort.

Remember, a financial payment plan agreement template isn’t a magic wand. It is, however, a valuable resource that can help you navigate financial challenges. By using it wisely, you can regain control of your finances and build a brighter future.