Starting a Limited Liability Company (LLC) in Florida is an exciting step for any entrepreneur. You’re diving into the world of business ownership, and that comes with responsibilities. One of the most crucial documents you’ll need, often overlooked, is an operating agreement. Think of it as the internal rulebook for your LLC, guiding how things will run and preventing future disagreements. While not legally required in Florida, having a solid operating agreement is absolutely essential for a smooth and successful business journey.

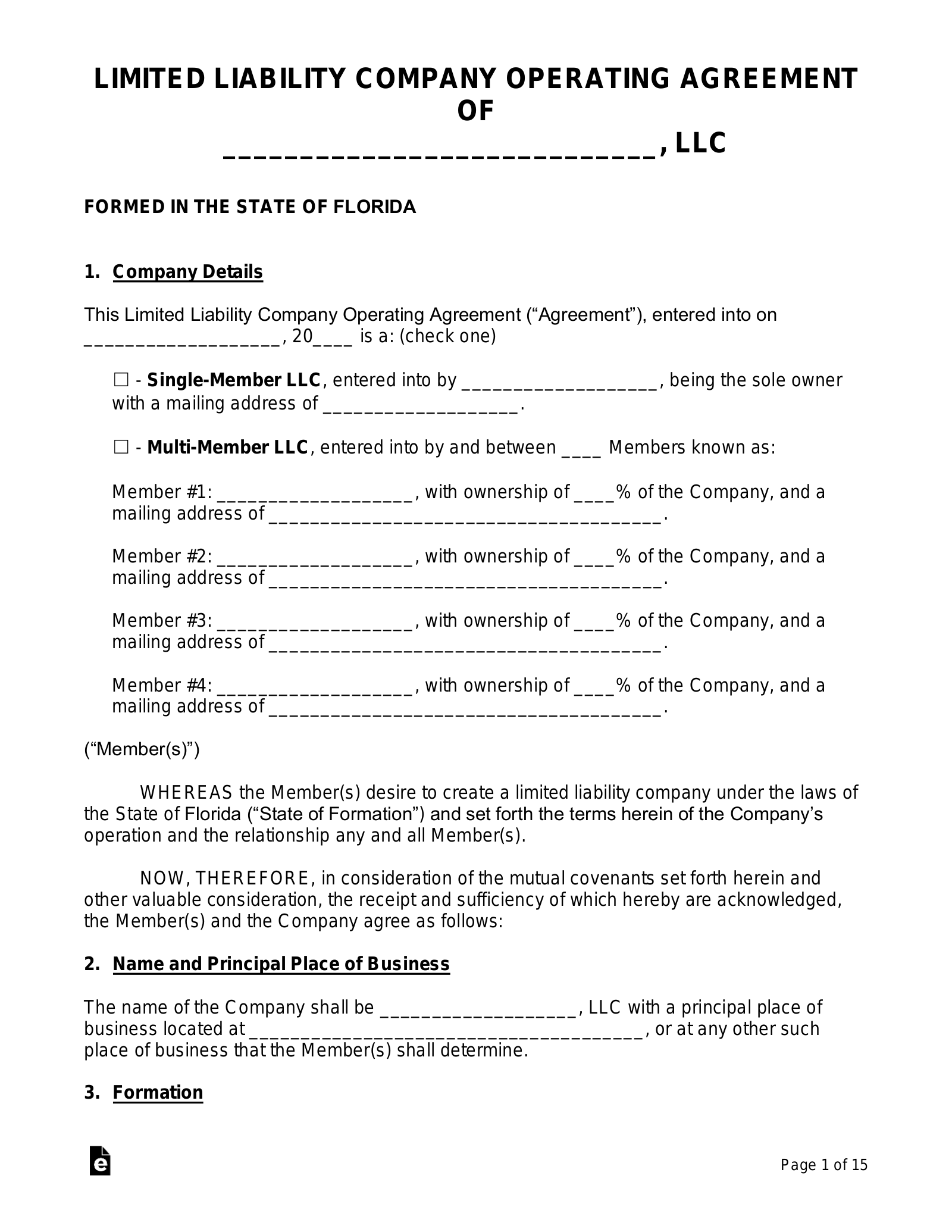

So, where do you start? Creating an operating agreement from scratch can seem daunting. Thankfully, you don’t have to reinvent the wheel. A Florida LLC operating agreement template can be a lifesaver. These templates provide a pre-structured framework, covering all the essential aspects of your LLC’s operations. They offer a solid foundation that you can then tailor to your specific business needs and the desires of your members.

This article will guide you through understanding the importance of an operating agreement, why using a template is a smart move, and what key elements you should consider when customizing it. We’ll explore how a fl llc operating agreement template can help you protect your business, establish clear roles, and plan for the future. Let’s get started!

Why Your Florida LLC Needs an Operating Agreement

Even though Florida doesn’t legally mandate an operating agreement for LLCs, foregoing one is like sailing a ship without a map. While you might eventually reach your destination, you’ll likely encounter unnecessary storms and obstacles along the way. An operating agreement acts as a shield, protecting your personal assets and clarifying the roles and responsibilities of each member involved. It helps prevent misunderstandings and potential legal battles down the road. Think of it as an insurance policy for your business relationship with your partners.

Without a written operating agreement, your LLC will be governed solely by Florida’s default LLC laws. While these laws provide a basic framework, they might not align with your specific business goals or the unique arrangements you’ve made with your fellow members. For instance, Florida law might dictate how profits and losses are distributed, how decisions are made, or what happens if a member leaves the LLC. These default provisions may not be ideal for your situation, potentially leading to disputes and inefficiencies.

Consider a scenario where two friends start an LLC, each investing equally. Without an operating agreement, Florida law might assume that both friends have equal say in all decisions, regardless of their actual involvement in the day-to-day operations. What if one friend is primarily responsible for sales and marketing, while the other handles finances? An operating agreement allows you to allocate responsibilities and decision-making power based on each member’s expertise and contribution, creating a more efficient and harmonious business environment.

Furthermore, an operating agreement adds credibility to your LLC. It demonstrates to banks, lenders, and potential investors that you’ve taken the time to establish a formal structure for your business. This can be crucial when seeking funding or establishing credit. A well-drafted operating agreement showcases your professionalism and commitment to the long-term success of your business.

In short, an operating agreement is not just a formality; it’s a vital tool that protects your interests, clarifies your relationships with your partners, and sets your Florida LLC up for success. A fl llc operating agreement template can be a great resource to get you started on creating yours.

Key Components of a Florida LLC Operating Agreement Template

A solid Florida LLC operating agreement template will cover several essential aspects of your business. While templates offer a helpful starting point, remember that customization is key to ensuring the agreement accurately reflects your specific circumstances. Here are some core components you’ll typically find in a good template:

Company Information: This section typically includes the LLC’s official name, registered agent information (who will receive legal notices), principal place of business, and purpose. Be specific about your business’s purpose, but avoid being overly restrictive, which could limit your future business activities.

Member Information: This part outlines the names and addresses of each member of the LLC, their initial contributions (cash, property, or services), and their percentage ownership in the company. Clearly defining ownership percentages is crucial for determining profit/loss distribution and voting rights.

Management Structure: Will your LLC be member-managed, where all members actively participate in running the business, or manager-managed, where one or more designated managers handle day-to-day operations? The operating agreement should clearly state the management structure and the roles and responsibilities of each manager (if applicable).

Profit and Loss Allocation: How will profits and losses be divided among the members? This is a critical section to tailor to your specific agreement. While often based on ownership percentages, you can also agree to allocate profits and losses differently based on factors such as individual contributions or responsibilities.

Meetings and Voting: How will decisions be made within the LLC? Will members hold regular meetings? What percentage of votes is required to pass a resolution? Clearly define the meeting frequency, voting procedures, and quorum requirements to avoid future disputes.

Transfer of Ownership: What happens if a member wants to sell their ownership interest? The operating agreement should outline the process for transferring ownership, including any restrictions or rights of first refusal granted to the other members. This is especially important to ensure the smooth continuation of the business.

Dissolution: Under what circumstances will the LLC be dissolved? The operating agreement should specify the triggers for dissolution, such as the death or withdrawal of a member, and outline the process for winding up the business and distributing assets.

Amendments: How can the operating agreement be amended or modified in the future? The operating agreement should specify the procedure for making changes, typically requiring a unanimous or supermajority vote of the members.

Remember to consult with an attorney to ensure that your Florida LLC operating agreement template is properly customized to meet your unique needs and complies with all applicable laws. Don’t just blindly fill in the blanks; take the time to understand each section and how it applies to your business.

Creating a comprehensive and tailored operating agreement, perhaps using a fl llc operating agreement template as a starting point, is one of the best investments you can make in the long-term success of your Florida LLC.

An operating agreement is more than just a legal document; it’s the foundation of your business relationship. Investing the time to create a well-drafted agreement now can save you considerable time, money, and headaches in the future.

Taking this step demonstrates commitment to your business, creating a professional image and fostering trust among members.