So, you’ve got a brilliant business idea, the kind that keeps you up at night with excitement. You’ve crunched the numbers, built a solid plan, and now… you need capital. But the world of venture capitalists and angel investors feels a bit daunting right now. That’s where friends and family often step in. They believe in you, maybe even more than you believe in yourself sometimes! But mixing personal relationships with business can be tricky. That’s why a well-structured friends and family investment agreement template is so important.

Imagine the scenario: your Aunt Susan loans you 10,000 dollars to get your startup off the ground. A year later, the business is struggling, and Aunt Susan starts hinting about needing that money back for her retirement. Without a clear agreement in place, things could get awkward fast. A written agreement isn’t about distrusting your loved ones; it’s about protecting those relationships and ensuring everyone is on the same page from the outset. It helps to prevent misunderstandings and keeps everything professional, even when dealing with familiar faces.

This article will walk you through why using a friends and family investment agreement template is crucial, what key elements it should include, and how it can help you navigate this unique fundraising landscape. We’ll break down the legal jargon and provide practical tips to help you create a document that is both fair and protective of everyone involved. Let’s get started and help you turn that brilliant idea into a thriving reality, with the support of your nearest and dearest – and a solid legal framework.

Why You Absolutely Need a Friends and Family Investment Agreement Template

Let’s face it, asking friends and family for money is never easy. It’s a delicate balance between leveraging trusted relationships and maintaining professional boundaries. The biggest mistake you can make is assuming that because they’re your loved ones, a formal agreement is unnecessary. That’s a recipe for disaster. A formal agreement, facilitated by a friends and family investment agreement template, ensures that everyone understands the terms of the investment, manages expectations, and minimizes the risk of future disputes. Think of it as a safety net for your relationships and your business.

Without a written agreement, assumptions run wild. What happens if the business fails? Is it a loan, or an investment? What rate of return are they expecting? How and when will they be repaid? These are crucial questions that need to be addressed upfront, and the answers documented clearly. A well-drafted agreement serves as a reference point, clarifying roles, responsibilities, and financial obligations for both the company and the investors.

Furthermore, consider the legal perspective. While your friends and family might not initially think about suing you, circumstances can change. If the business takes off, they might feel entitled to a larger share than originally agreed upon. Conversely, if the business fails, they might regret their investment and try to recoup their losses. A properly executed agreement, outlining the terms of the investment, provides legal protection for both you and your investors, helping to avoid costly and stressful legal battles down the line.

Think of the agreement as a communication tool as well. It forces you to have open and honest conversations about the risks involved, the potential returns, and the timeline for repayment or equity distribution. This process can strengthen your relationships by building trust and demonstrating your commitment to transparency and professionalism. It also shows potential future investors that you take your business seriously and are willing to put in the work to protect everyone involved.

Essentially, a friends and family investment agreement template isn’t just a legal document; it’s a tool for managing relationships, setting expectations, and protecting your business from potential conflicts. It’s a sign of respect for your investors and a commitment to running your business with integrity and transparency. It helps make the entire process as smooth and professional as possible, even when dealing with loved ones.

Key Elements of a Comprehensive Friends and Family Investment Agreement

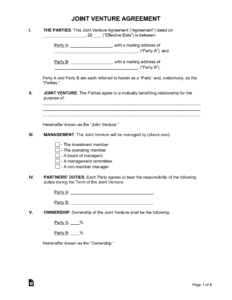

Now that you understand why a friends and family investment agreement template is so vital, let’s delve into the key elements that should be included in a comprehensive agreement. A well-structured agreement should clearly define the terms of the investment, protect the interests of both the company and the investors, and minimize the potential for future disputes. Here are some essential components to consider:

First and foremost, identify the parties involved. Clearly state the full legal names and addresses of the company and each investor. This might seem obvious, but accuracy is crucial for legal enforceability. Include a brief description of the company, outlining its business purpose and the industry it operates in. This provides context for the investment and helps to clarify the overall objective.

Next, specify the amount of the investment. Clearly state the exact dollar amount each investor is contributing. Also, define the type of investment: is it a loan or an equity investment? If it’s a loan, specify the interest rate, the repayment schedule (including the frequency and amount of payments), and any collateral securing the loan. If it’s an equity investment, define the percentage of ownership each investor will receive and the type of equity (e.g., common stock, preferred stock).

Include a section detailing the rights and responsibilities of both the company and the investors. This might include voting rights, information rights (the right to receive regular financial reports), and any restrictions on the transfer of shares. For the company, outline its obligations to manage the business prudently and to act in the best interests of the investors. Be very clear what the money will be used for, this protects both parties and holds the company accountable for reaching milestones.

Address the potential for future financing. What happens if the company needs to raise additional capital in the future? Will existing investors have the right to participate in future rounds of financing? Include a clause outlining the process for valuing the company in future fundraising events and the impact on existing investors’ equity. Also, outline what happens if the business fails. Is there anything investors can expect to recoup?

Finally, include standard legal clauses such as governing law (the state or jurisdiction whose laws will govern the agreement), dispute resolution (mediation or arbitration), and severability (if one clause is deemed invalid, the rest of the agreement remains in effect). These clauses help to ensure that the agreement is legally sound and enforceable. Make sure everyone takes the time to have the agreement looked over by a legal professional, just to be safe.

Navigating the intersection of personal relationships and business ventures requires careful consideration and open communication. A friends and family investment agreement template acts as a compass, guiding both parties towards a shared understanding and a mutually beneficial outcome. By addressing potential challenges upfront and establishing clear expectations, you can protect your relationships and set your business up for success.

With a clear agreement in place, everyone involved can move forward with confidence, knowing that their interests are protected and that the foundation for a strong and lasting relationship is firmly established. It’s about starting with the right foot forward and building a bridge of trust and transparency.