So, you’re thinking about offering or entering into a hire purchase agreement in the UK? Smart move! It’s a popular way to finance goods, from cars to equipment, allowing the buyer to spread out payments while the seller retains ownership until the final installment is paid. But navigating the legalities can feel a bit like wading through treacle, can’t it? That’s where a solid hire purchase agreement template uk comes in handy. Think of it as your roadmap to a smooth and legally sound transaction, protecting both parties involved.

A well-crafted hire purchase agreement clearly outlines the terms of the deal: the goods being purchased, the total price, the deposit amount (if any), the repayment schedule, and what happens if payments are missed. It’s not just about ticking boxes; it’s about establishing a clear understanding and preventing potential disputes down the line. After all, nobody wants a messy legal battle over a car or piece of machinery!

In this article, we’ll delve into the nitty-gritty of hire purchase agreements in the UK, exploring what makes them tick, why they’re important, and where you can find a reliable template to get you started. We’ll break down the key clauses and considerations, ensuring you’re well-equipped to navigate the world of hire purchase with confidence. So, let’s get started!

Understanding the Essentials of a Hire Purchase Agreement

A hire purchase agreement is, at its core, a financing agreement. The seller retains ownership of the goods until the buyer has made all the agreed payments. This is a crucial distinction from a regular sale, where ownership transfers immediately. Think of it like renting with an option to buy. You get to use the item right away, but you don’t own it until you’ve paid it off. This arrangement offers several benefits to both the seller and the buyer.

For the seller, a hire purchase agreement provides security. If the buyer defaults on payments, the seller can repossess the goods. This reduces the risk of selling on credit. It also allows sellers to reach a wider customer base, as they can offer financing options to those who might not be able to afford an outright purchase. This can significantly boost sales volume and overall profitability. It’s a win-win situation when structured correctly.

For the buyer, hire purchase offers the opportunity to acquire valuable assets without a large upfront investment. This can be particularly useful for businesses needing equipment or individuals purchasing a vehicle. Spreading the cost over time makes it more manageable and can free up capital for other investments or expenses. The buyer also gets immediate use of the goods, allowing them to generate income or improve their quality of life.

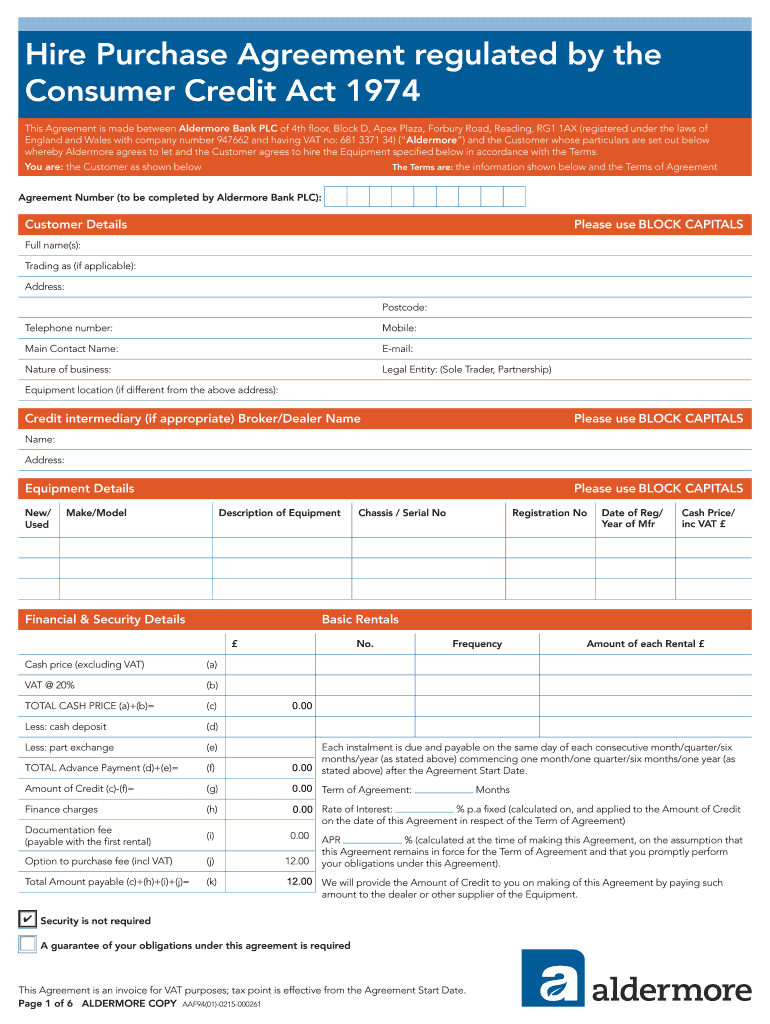

A comprehensive hire purchase agreement template uk should address several key areas. These include a detailed description of the goods, the total price including interest and charges, the amount of any deposit required, the number and frequency of repayments, and the consequences of defaulting on payments. It should also outline the buyer’s rights, such as the right to terminate the agreement early and receive a rebate on unearned interest. Clarity and transparency are essential for a fair and enforceable agreement.

Furthermore, the agreement should specify who is responsible for insuring and maintaining the goods during the hire period. Typically, the buyer is responsible, but this should be explicitly stated. It’s also important to include clauses addressing wear and tear, damage, and loss of the goods. A well-drafted agreement anticipates potential problems and provides clear solutions, minimising the risk of disputes.

Key Clauses and Considerations When Using a Hire Purchase Agreement Template Uk

When using a hire purchase agreement template uk, it’s important to understand the key clauses and considerations to ensure it aligns with your specific needs. Don’t just blindly fill in the blanks – carefully review each section and adapt it as necessary. A one-size-fits-all approach rarely works in legal matters, and hire purchase agreements are no exception. Paying attention to detail can save you a lot of headaches down the road.

One crucial clause is the description of the goods. Be as specific as possible, including make, model, serial number, and any unique features. This eliminates any ambiguity about what is being hired and purchased. Vague descriptions can lead to disputes later on, so take the time to be thorough. Photos can also be helpful, especially for complex or used items.

The repayment schedule is another critical element. Clearly state the amount of each installment, the due date, and the method of payment. Consider adding a clause that allows for early repayment without penalty, as this can be attractive to buyers. Also, specify the interest rate and how it is calculated. Transparency in pricing is essential for building trust and avoiding accusations of unfair practices.

Default clauses are often overlooked but are incredibly important. Outline the consequences of missed payments, including late fees, repossession rights, and potential legal action. Be clear about the process for repossession, including notice periods and the buyer’s right to redeem the goods. It’s a difficult topic to discuss, but addressing it upfront can prevent misunderstandings and protect both parties.

Finally, consider including a clause regarding warranties and guarantees. If the goods are new, the manufacturer’s warranty may apply. If they are used, you may want to offer a limited warranty of your own. Clearly define the scope of the warranty and the process for making a claim. This can give the buyer peace of mind and reduce the risk of future disputes. Remember, a well-drafted hire purchase agreement is an investment in a smooth and successful transaction.

Drafting a hire purchase agreement, while seemingly straightforward with a template, requires careful attention to detail and a clear understanding of the legal implications involved. Consulting with a legal professional to review and tailor the template to your specific circumstances is always a prudent step.

By carefully reviewing the terms, seeking professional advice when needed, and ensuring that both parties are fully informed and in agreement, you can navigate the complexities of hire purchase agreements with confidence. This will contribute to mutually beneficial arrangements and long-term business relationships.