Ever feel like you’re walking a tightrope without a net? In the world of contracts and agreements, that net is often a hold harmless and indemnity agreement. It’s the safety mechanism that protects you from potential liabilities and losses that might arise from a particular activity or relationship. Think of it as a shield, deflecting potential financial blows before they even land. But navigating the legal jargon and ensuring you’ve got all your bases covered can be daunting. That’s where understanding and utilizing a solid hold harmless and indemnity agreement template comes into play. It provides a structured foundation, helping you craft an agreement that safeguards your interests effectively.

Many people mistakenly believe that a simple verbal agreement is enough to protect them. However, relying on handshake deals can leave you vulnerable to misunderstandings and legal disputes down the line. A written agreement, especially one that includes hold harmless and indemnity clauses, offers a much stronger layer of protection. It clearly defines the responsibilities and liabilities of each party involved, minimizing the potential for ambiguity and conflict. This clarity can be invaluable in preventing costly litigation and preserving your financial well-being. It is especially important when dealing with risky projects, such as construction, or even when renting your property.

So, what exactly is a hold harmless and indemnity agreement, and why is it so important to have a solid template at your disposal? We’ll dive into the specifics, breaking down the key components and exploring how you can use a hold harmless and indemnity agreement template to create an agreement that meets your unique needs. Understanding the nuances of these clauses is crucial for anyone involved in business transactions, event planning, or any situation where potential liabilities exist. By the end of this article, you’ll have a clearer understanding of how these agreements work and how to use them effectively.

Understanding the Essentials of a Hold Harmless and Indemnity Agreement

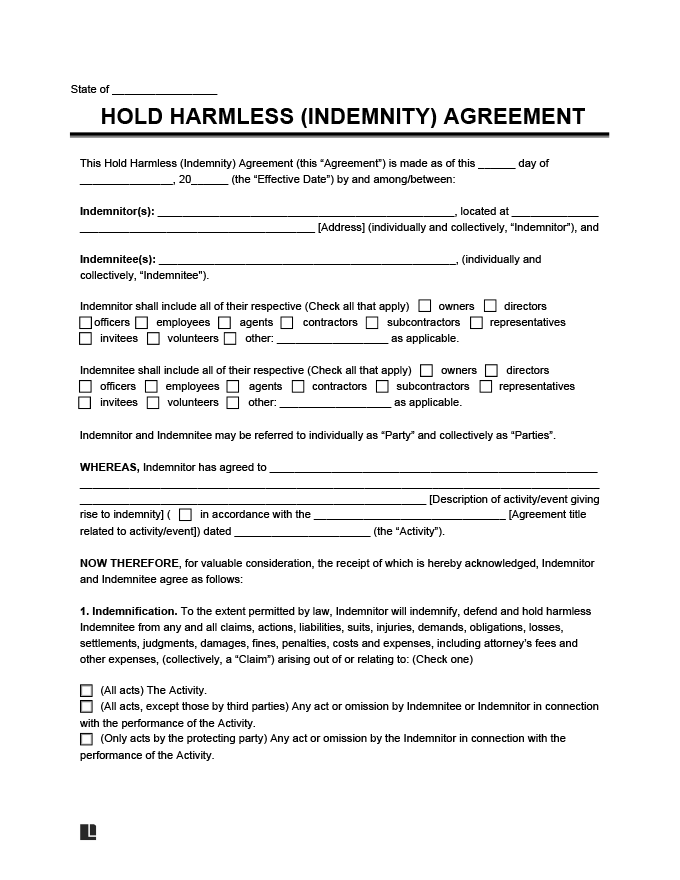

At its core, a hold harmless and indemnity agreement is a legal contract that shifts potential liability from one party to another. It’s designed to protect one party (the indemnitee) from financial losses or damages caused by the actions of another party (the indemnitor) or by specific events outlined in the agreement. The “hold harmless” portion essentially states that the indemnitee will not be held responsible for any losses, damages, or claims arising from the defined activity or relationship. The “indemnity” portion goes a step further, obligating the indemnitor to compensate the indemnitee for any such losses or damages, including legal fees and costs.

To truly grasp the concept, consider a simple example. Imagine you’re hiring a contractor to renovate your home. A hold harmless and indemnity agreement would protect you, the homeowner, from liability if the contractor gets injured on your property while performing the work. The contractor, as the indemnitor, would agree to be responsible for their own injuries and to indemnify you for any claims arising from the injury. This agreement shields you from potential lawsuits and financial burdens related to the contractor’s work. It’s a crucial element in risk management, ensuring that you’re not unfairly held responsible for someone else’s actions or misfortunes.

The scope of a hold harmless and indemnity agreement can vary widely depending on the specific situation. Some agreements are broad, covering a wide range of potential liabilities, while others are more narrowly tailored to address specific risks. It’s essential to carefully consider the potential risks involved in the particular activity or relationship and to draft the agreement accordingly. A well-drafted agreement should clearly define the scope of the indemnity, specifying the types of losses and damages that are covered, as well as any limitations on the indemnitor’s liability. This level of detail helps to avoid misunderstandings and disputes down the line.

Another key aspect of these agreements is the concept of “negligence.” Indemnity clauses often address situations where the indemnitee’s own negligence might contribute to the loss or damage. In some cases, the indemnitor may agree to indemnify the indemnitee even if the indemnitee was partially at fault. However, this is a complex area of law, and the enforceability of such clauses can vary depending on the jurisdiction. It’s crucial to consult with an attorney to ensure that the indemnity clause is enforceable and complies with applicable laws. A poorly drafted clause could be deemed invalid, leaving the indemnitee without the protection they thought they had.

When utilizing a hold harmless and indemnity agreement template, it’s vital to remember that it’s just a starting point. Templates are designed to provide a general framework, but they may not be suitable for every situation. You’ll need to carefully review the template and customize it to reflect the specific circumstances of your agreement. Consider the potential risks, the scope of the indemnity, and the applicable laws in your jurisdiction. Don’t hesitate to seek legal advice to ensure that the agreement is comprehensive, enforceable, and adequately protects your interests. A little extra effort upfront can save you a lot of headaches (and money) in the long run.

Key Considerations When Using a Hold Harmless and Indemnity Agreement Template

Selecting the right hold harmless and indemnity agreement template is the first step, but effectively using it requires careful attention to detail. Not all templates are created equal, and some may be poorly drafted or unsuitable for your specific needs. Before you even begin filling in the blanks, take the time to thoroughly review the template and assess its suitability. Look for clear and concise language, well-defined terms, and comprehensive coverage of potential liabilities. Avoid templates that are overly complex or filled with legal jargon that you don’t understand. A good template should be easy to customize and adapt to your specific situation.

Once you’ve chosen a suitable template, the next step is to carefully customize it to reflect the specific details of your agreement. Don’t just blindly fill in the blanks without understanding the implications of each clause. Pay close attention to the description of the activities or relationships that are covered by the indemnity. Be specific and avoid vague or ambiguous language. Clearly define the scope of the indemnity, specifying the types of losses and damages that are covered, as well as any limitations on the indemnitor’s liability. The more detail you provide, the less room there is for misunderstandings and disputes down the line.

Another critical consideration is the governing law. The laws governing indemnity agreements can vary significantly from one jurisdiction to another. It’s essential to specify in the agreement which jurisdiction’s laws will apply in the event of a dispute. This will help to ensure that the agreement is interpreted and enforced in accordance with your expectations. If you’re unsure about which jurisdiction’s laws to choose, consult with an attorney who is familiar with the laws of both jurisdictions. They can help you to assess the potential risks and benefits of each option and to make an informed decision.

Insurance requirements are also an important factor to consider. In many cases, the indemnitor will be required to maintain insurance coverage to protect against the potential liabilities covered by the agreement. The agreement should specify the types and amounts of insurance that are required, as well as the procedures for providing proof of insurance. It’s crucial to ensure that the insurance coverage is adequate to cover the potential losses and damages that could arise. Failure to maintain adequate insurance coverage could leave the indemnitor unable to fulfill their obligations under the agreement, potentially exposing the indemnitee to significant financial risk.

Finally, remember that a hold harmless and indemnity agreement is only as good as its enforceability. Even the most well-drafted agreement will be worthless if it’s not legally enforceable. Before finalizing the agreement, it’s always a good idea to have it reviewed by an attorney. An attorney can help you to identify any potential weaknesses or ambiguities in the agreement and to ensure that it complies with all applicable laws. They can also advise you on the potential risks and benefits of the agreement and help you to negotiate more favorable terms. Investing in legal advice upfront can save you a lot of time, money, and headaches in the long run.

In essence, the purpose of having a solid template is to provide a foundational base and a clear structure for crafting your own agreement. From here, you can then fill in the blank to make it work based on your own necessities.

By understanding what is at stake, you could adjust the template, making it suitable for your usage. It ensures that both parties are protected and have a clear understanding of their responsibilities and potential liabilities.