Navigating the complexities of shared homeownership can be tricky, especially when relationships change. Whether it’s a divorce, separation, or simply a shift in financial priorities, deciding what to do with a jointly owned property often requires a carefully considered plan. One such plan involves a home equity buyout agreement. This is where one owner buys out the other’s share of the home equity, allowing one party to remain in the residence while the other receives fair compensation for their investment.

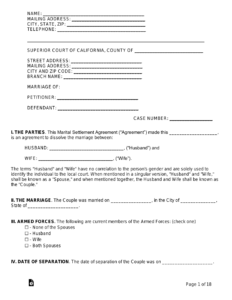

Think of a home equity buyout agreement as a formal contract that clearly outlines the terms and conditions of this transaction. It’s a roadmap that guides both parties through the process, ensuring everyone is on the same page regarding valuation, payment schedules, and transfer of ownership. Having a well-drafted agreement is crucial for avoiding potential disputes and ensuring a smooth transition.

So, where does a home equity buyout agreement template come in? Well, it provides a solid foundation upon which you can build your specific agreement. It’s a pre-structured document containing the essential elements needed, which you can then customize to reflect your unique circumstances. Using a template saves you time and effort, while also ensuring that you don’t overlook any important legal considerations. It’s like having a guide to help you navigate the often-complicated process of transferring home equity.

Understanding the Ins and Outs of a Home Equity Buyout Agreement

A home equity buyout agreement, at its core, is a legally binding contract. It’s more than just a handshake agreement; it’s a detailed document that protects the interests of both parties involved. This agreement meticulously outlines the terms under which one co-owner will purchase the other’s share of the property. This includes not only the financial aspects but also the timeline for the buyout and the legal transfer of ownership.

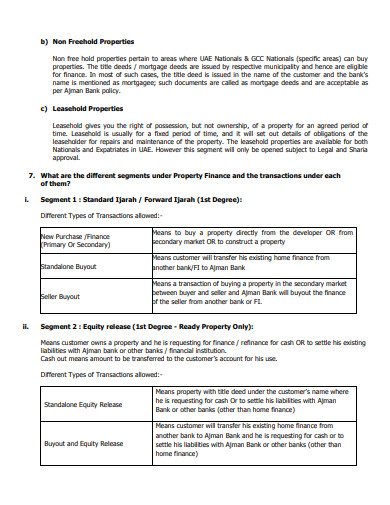

One of the most crucial elements of a home equity buyout agreement is determining the fair market value of the property. This is typically achieved through an independent appraisal conducted by a qualified professional. The appraised value then serves as the basis for calculating the equity each party holds in the home. Remember, the equity is the difference between the home’s value and the outstanding mortgage balance. Once the equity is determined, you can calculate the buyout amount – which is essentially half of the equity (assuming a 50/50 ownership split).

Beyond the valuation, the agreement must also specify how the buyout will be financed. Will the remaining owner obtain a new mortgage to cover the buyout amount? Or will they use personal funds? The agreement should clearly detail the financing method, the payment schedule, and any associated interest rates. Additionally, it’s important to address any outstanding debts or liens on the property, ensuring that they are properly handled as part of the buyout process. Failing to address these issues upfront can lead to significant complications down the road.

Another critical aspect is the transfer of ownership. The home equity buyout agreement should outline the steps required to legally transfer the property title from both owners to the remaining owner. This typically involves filing a quitclaim deed or other relevant legal documents with the local county recorder’s office. The agreement should also specify who is responsible for covering the costs associated with the title transfer, such as recording fees and transfer taxes. Proper legal documentation is essential to ensure a clean and valid transfer of ownership.

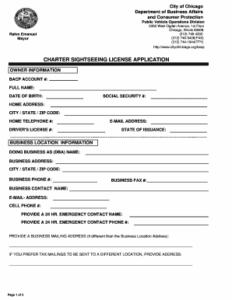

Finally, it’s always recommended to consult with legal and financial professionals before finalizing a home equity buyout agreement. An attorney can review the agreement to ensure it’s legally sound and protects your interests. A financial advisor can help you assess the financial implications of the buyout and develop a plan to manage your finances effectively. Their expert guidance can provide invaluable peace of mind during this significant life transition.

Key Components of a Solid Home Equity Buyout Agreement Template

A comprehensive home equity buyout agreement template will include several essential sections. First, it should clearly identify the parties involved – the owner who is buying out the other and the owner who is selling their share. Full legal names and addresses should be included to avoid any ambiguity. The template should also provide a detailed description of the property being transferred, including its address and legal description.

Next, the template will outline the agreed-upon purchase price for the equity being transferred. This section should specify the amount of money being paid to the departing owner and how that amount was calculated. It’s crucial to clearly state the appraisal method used to determine the fair market value of the home and to attach a copy of the appraisal report to the agreement as an exhibit.

The template should also cover the terms of payment. This includes the method of payment (e.g., cash, check, wire transfer), the payment schedule, and any applicable interest rates. If the remaining owner is obtaining a new mortgage to finance the buyout, the agreement should specify the loan amount, the interest rate, and the lender’s name and contact information. It should also include a contingency clause that allows the agreement to be terminated if the remaining owner is unable to secure financing.

Furthermore, a solid template will address the issue of closing costs and other expenses associated with the buyout. It should clearly state who is responsible for paying these costs, such as appraisal fees, title insurance, recording fees, and transfer taxes. This section can help prevent disputes and ensure that both parties are aware of their financial obligations.

Finally, the home equity buyout agreement template should include clauses regarding dispute resolution, governing law, and severability. The dispute resolution clause outlines the process for resolving any disagreements that may arise between the parties, such as mediation or arbitration. The governing law clause specifies the state law that will govern the interpretation and enforcement of the agreement. The severability clause ensures that if one part of the agreement is found to be invalid, the remaining parts will still be enforceable. Using a home equity buyout agreement template ensures that all these important aspects are covered.

While navigating a home equity buyout can feel overwhelming, remember that careful planning and a well-drafted agreement are your best allies. Take the time to understand the process, gather the necessary information, and seek professional guidance when needed.

Ultimately, a successful home equity buyout is one that is fair, transparent, and respectful of the rights and interests of all parties involved. It’s a chance to move forward with clarity and confidence, knowing that you’ve reached a mutually agreeable solution.