Thinking about tapping into the equity you’ve built up in your home? A home equity loan can be a powerful tool for financing major projects, consolidating debt, or covering unexpected expenses. But before you jump in, it’s crucial to understand the agreement you’re signing. A solid home equity loan agreement template protects both you and the lender, ensuring everyone is on the same page about the terms, conditions, and responsibilities involved.

Finding the right home equity loan agreement template can feel overwhelming. There are countless options online, and wading through legal jargon can be daunting. This article aims to simplify the process by explaining what to look for in a reliable template, what key components it should include, and how to ensure it accurately reflects your specific loan terms. We’ll break down the complex details so you can approach your home equity loan with confidence.

Essentially, a well-crafted agreement serves as a roadmap for the entire loan process, preventing misunderstandings and potential disputes down the line. It outlines everything from the loan amount and interest rate to the repayment schedule and consequences of default. By understanding the ins and outs of your agreement, you’re empowering yourself to make informed financial decisions and protect your investment.

Key Components of a Comprehensive Home Equity Loan Agreement Template

A robust home equity loan agreement template should cover several critical areas to ensure clarity and legal enforceability. Think of it as a detailed instruction manual for your loan. The more comprehensive it is, the better protected you are.

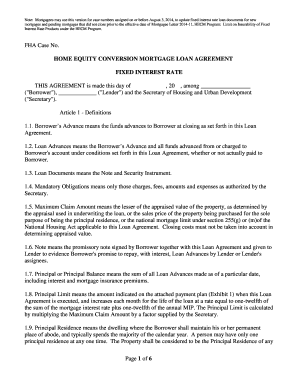

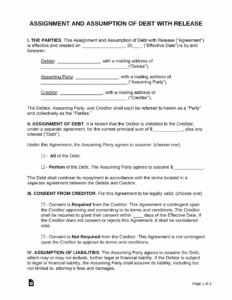

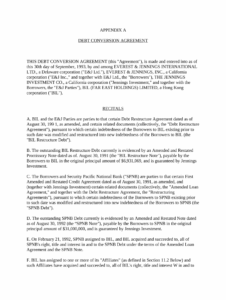

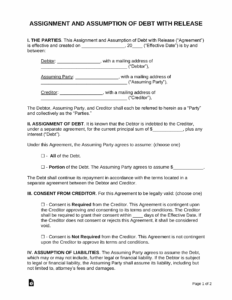

First and foremost, the template needs to clearly state the parties involved. This includes the full legal names and addresses of both the borrower (you) and the lender. Accuracy is paramount here, as even minor discrepancies can cause issues later on. Then, the agreement should precisely define the loan amount, often referred to as the principal. This is the exact sum of money being borrowed. The interest rate, whether fixed or variable, must also be explicitly stated, along with details on how it’s calculated and when it may be adjusted.

Next, the repayment schedule is a cornerstone of any loan agreement. The template needs to outline the frequency of payments (usually monthly), the due date for each payment, and the method of payment accepted by the lender. It should also specify how payments are applied, typically first to interest and then to the principal balance. Late payment penalties and any associated fees should be clearly defined, leaving no room for ambiguity.

Perhaps one of the most crucial sections of a home equity loan agreement template is the collateral section. This clearly identifies your home as the security for the loan. It should include the property address and a legal description of the property. The agreement will also detail the lender’s rights in the event of default, meaning your failure to make timely payments. This typically includes the right to foreclose on the property to recover the outstanding loan amount.

Finally, a complete home equity loan agreement template will include clauses addressing insurance requirements, property taxes, and potential modifications to the agreement. It should also outline dispute resolution mechanisms, such as arbitration or mediation, in case disagreements arise between the borrower and the lender. Make sure the document clearly states under which jurisdiction any disputes will be resolved, ensuring legal protection in your specific location.

Navigating the Fine Print: Understanding Your Rights and Responsibilities

Once you have a home equity loan agreement template in hand, the real work begins: carefully reviewing and understanding every single line. Don’t be afraid to ask questions! Lenders have a responsibility to explain the terms of the agreement in plain language. If anything is unclear, seek clarification until you’re completely comfortable with the terms.

One key area to focus on is the default clause. This outlines what constitutes a default, such as missing payments or failing to maintain homeowners insurance. It also details the lender’s remedies in the event of a default, which, as mentioned earlier, typically includes foreclosure. Understand the grace period, if any, for late payments and the process the lender must follow before initiating foreclosure proceedings. Knowing your rights in this area can be crucial in protecting your home.

Another critical aspect to consider is prepayment penalties. Some lenders may charge a fee if you pay off the loan early. Carefully review the agreement to determine if there are any prepayment penalties and, if so, how they are calculated. This can impact your ability to refinance the loan in the future or pay it off sooner than expected.

Furthermore, pay close attention to any clauses related to changes in the interest rate, especially if you have a variable-rate loan. The agreement should clearly explain how the interest rate is tied to an index, such as the prime rate, and how often the rate can be adjusted. Understand the maximum interest rate that can be charged over the life of the loan to protect yourself from unexpected payment increases.

Finally, remember that you have the right to negotiate certain terms of the agreement, particularly if you have a strong credit history and a good relationship with the lender. Don’t be afraid to ask for a lower interest rate, more favorable repayment terms, or the removal of prepayment penalties. A well-negotiated agreement can save you significant money over the life of the loan. Using a solid home equity loan agreement template is just the start; understanding and customizing it to your needs is key.

Taking out a home equity loan can be a great decision, providing access to funds for various needs. Approaching this financial tool with knowledge and careful consideration is paramount.

Ensure that the chosen home equity loan agreement template is complete and that you fully comprehend its implications. Don’t hesitate to seek expert advice if needed; it’s a worthwhile investment in your financial well-being and peace of mind.