So, you’re thinking of buying a house with someone? Awesome! It’s a big step, and sharing the financial burden (and hopefully the joy!) of homeownership can be a fantastic idea. But before you pop the champagne and start browsing paint swatches, there’s a really important piece of paperwork you absolutely need: a house co ownership agreement template. Think of it as your roadmap to co-ownership success, helping you navigate potential bumps in the road with grace and, more importantly, legal clarity.

Without a solid agreement in place, you’re essentially sailing into uncharted waters. What happens if one of you wants to sell? What if one person can’t make their mortgage payments? What if you disagree on renovations? These are all crucial questions that a well-drafted agreement can answer, saving you potential headaches, legal battles, and even damaged relationships down the line.

Consider it an investment in your friendship, your finances, and your peace of mind. A house co ownership agreement template isn’t about distrust; it’s about proactively addressing potential issues and ensuring that everyone is on the same page from the get-go. It’s a safety net, a communication tool, and a legal document all rolled into one. Let’s dive deeper into why this is so important and what it typically includes.

Why You Absolutely Need a House Co Ownership Agreement

Let’s be honest, buying a house is a huge financial undertaking. Adding another person into the mix complicates things further. While you might have the best intentions and a rock-solid friendship with your co-owner, unforeseen circumstances can arise. That’s where a house co ownership agreement steps in to protect everyone involved. It’s not about doubting your co-owner; it’s about being prepared for any eventuality.

Imagine this: you and your best friend buy a house together. A few years down the line, one of you gets a fantastic job opportunity in another city. What happens to the house? Without an agreement, you could be stuck in a legal quagmire, trying to figure out how to divide assets or sell the property fairly. A co-ownership agreement outlines the procedures for selling, buying out a partner, or handling disputes, ensuring a smooth and equitable process.

Furthermore, a comprehensive agreement clarifies financial responsibilities. It specifies how mortgage payments, property taxes, insurance, and maintenance costs will be divided. This prevents misunderstandings and ensures that each co-owner is contributing their fair share. It also addresses what happens if one owner is unable to contribute their share for a period of time. Having these details clearly documented can prevent resentment and financial strain.

Think about disagreements about home improvements. One person might want to renovate the kitchen, while the other prefers to focus on landscaping. A co-ownership agreement can establish a process for making decisions about renovations, ensuring that both owners have a voice and that financial contributions are agreed upon in advance. It can even specify a maximum amount one person can spend without the other’s explicit permission. The agreement becomes the guide for decision making and investment.

Beyond the practical aspects, a co-ownership agreement provides peace of mind. Knowing that you have a legally binding document that protects your interests allows you to enjoy your home without constantly worrying about potential conflicts. It fosters open communication and encourages a collaborative approach to homeownership, creating a positive and sustainable living arrangement. A house co ownership agreement template is more than just a document; it is a tool for creating and maintaining a thriving co-ownership relationship.

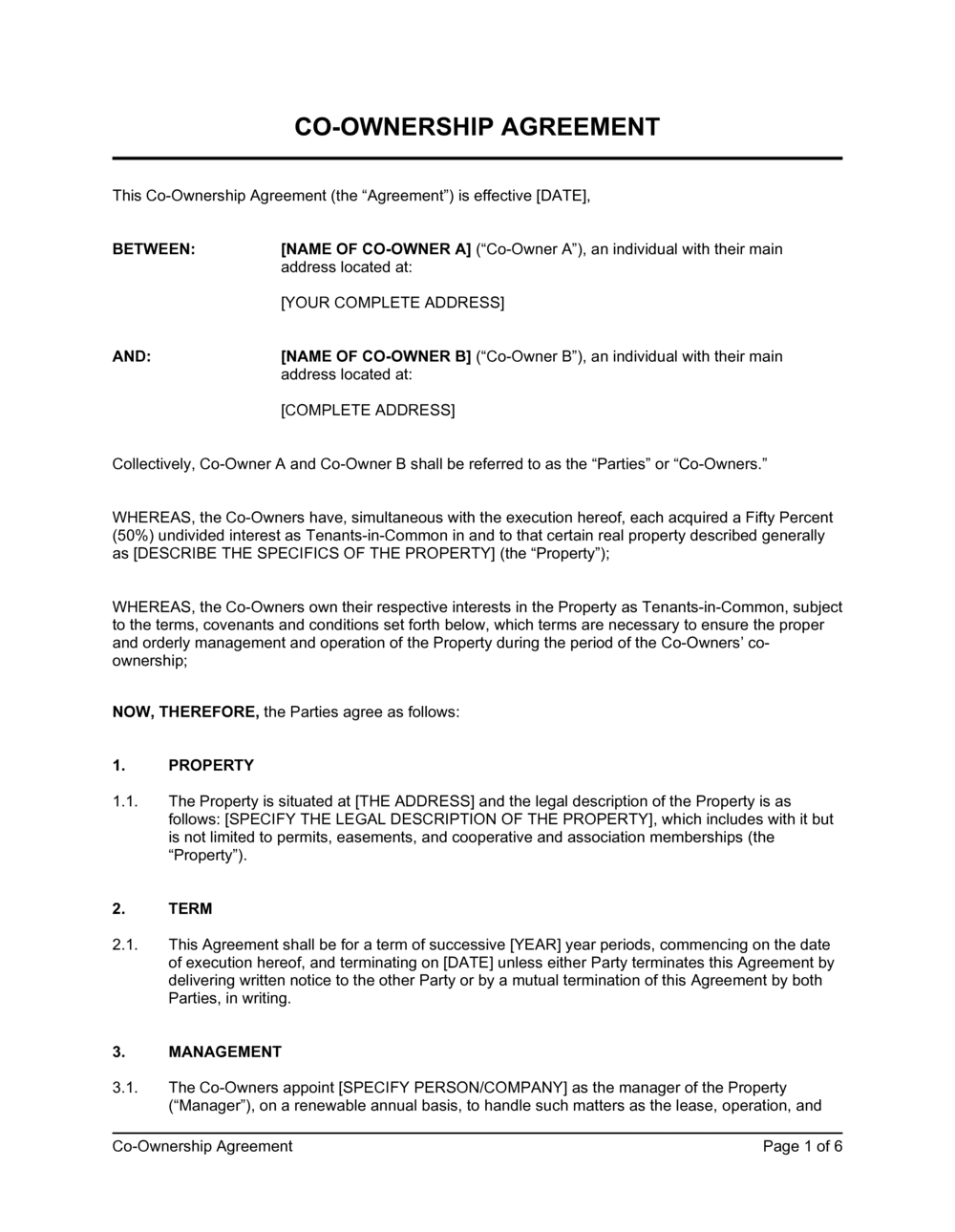

Key Elements of a Solid House Co Ownership Agreement Template

So, what exactly should be included in your house co ownership agreement? While the specific details will vary depending on your individual circumstances, there are several key elements that should be addressed to ensure a comprehensive and effective agreement. Here’s a breakdown of the essential components:

First and foremost, you need to clearly define the ownership percentages. Are you both 50/50 owners, or is there a different split? This is crucial for determining how profits are divided upon sale and how liabilities are shared. Be precise and unambiguous in stating each owner’s percentage of ownership in the property.

Next, outline the financial responsibilities. This section should cover everything from mortgage payments and property taxes to insurance premiums and maintenance costs. Specify how these expenses will be divided and when they are due. Include a plan for what happens if one owner is unable to make their payments. Will the other owner cover the shortfall, or will alternative arrangements be made? Also consider adding a clause on how to decide on and manage unexpected repair expenses.

The agreement should also address the process for selling the property. What happens if one owner wants to sell but the other doesn’t? Will there be a right of first refusal, allowing the other owner to buy out the selling owner’s share? What is the procedure for determining the sale price and listing the property? Having a clear plan in place will prevent disputes and ensure a smooth sale process when the time comes.

Furthermore, consider including a dispute resolution mechanism. Disagreements are inevitable, so it’s important to have a process for resolving conflicts amicably. This could involve mediation or arbitration, where a neutral third party helps you reach a resolution. Specifying a dispute resolution process can save you time, money, and stress compared to pursuing legal action.

Finally, don’t forget to address what happens if one owner passes away. Will their share of the property be inherited by their heirs, or will the surviving owner have the option to buy it out? This is a sensitive topic, but it’s crucial to have a clear understanding of the implications for both parties. A comprehensive house co ownership agreement template ensures that all aspects of the co-ownership are covered, providing a solid foundation for a successful partnership.

A house co ownership agreement template provides clarity, sets expectations, and protects everyone involved. It promotes open communication and helps prevent misunderstandings that can strain relationships. It’s not just a piece of paper; it’s an investment in a secure and harmonious co-ownership experience.

So, take the time to find a template that suits your needs, customize it to reflect your specific agreement, and consult with a legal professional to ensure that it’s legally sound. It’s a small price to pay for the peace of mind and security it provides.