Ever find yourself in a situation where you need to borrow something from a friend, lend someone money, or promise a service in exchange for something else? Life is full of informal agreements, and sometimes, relying on memory alone just isn’t enough. That’s where the beauty of a simple “I owe you,” or IOU, comes in. It’s a straightforward way to acknowledge a debt or obligation, ensuring everyone is on the same page.

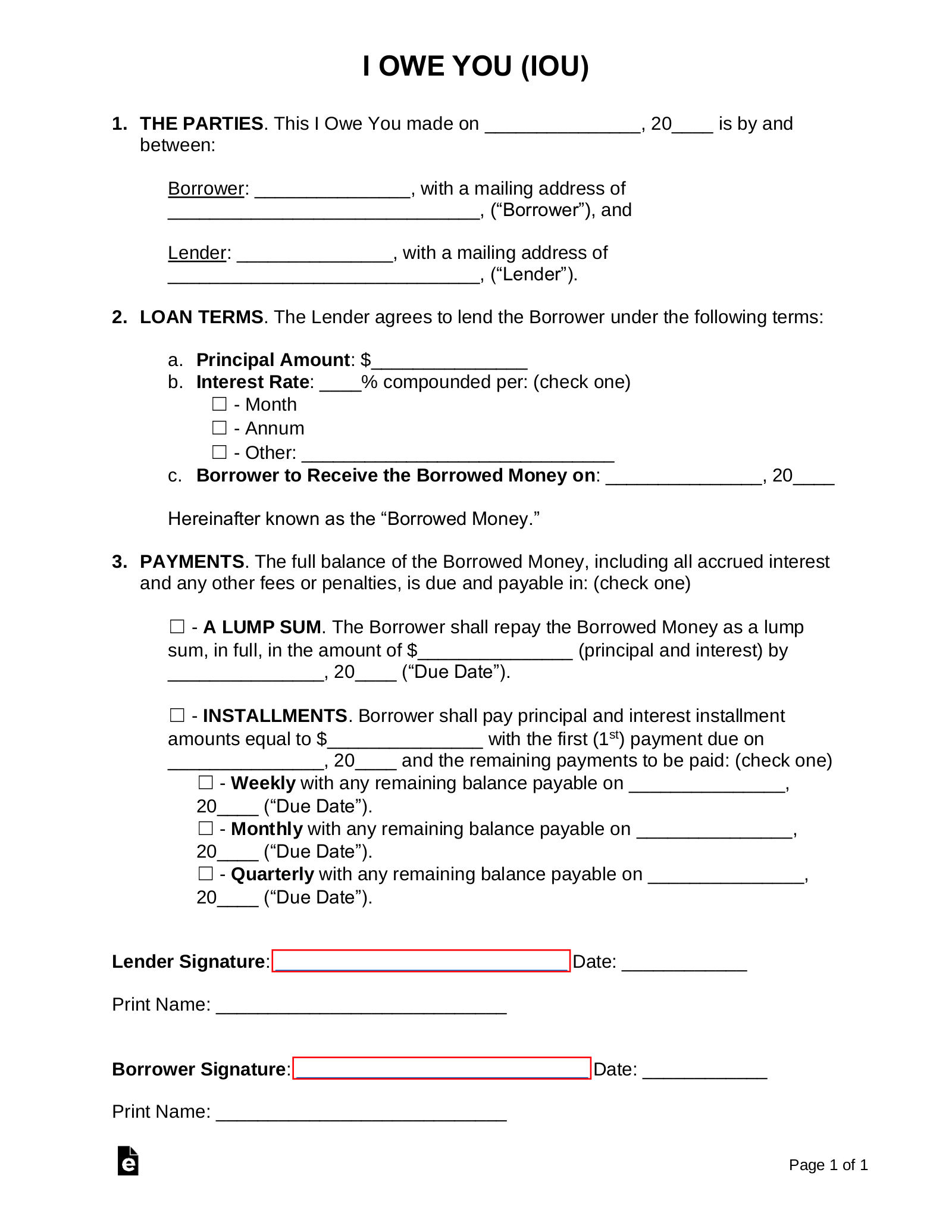

An IOU is essentially a written promise to repay a debt. Think of it as a friendly contract, a way to formalize an informal arrangement. It’s less intimidating than a formal loan agreement but provides more security than a verbal agreement. Using an i owe you agreement template offers a quick and easy method to create a legally sound document.

While it’s not as legally binding as a promissory note, it still serves as evidence of a debt in case of misunderstandings or disputes. In this article, we’ll explore everything you need to know about IOU agreements, why they’re useful, and how to create your own, making your life easier, and hopefully, avoiding any awkward situations later on.

Why Use an I Owe You Agreement Template?

Let’s face it, memories can be unreliable. Especially when it comes to money or favors, things can get confusing pretty quickly. That’s where a well-structured i owe you agreement template comes in handy. It serves as a clear record of the transaction, leaving no room for ambiguity or disagreements down the line.

An IOU is particularly useful in situations where a formal loan agreement feels like overkill. Imagine borrowing a hundred dollars from a friend to cover a concert ticket. A full-blown legal document would be excessive. However, a simple IOU stating the amount borrowed, the repayment date, and any agreed-upon interest (if applicable) can provide peace of mind to both parties.

Furthermore, an IOU can be valuable for tracking informal debts within a family or between close friends. It helps maintain transparency and ensures that everyone is aware of their obligations. This is especially important to prevent misunderstandings that could strain relationships. It acts as a friendly reminder, without being overly demanding or formal.

Using an i owe you agreement template saves time and effort. Instead of drafting a document from scratch, you can simply fill in the blanks with the relevant details. Many templates are available online for free, offering a variety of formats and styles to suit your specific needs. This accessibility makes it easier than ever to formalize your informal agreements.

In essence, an IOU represents more than just a debt; it symbolizes trust and accountability. It shows that you take your obligations seriously and are committed to fulfilling your promises. A well-written IOU can help maintain healthy relationships and prevent financial misunderstandings.

Key Elements of a Solid IOU

So, what makes a good IOU? Well, it’s all about clarity and completeness. You want to make sure all the important details are spelled out clearly to avoid any confusion later on. The more specific you are, the better. Here are the key elements that should be included in any IOU:

First and foremost, clearly state the parties involved. Include the full names of the lender (the person owed the money or service) and the borrower (the person owing the money or service). This establishes who is responsible for the debt and to whom it is owed. Accuracy is key here, so double-check the spelling of names.

Next, specify the exact amount owed. This should be stated clearly, using both numerals and words (e.g., “$100.00 – One Hundred Dollars”). This helps prevent any ambiguity about the sum involved. If the IOU is for something other than money, describe the service or item owed in detail. For example, “Two hours of gardening work” or “One delivered pizza.”

It’s also important to include the repayment terms. When is the debt due? Will it be repaid in a single lump sum, or in installments? If installments are agreed upon, specify the amount of each installment and the frequency of payments. If interest is being charged, clearly state the interest rate and how it will be calculated. For instance, “No interest will be charged,” or “Interest will accrue at a rate of 5% per annum.”

Consider including a section for late payment penalties. While it might seem a bit formal for a friendly agreement, specifying a penalty for late payments can provide extra incentive for timely repayment. This could be a small fee or a slight increase in the interest rate. Make sure both parties are comfortable with the terms before signing. Finally, don’t forget the date of the agreement and the signatures of both the lender and the borrower. This confirms that both parties are aware of the terms and agree to abide by them.

By including all these key elements in your IOU, you’ll create a clear, comprehensive record of the debt that can help prevent misunderstandings and maintain positive relationships. Consider using an i owe you agreement template as a guide to ensure you don’t miss any crucial information.

Ultimately, remembering promises and keeping your word strengthens bonds and fosters trust. An IOU, while a formal acknowledgement, stands as a testament to that commitment.

Sometimes, life gets hectic, and we unintentionally overlook commitments. Having a written reminder, like an IOU, can be incredibly helpful in staying organized and fulfilling our obligations.