Starting a business in Illinois? Congratulations! One of the most important things you’ll need to consider, if you’re forming a Limited Liability Company (LLC), is an operating agreement. Think of it as the rulebook for your business. It outlines how your LLC will be run, who the members are, their responsibilities, and how profits and losses will be distributed. While Illinois doesn’t legally *require* an LLC operating agreement, trust us, you absolutely want one.

Without a well-defined operating agreement, your LLC might be subject to Illinois’ default rules, which might not align with what you and your co-founders envisioned for your business. An operating agreement lets you customize how your LLC functions, giving you control and flexibility. It also helps protect your personal assets by clearly separating your business from your personal finances, which is a key benefit of forming an LLC in the first place.

So, where do you start? Many entrepreneurs turn to an Illinois LLC operating agreement template to get a head start. These templates provide a solid framework, ensuring you cover all the essential elements. But remember, a template is just a starting point. You’ll need to tailor it to fit the specific needs and circumstances of your business. Think of it like a suit – you buy it off the rack, then get it tailored for a perfect fit.

Why You Absolutely Need an Illinois LLC Operating Agreement (Even Though the State Doesn’t Require It)

We know, legal documents can feel overwhelming. But seriously, taking the time to create a solid operating agreement is one of the best investments you can make in your LLC’s success. Think of it as preventative medicine for your business. It helps avoid misunderstandings, disagreements, and even potential legal battles down the road. It’s far easier to agree on things upfront than to try and sort them out when tensions are high and money is on the line.

One of the biggest benefits of an operating agreement is clarifying ownership percentages and profit/loss distribution. Imagine two partners starting an LLC. Without an agreement, they might assume they each own 50%. But what happens if one partner invests significantly more capital or dedicates far more time to the business? An operating agreement clearly spells out these contributions and assigns ownership accordingly, preventing future disputes. It also details how profits and losses are allocated. Are they split evenly, based on ownership percentage, or some other formula? The agreement clarifies all of this.

Beyond ownership and profits, an operating agreement also outlines management structure. Will the LLC be member-managed, meaning the owners directly run the business? Or will it be manager-managed, with designated managers responsible for day-to-day operations? The agreement defines roles, responsibilities, and decision-making authority. It also addresses how important decisions are made, such as selling the business, taking on debt, or adding new members.

Another crucial aspect covered in an operating agreement is the process for adding or removing members. What happens if a member wants to leave the LLC? Can they simply sell their ownership interest? What happens if a member dies or becomes incapacitated? The operating agreement outlines the procedures for these events, ensuring a smooth transition and preventing disruption to the business. This is especially important for multi-member LLCs.

Finally, an operating agreement protects your limited liability. By clearly defining the separation between your personal assets and the business, it reinforces the LLC’s liability shield. This helps protect you from personal liability for the LLC’s debts and obligations. While forming an LLC provides this protection, a well-drafted operating agreement strengthens it by demonstrating that you treat the LLC as a separate and distinct entity.

Key Components of an Illinois LLC Operating Agreement Template

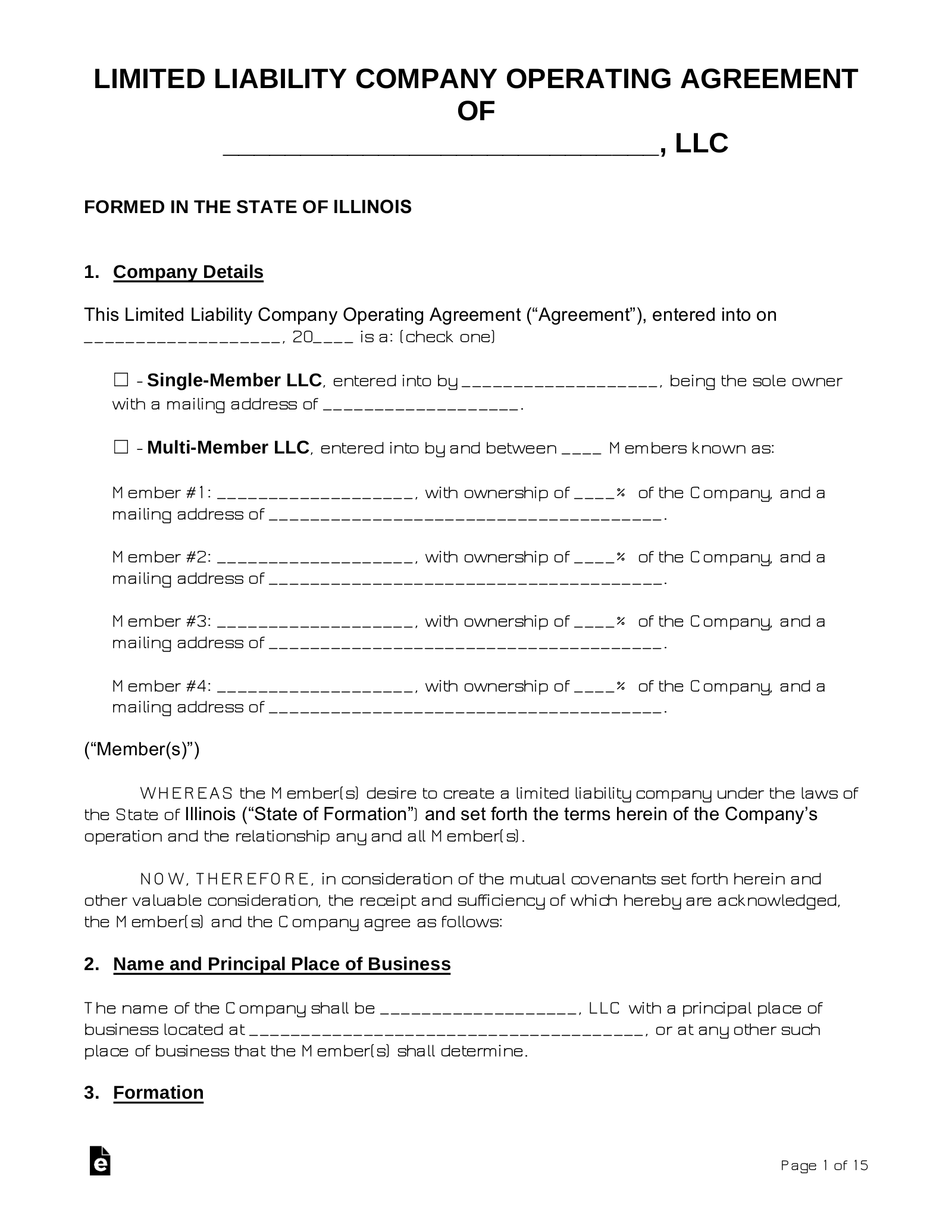

Okay, so you’re convinced you need an operating agreement. Let’s talk about what goes into an Illinois LLC operating agreement template. These templates typically include several key sections, each addressing different aspects of your LLC’s operations. Understanding these components will help you tailor the template to your specific needs.

First, the template will include basic information about your LLC, such as its name, registered agent, and principal place of business. This information is essential for identifying your LLC and ensuring it’s properly registered with the Illinois Secretary of State. The registered agent is the person or entity designated to receive official legal documents on behalf of the LLC. The principal place of business is the location where the LLC conducts its primary business activities.

Next, the template will address membership information. This section lists the names and addresses of all the members of the LLC, along with their respective ownership percentages. As mentioned earlier, this section is crucial for clarifying ownership and preventing future disputes. It also outlines the initial contributions of each member, whether it’s cash, property, or services.

The operating agreement template will also detail the management structure of the LLC. Whether it’s member-managed or manager-managed, this section outlines the roles and responsibilities of the individuals responsible for running the business. For manager-managed LLCs, it specifies the powers and limitations of the managers. It also addresses how managers are appointed and removed.

Finally, the template will include provisions for amendments, dissolution, and other important matters. The amendment section outlines the process for making changes to the operating agreement. The dissolution section specifies the conditions under which the LLC will be dissolved and the procedures for winding up its affairs. It might also include provisions for dispute resolution, such as mediation or arbitration.

While an Illinois LLC operating agreement template can be a great starting point, it’s essential to review it carefully and tailor it to your specific needs. Consider consulting with an attorney to ensure your operating agreement is comprehensive and legally sound. Don’t just fill in the blanks – understand what each section means and how it applies to your business. Finding a reliable Illinois LLC operating agreement template is the first step in setting your business up for success.

Setting up your business properly from the start allows you to deal with potential issues proactively. This proactive approach means that your LLC has a much greater chance of success.

Taking the time to thoughtfully draft and execute a complete operating agreement is extremely vital in providing a framework for navigating the challenges and taking advantage of opportunities that will inevitably arise. Remember, the goal is to have a business plan ready to grow and thrive.