So, you’re thinking about becoming an independent insurance agent, or perhaps you’re an agency looking to bring on some new talent? That’s fantastic! It’s a rewarding career path with the potential for great income and the satisfaction of helping people protect what matters most. But before you dive in headfirst, there’s a crucial piece of paperwork you absolutely need: an independent insurance agent agreement template. It’s the foundation upon which your professional relationship is built, clearly outlining the rights, responsibilities, and expectations of both parties.

Think of this agreement as your roadmap to success. It’s not just a formality; it’s a document that protects both the agent and the agency. It covers everything from commission structures and ownership of client information to termination clauses and non-compete agreements. Without a well-defined agreement, you could find yourself facing legal disputes, misunderstandings, and a whole lot of unnecessary headaches down the road. This is where finding the right independent insurance agent agreement template becomes vital.

Therefore, taking the time to create or find the perfect independent insurance agent agreement template is essential. You will want to be protected, ensure you’re compliant, and have laid out the foundation for a successful partnership. A solid agreement can avoid any future disputes.

What to Include in Your Independent Insurance Agent Agreement

Crafting a comprehensive independent insurance agent agreement is crucial for setting clear expectations and protecting both the agent and the agency. There are several essential elements you’ll want to consider, ensuring that your agreement is thorough, legally sound, and tailored to your specific needs.

First and foremost, clearly define the scope of the agent’s authority. What types of insurance products are they authorized to sell? Are there any limitations on their ability to bind coverage or settle claims? Be explicit about the agent’s powers and restrictions to avoid any ambiguity that could lead to disputes later on. This section should also specify the geographical area in which the agent is authorized to operate. Including this can prevent conflicts arising from overlapping territories or clients.

Compensation is another critical aspect that needs to be meticulously addressed. Outline the commission structure, including the percentage the agent will receive on initial sales and renewals. Specify when and how commissions will be paid, as well as any circumstances that might affect commission eligibility, such as policy cancellations or chargebacks. It’s also a good idea to include details about any bonus structures or performance-based incentives that the agent might be eligible for. A clear and transparent compensation plan is essential for motivating agents and maintaining a positive working relationship.

Ownership of client information is a sensitive topic that should be handled with care. The agreement should clearly state who owns the client list and any related data. Typically, the agency retains ownership of this information, as it’s considered a valuable asset. However, you might want to consider including provisions that allow the agent to take certain client information with them if they leave the agency, particularly if they were responsible for generating those leads. Whatever you decide, make sure it’s clearly stated in the agreement to avoid any misunderstandings.

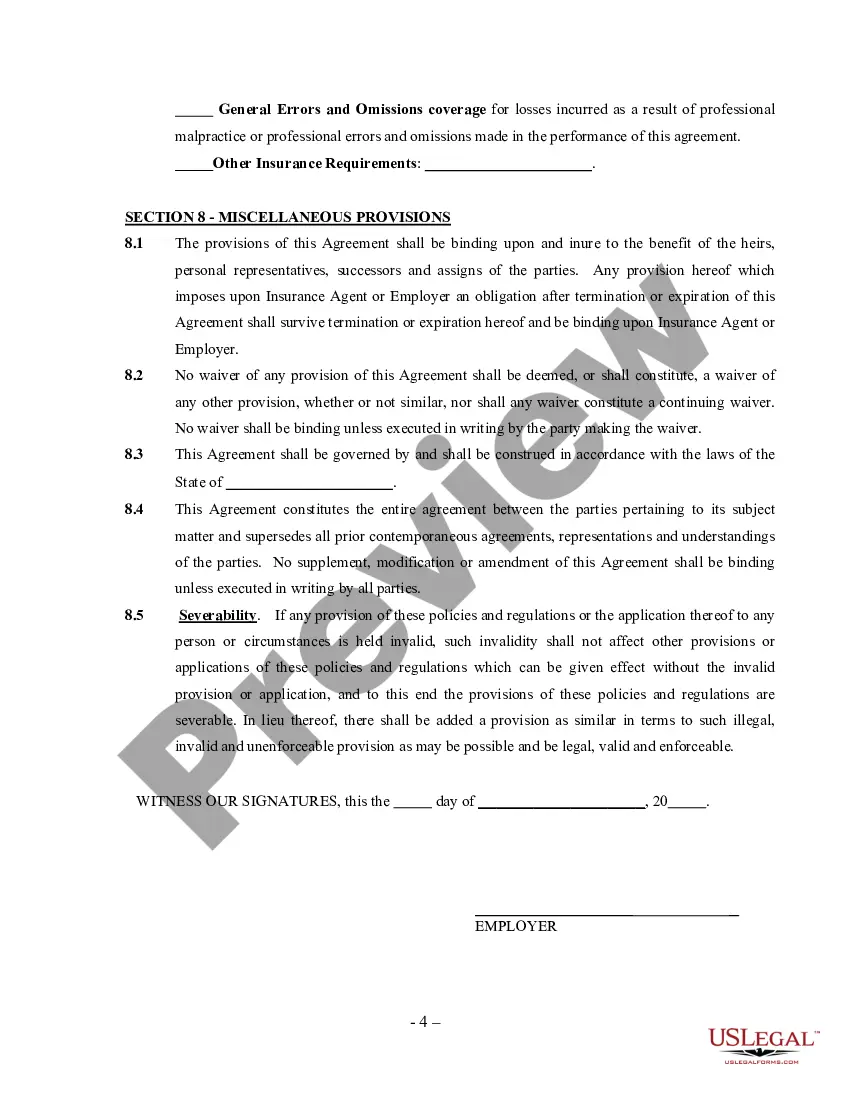

Termination clauses are another vital element to consider. The agreement should outline the circumstances under which either party can terminate the agreement, as well as the required notice period. It should also specify what happens to the agent’s commissions on policies that are still in effect after the termination date. A well-defined termination clause can prevent costly legal battles and ensure a smooth transition when the relationship comes to an end. Consider including provisions for both termination with cause (e.g., breach of contract) and termination without cause, as well as the procedures for resolving any disputes that may arise.

Finally, a non-compete agreement may be necessary to protect the agency’s interests, especially if the agent has access to confidential information or client relationships. A non-compete agreement restricts the agent from working for a competing agency or soliciting clients within a specified geographical area for a certain period after the termination of the agreement. However, it’s important to ensure that the non-compete agreement is reasonable in scope and duration, as overly restrictive agreements may be difficult to enforce. Consult with an attorney to ensure that your non-compete agreement is legally sound and complies with applicable state laws.

Important Note about State Regulations

Insurance regulations vary greatly from state to state. Therefore, it is absolutely essential to ensure that your independent insurance agent agreement template complies with all applicable state laws and regulations. This may require consulting with an attorney who specializes in insurance law in your specific jurisdiction.

Benefits of Using an Independent Insurance Agent Agreement Template

Utilizing an independent insurance agent agreement template provides numerous advantages for both the agency and the agent. It establishes a solid framework for the working relationship, minimizing potential misunderstandings and disputes down the line. This framework offers several key benefits that contribute to a more stable and productive partnership.

Firstly, it provides clarity and structure. A template ensures that all essential terms and conditions are covered, leaving little room for ambiguity. This reduces the risk of misunderstandings and disagreements, as both parties have a clear understanding of their rights and responsibilities. This clarity can significantly contribute to a more harmonious and productive working relationship.

Secondly, it protects both parties. The agreement outlines the rights and obligations of both the agency and the agent, providing a legal framework for the relationship. This helps protect the agency from potential liabilities and ensures that the agent is treated fairly and receives the compensation they are entitled to. It helps protect both sides.

Thirdly, it saves time and money. Creating a custom agreement from scratch can be a time-consuming and expensive process. An independent insurance agent agreement template provides a ready-made solution that can be customized to fit your specific needs, saving you valuable time and legal fees. The time saved allows focus on core business activities.

Fourthly, it ensures compliance. A well-drafted template will typically include provisions that ensure compliance with all applicable laws and regulations. This is especially important in the insurance industry, where regulations can be complex and vary from state to state. Having a compliant agreement can help you avoid costly fines and legal penalties.

Finally, it facilitates a professional relationship. By clearly defining the terms of the agreement, the template fosters a sense of professionalism and mutual respect between the agency and the agent. This can lead to a more collaborative and productive working environment, benefiting both parties in the long run. It shows that both parties are committed to doing business the right way.

In essence, the independent insurance agent agreement template isn’t just a document; it’s an investment. It’s an investment in a stable relationship, in protection from legal issues, and in a clear future. Think of it as setting the stage for a long-term partnership.

Ultimately, the effort in creating a quality agreement paves the way for a fruitful business relationship. It establishes expectations upfront and avoids problems in the future by planning ahead. Therefore, it is worth taking the time to find or customize the perfect agreement.