Buying or selling an insurance agency can be a complex process, much like navigating the intricacies of insurance policies themselves. One of the most crucial documents involved is the insurance agency purchase agreement. Think of it as the roadmap for transferring ownership, outlining all the terms, conditions, and responsibilities that both the buyer and seller agree upon. It’s more than just a piece of paper; it’s a safeguard for both parties, ensuring a smooth and legally sound transaction.

Without a well-drafted agreement, you risk facing disputes, misunderstandings, and potential legal battles down the line. Imagine selling your agency and later discovering the buyer is mishandling client accounts, damaging your hard-earned reputation. Or, on the flip side, imagine buying an agency only to find out it’s riddled with undisclosed liabilities. A comprehensive purchase agreement acts as a shield, protecting you from unforeseen issues and providing a clear path forward.

That’s why having a solid insurance agency purchase agreement template is so important. It offers a framework for addressing key aspects of the transaction, from the purchase price and payment terms to the transfer of client relationships and non-compete clauses. While it’s always wise to consult with legal counsel to tailor the agreement to your specific situation, a good template provides a valuable starting point and helps you understand the essential elements to consider.

Key Elements of an Insurance Agency Purchase Agreement

An insurance agency purchase agreement isn’t a one-size-fits-all document. It needs to be carefully crafted to reflect the unique circumstances of the deal. However, certain core components are essential for ensuring a comprehensive and legally sound agreement. These elements provide clarity and protection for both the buyer and the seller, helping to avoid potential disputes and misunderstandings down the line.

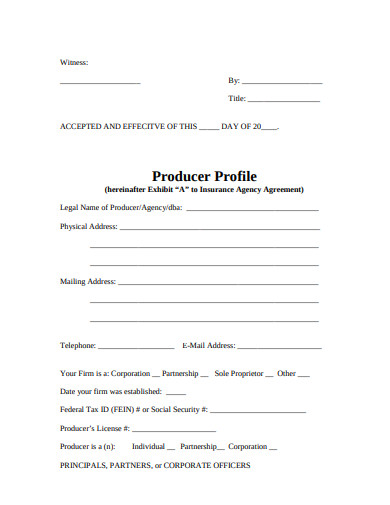

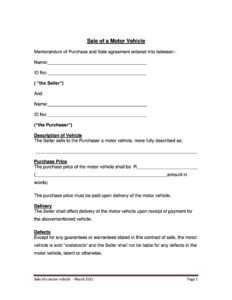

First and foremost, the agreement must clearly identify the parties involved: the buyer and the seller. It should include their full legal names, addresses, and contact information. This seems obvious, but it’s a fundamental requirement for establishing the validity of the contract. Beyond the parties themselves, the agreement needs to precisely define what’s being sold. Is it just the assets of the agency, or is it the entire entity, including its liabilities? This distinction is crucial for determining the scope of the transaction and the responsibilities being transferred.

Next, the purchase price needs to be clearly stated, along with the payment terms. How much is the buyer paying for the agency? What is the method of payment? Is it a lump sum, installments, or a combination of both? What are the deadlines for each payment? These details should be meticulously outlined to avoid any ambiguity or confusion. Furthermore, the agreement should address the allocation of the purchase price to specific assets, such as goodwill, client lists, and fixed assets. This allocation can have significant tax implications for both parties, so it’s important to consult with a tax professional.

Another critical element is the transfer of client relationships. In the insurance industry, client relationships are often the most valuable asset of an agency. The agreement should specify how these relationships will be transferred to the buyer. Will the seller be required to introduce the buyer to key clients? Will the seller be obligated to assist with the transition process? Clear provisions regarding client transfers are essential for ensuring a smooth transition and maximizing the value of the agency.

Finally, non-compete clauses are commonly included in insurance agency purchase agreements. These clauses restrict the seller from competing with the buyer for a specified period of time and within a defined geographic area. The purpose of a non-compete clause is to protect the buyer’s investment by preventing the seller from immediately starting a competing agency and poaching clients. However, non-compete clauses must be reasonable in scope and duration to be enforceable. It’s important to consult with legal counsel to ensure that the non-compete clause is valid and enforceable in your jurisdiction.

Benefits of Using an Insurance Agency Purchase Agreement Template

Using an insurance agency purchase agreement template offers several advantages for both buyers and sellers. One of the most significant benefits is that it saves time and money. Instead of starting from scratch, you have a pre-designed framework that covers the essential elements of the transaction. This can significantly reduce the legal fees associated with drafting a custom agreement. It can also speed up the negotiation process, as both parties have a common starting point to work from.

Templates provide a structured approach to the purchase process. They help you identify and address key issues that you might otherwise overlook. This is particularly helpful for those who are unfamiliar with the intricacies of buying or selling an insurance agency. The template prompts you to consider important factors such as the allocation of purchase price, the transfer of client relationships, and the terms of non-compete clauses. By addressing these issues upfront, you can avoid potential disputes and misunderstandings later on.

Furthermore, an insurance agency purchase agreement template can help ensure compliance with legal requirements. While it’s not a substitute for legal advice, a well-designed template will incorporate standard legal provisions and clauses that are commonly required in purchase agreements. This can help you avoid legal pitfalls and ensure that the agreement is enforceable. Of course, it’s still essential to have the agreement reviewed by an attorney to ensure that it complies with all applicable laws and regulations in your jurisdiction.

Another advantage of using a template is that it provides a neutral starting point for negotiations. Both the buyer and the seller can review the template and make modifications as needed. This can foster a more collaborative and cooperative negotiation process. It can also help to ensure that both parties are aware of their rights and responsibilities under the agreement. Open communication and transparency are essential for a successful transaction, and a well-designed template can facilitate this process.

Ultimately, the goal is to create a clear, comprehensive, and legally sound document that protects the interests of all parties involved. Using an insurance agency purchase agreement template can be a valuable step towards achieving this goal, but it’s important to remember that it’s not a substitute for professional legal advice. Always consult with an attorney to ensure that the agreement is tailored to your specific situation and that it complies with all applicable laws and regulations. You can find an insurance agency purchase agreement template online, but make sure you consult with a lawyer to have them review it.

Navigating the world of insurance agency transactions requires careful planning and attention to detail. The insurance agency purchase agreement template serves as a critical tool, streamlining the process and providing a solid foundation for a successful deal.

Ultimately, a well-crafted agreement fosters trust and protects all parties involved, ensuring a smooth transition and setting the stage for a prosperous future.