Ever feel like managing expenses between different parts of your company is like herding cats? You’re not alone. When various entities within a corporate group benefit from shared resources or activities, figuring out who pays for what can become a real headache. That’s where an intercompany cost sharing agreement template comes in. Think of it as a clear, written agreement that outlines how costs are allocated between related companies, ensuring everyone is playing by the same rules and contributing their fair share.

These agreements aren’t just about fairness; they’re also crucial for tax compliance and efficient financial management. Without a formal agreement, companies risk scrutiny from tax authorities who may question the allocation of costs, potentially leading to adjustments and penalties. A well-drafted intercompany cost sharing agreement template provides documentation to support the allocation methodology, helping to justify the arrangement to auditors and tax inspectors.

So, if you’re involved in a business with multiple related entities sharing costs, understanding and implementing an intercompany cost sharing agreement is essential. It’s not just a piece of paper; it’s a tool for transparency, efficiency, and regulatory compliance. Let’s dive deeper into what these agreements entail and how you can use an intercompany cost sharing agreement template to create one that works for your organization.

Understanding the Essentials of an Intercompany Cost Sharing Agreement

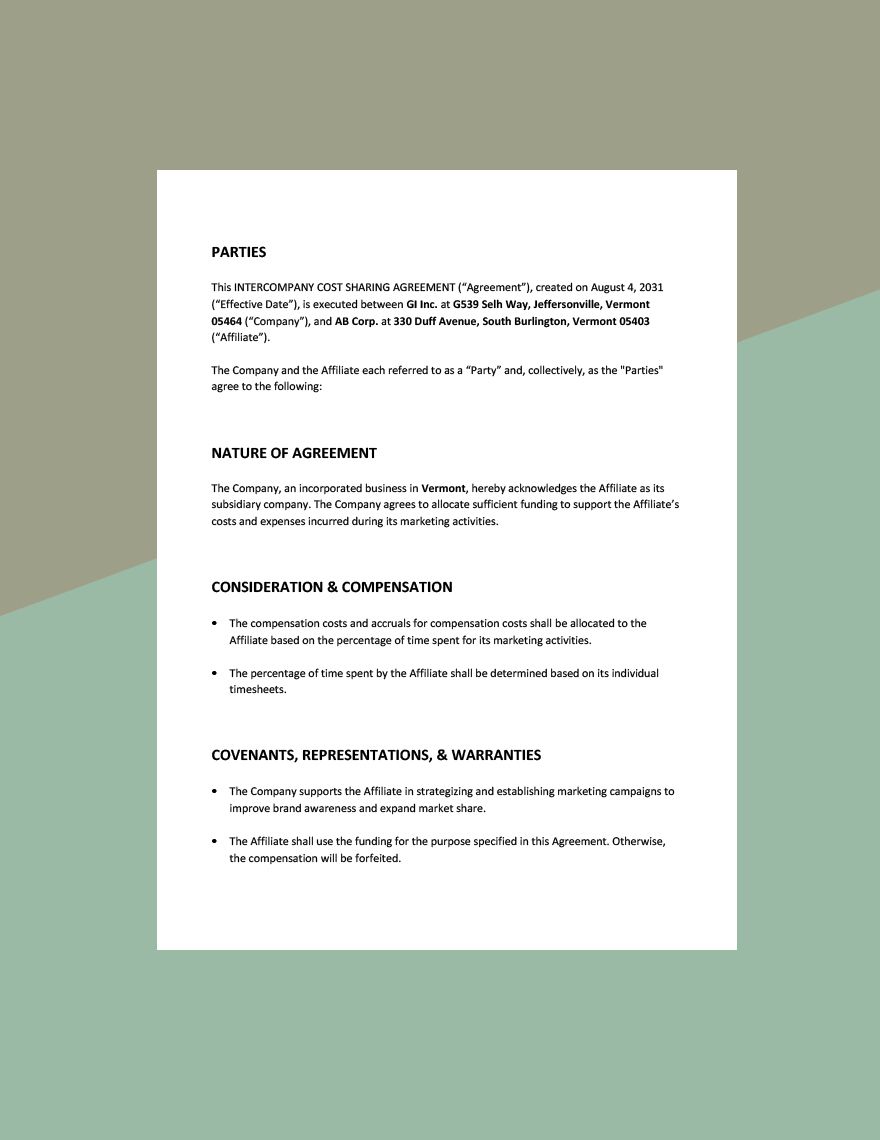

An intercompany cost sharing agreement is a legally binding contract between related entities within a corporate group. Its primary purpose is to allocate the costs associated with developing, owning, and exploiting intangible property (like patents, trademarks, or know-how) or providing services that benefit multiple entities. This agreement ensures that each participating entity bears a portion of the costs commensurate with the benefits it expects to receive. It’s a structured way to handle shared expenses, promoting clarity and accountability.

Key components of a robust intercompany cost sharing agreement template typically include the identification of participating companies, a detailed description of the activities or intangible property being covered, the cost allocation method, and the expected benefits for each participant. The cost allocation method is particularly crucial; it must be reasonable and reflect the actual economic substance of the arrangement. Common methods include the benefit ratio, the sales ratio, or a more sophisticated discounted cash flow analysis. Selecting the appropriate method is essential to avoid disputes and ensure compliance with tax regulations.

Furthermore, the agreement should clearly define the roles and responsibilities of each participating entity. Who is responsible for managing the activity? Who owns the intellectual property? How are disputes resolved? Addressing these questions upfront can prevent misunderstandings and conflicts down the line. It is vital that the agreement accurately reflect the conduct of the parties. The agreement must be reviewed periodically to ensure that the terms of the agreement and the conduct of the parties are in alignment.

One important aspect is ensuring the agreement complies with relevant tax laws, particularly transfer pricing regulations. These regulations aim to prevent companies from shifting profits to lower-tax jurisdictions through artificial cost allocations. Therefore, it’s essential to consult with tax professionals when drafting and implementing an intercompany cost sharing agreement. They can help ensure that the agreement is structured in a way that is both commercially sound and tax-compliant.

In summary, an intercompany cost sharing agreement is a powerful tool for managing costs within a corporate group. By clearly defining the roles, responsibilities, and cost allocation methods, it promotes transparency, accountability, and compliance. With the right intercompany cost sharing agreement template and expert guidance, businesses can streamline their financial operations and minimize tax risks.

Key Considerations When Using an Intercompany Cost Sharing Agreement Template

While an intercompany cost sharing agreement template can provide a solid foundation, it’s important to remember that it’s just a starting point. Every business is unique, and the specific terms of the agreement must be tailored to reflect the particular circumstances of your organization. Simply filling in the blanks without careful consideration can lead to problems down the road.

First, carefully assess the scope of the agreement. What activities or intangible property should be included? Are there any related activities that should be excluded? Be as specific as possible to avoid ambiguity. For example, if the agreement covers research and development activities, clearly define the types of research being conducted and the technologies being developed.

Second, meticulously review the cost allocation method. Is the proposed method appropriate for your business? Does it accurately reflect the benefits received by each participating entity? Consider consulting with financial professionals to determine the most suitable method. Remember, the cost allocation method must be defensible in the event of a tax audit. It’s a good idea to test the results of the cost allocation method before finalizing the agreement to make sure it yields equitable results.

Third, pay close attention to the intellectual property ownership provisions. Who owns the intellectual property developed under the agreement? How are royalties or other payments handled? These provisions can have significant tax implications, so it’s essential to consult with legal and tax advisors. The intercompany cost sharing agreement template should include appropriate legal disclaimers.

Finally, remember that an intercompany cost sharing agreement is not a set-it-and-forget-it document. It should be reviewed and updated periodically to reflect changes in the business environment, tax laws, or the activities being covered. Regular reviews can help ensure that the agreement remains effective and compliant over time. Using the right intercompany cost sharing agreement template will enable compliance and avoid penalties.

By carefully considering these factors and tailoring the template to your specific needs, you can create an intercompany cost sharing agreement that promotes fairness, efficiency, and compliance within your organization.

An intercompany cost sharing agreement is a critical tool for businesses with multiple related entities and careful consideration of the elements discussed are essential for its successful implementation. Remember that a well-designed intercompany cost sharing agreement template contributes significantly to streamlined financial operations and minimized tax risks.