Navigating the world of international business often requires engaging with skilled individuals across borders. When hiring someone who isn’t an employee but an independent contractor located in another country, a robust agreement becomes absolutely essential. This agreement clarifies expectations, protects your interests, and ensures a smooth working relationship. It’s your roadmap for a successful collaboration, especially when dealing with different legal systems and cultural nuances.

Why is a specific “international” agreement so important? Well, think of it this way: laws governing contractors differ wildly from country to country. What’s perfectly acceptable in the United States might be completely illegal or unenforceable in Germany, for example. Using a generic, domestic agreement leaves you vulnerable to misinterpretations, disputes, and potentially costly legal battles. An international independent contractor agreement template addresses these cross-border complexities head-on.

This article will guide you through the critical elements of an effective international independent contractor agreement, explaining why each section matters and offering insights into crafting a document that safeguards your business while fostering a productive partnership with your international contractors. We’ll delve into the specifics, helping you understand what to include and what to avoid to create a legally sound and mutually beneficial agreement.

Key Elements of a Solid International Independent Contractor Agreement

A comprehensive international independent contractor agreement should cover all aspects of the working relationship, leaving no room for ambiguity or misunderstanding. It should act as a shield, protecting both you and the contractor from unforeseen issues that might arise during the project. So, what essential components should you include?

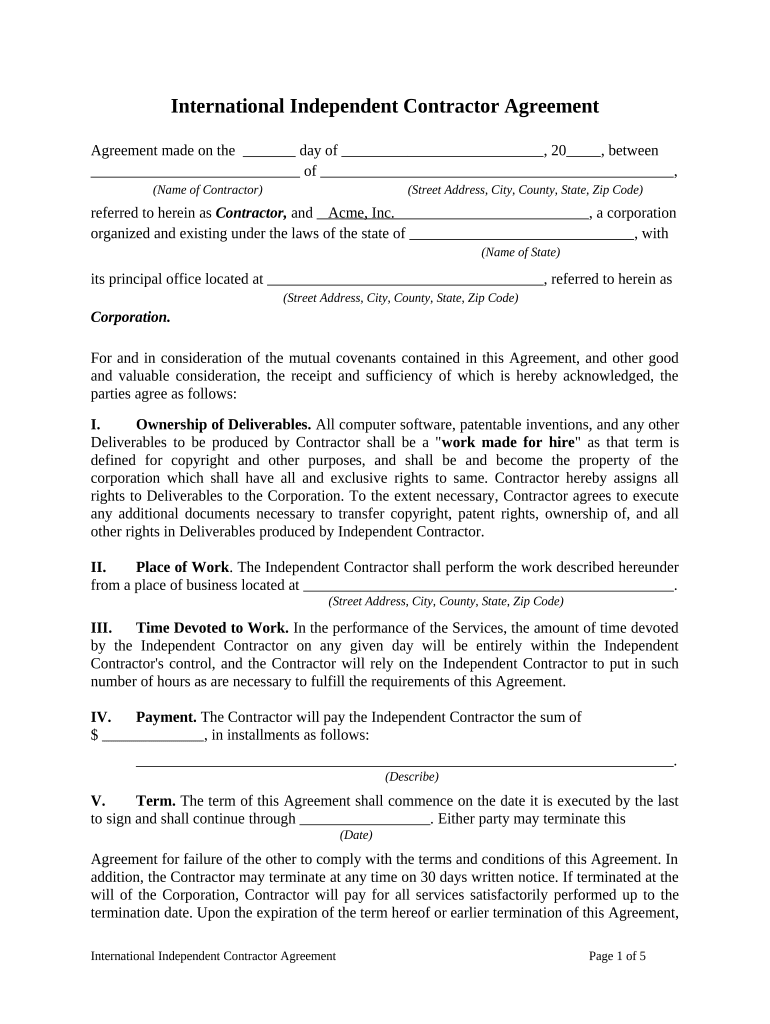

First and foremost, clearly define the scope of work. This section should explicitly detail the services the contractor will provide, the deliverables expected, and the timeline for completion. Be as specific as possible, avoiding vague language that could lead to disagreements later on. Think about outlining milestones and incorporating revision phases if needed. The more detailed you are here, the less room for misinterpretation.

Next, compensation and payment terms are crucial. State the agreed-upon payment amount, currency, and payment schedule. Specify how the contractor will invoice you and the method of payment you’ll use (e.g., wire transfer, PayPal). Address any potential expenses the contractor might incur and how those will be reimbursed. Will they need to purchase specific software or tools for the project? Lay it all out in this section.

Intellectual property ownership is another critical area to address. Who owns the rights to the work produced by the contractor? Typically, you’ll want to own the copyright to the work created for your company. The agreement should clearly state that all intellectual property created by the contractor within the scope of the agreement belongs to your company. This is especially important for software development, content creation, and design work.

The agreement should also outline the termination clause. Under what circumstances can either party terminate the agreement? What notice period is required? What happens to any work in progress if the agreement is terminated early? Including a clear and fair termination clause protects both parties and provides a framework for ending the relationship amicably if necessary. Think about including clauses for breach of contract and dispute resolution.

Finally, don’t forget about governing law and jurisdiction. Which country’s laws will govern the agreement? Where will any legal disputes be resolved? Choosing the right governing law and jurisdiction is crucial, as it can significantly impact the enforceability of the agreement. It’s often advisable to choose a neutral jurisdiction or the jurisdiction where your company is located.

Navigating Legal and Cultural Considerations

Creating an international independent contractor agreement is not just about filling in the blanks of a template. You must be aware of the significant legal and cultural differences that exist across borders. Ignoring these considerations can lead to misunderstandings, compliance issues, and even legal penalties.

One key aspect is compliance with local labor laws. In some countries, classifying a worker as an independent contractor when they should be considered an employee can result in hefty fines and back taxes. Research the laws of the contractor’s country of residence to ensure you’re not inadvertently misclassifying them. Factors like the level of control you exert over the contractor, the exclusivity of the relationship, and the provision of benefits can all influence whether a worker is considered an employee or a contractor.

Cultural differences also play a significant role. Communication styles, work ethics, and expectations can vary widely across cultures. Be mindful of these differences when drafting the agreement and communicating with the contractor. For example, in some cultures, direct and assertive communication is preferred, while in others, a more indirect and polite approach is more appropriate. Understanding these nuances can help prevent misunderstandings and build a stronger working relationship.

Consider including a clause that addresses language barriers. Will the agreement be translated into the contractor’s native language? Who is responsible for the cost of translation? If the agreement is in English, make sure the contractor has a sufficient understanding of the language to comprehend the terms and conditions. Providing a translated version can demonstrate goodwill and prevent misunderstandings.

Another essential consideration is data privacy. If the contractor will be handling personal data, ensure the agreement complies with applicable data privacy laws, such as the GDPR in Europe. Include provisions that address data security, confidentiality, and the contractor’s obligations to protect personal data. Failing to comply with data privacy laws can result in significant fines and reputational damage. When searching for your international independent contractor agreement template, make sure it takes into account data privacy laws.

Finally, be sure to consult with legal professionals familiar with international law and the laws of the contractor’s country of residence. They can provide valuable guidance on drafting an agreement that complies with all applicable laws and protects your interests. Investing in legal advice upfront can save you significant time and money in the long run.

Working with international independent contractors can be a great way to access specialized skills and expand your business globally. A well-drafted agreement is more than just a piece of paper; it’s the foundation of a successful and mutually beneficial relationship.

Taking the time to create a comprehensive and legally sound international independent contractor agreement protects your business and contributes to a positive working experience for everyone involved. Remember, clarity and communication are key to navigating the complexities of international collaborations.