So, you’re thinking about lending money to a family member, or maybe you’re the one needing a loan from a relative. That’s a big step! Mixing family and finances can be tricky, but it doesn’t have to be a recipe for disaster. In fact, with the right approach and a little bit of planning, it can be a win win situation for everyone involved. The key to success in these situations is clear communication and a solid agreement.

That’s where an intra family loan agreement template comes in. Think of it as a roadmap for your financial arrangement, outlining all the important details and helping to prevent misunderstandings down the road. It’s not just about protecting your money; it’s about protecting your relationship too. No one wants awkward Thanksgiving dinners because of an unresolved loan dispute.

This guide will walk you through everything you need to know about using an intra family loan agreement template, why it’s so important, and what you need to include to make it legally sound and emotionally safe for everyone involved. We’ll cover all the bases, from interest rates and repayment schedules to potential tax implications and what happens if things don’t go according to plan. Let’s dive in and explore how to make this work for your family.

Why You Absolutely Need an Intra Family Loan Agreement

Let’s be honest, lending money to family is often more about helping someone you care about than expecting a huge return on investment. But even with the best intentions, informal agreements can quickly turn sour. Memories fade, interpretations differ, and before you know it, your well-meaning loan has become a source of friction. An intra family loan agreement acts as a clear record of the loan’s terms, leaving no room for ambiguity.

Beyond preventing family squabbles, a formal agreement can also have significant tax implications. The IRS treats loans between family members the same way they treat loans between strangers. If the loan isn’t properly documented and doesn’t charge a minimum interest rate (known as the Applicable Federal Rate, or AFR), the IRS might consider it a gift. Gifts above a certain amount are subject to gift tax, which can be a nasty surprise for both the lender and the borrower. By using a template and adhering to IRS guidelines, you can avoid these potential pitfalls.

Furthermore, having a written agreement demonstrates the seriousness of the loan to the borrower. It shows that you’re not just handing over money with no expectations of repayment. This can encourage the borrower to treat the loan responsibly and prioritize repayments, ultimately benefiting both parties involved. It can also help set expectations and create a structured plan for repayment.

An intra family loan agreement template also helps to clarify what happens if the borrower is unable to repay the loan. What are the consequences? Will you adjust the repayment schedule? Will you forgive the debt altogether? Addressing these difficult questions upfront can prevent resentment and ensure that everyone is on the same page. It provides a framework for navigating potential financial hardships without damaging family relationships.

Think of it this way: an intra family loan agreement is like an insurance policy for your relationships and your finances. It’s a small investment of time and effort that can prevent a world of headaches down the road. It protects both the lender and the borrower by clearly defining the terms of the loan and ensuring that everyone understands their rights and responsibilities.

Key Elements of an Intra Family Loan Agreement Template

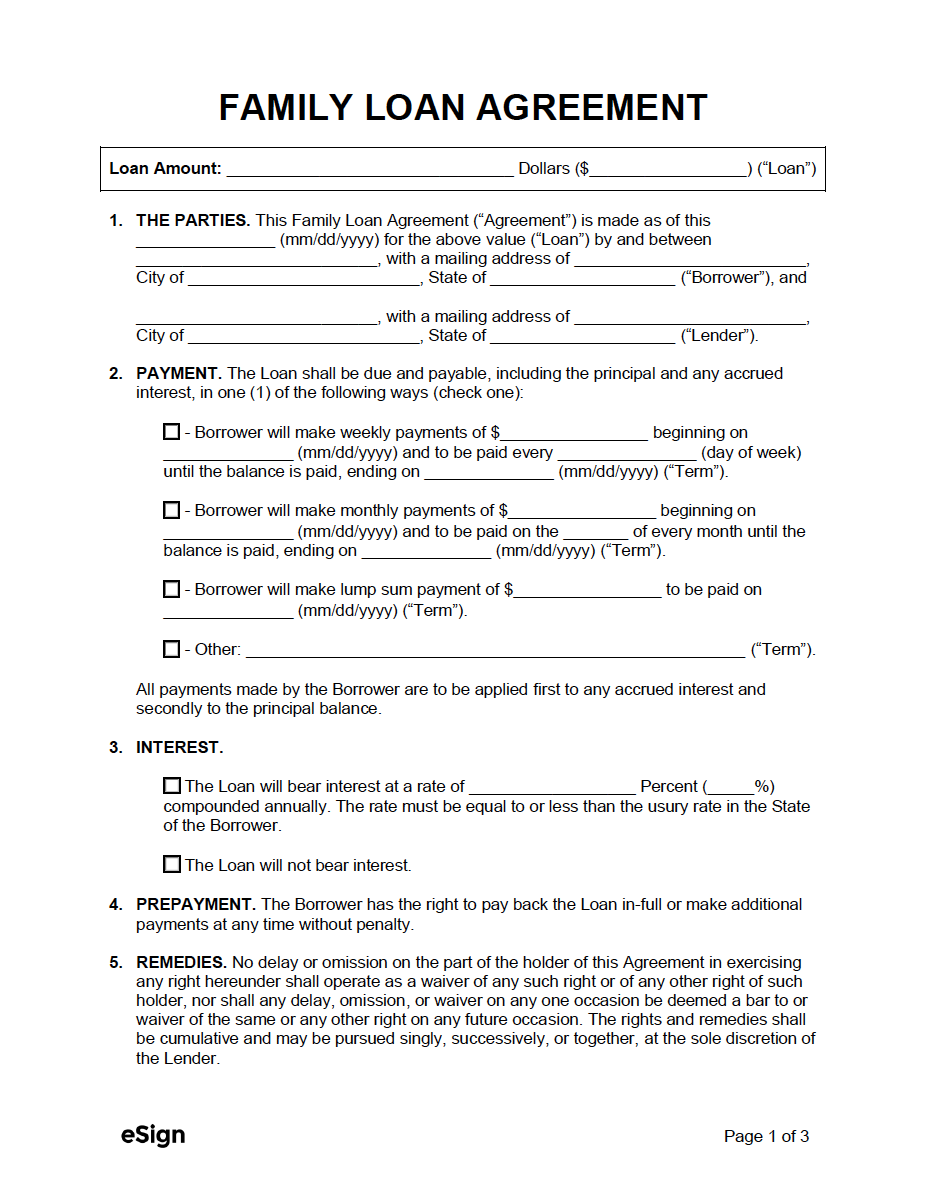

So, what exactly should you include in your intra family loan agreement template? Here are some essential elements to consider.

First and foremost, clearly identify the lender and the borrower. Include their full legal names and addresses. This might seem obvious, but it’s important for legal clarity. Next, specify the loan amount. Be precise and avoid vague language. State the exact dollar amount being borrowed.

The interest rate is another crucial element. As mentioned earlier, it’s important to charge at least the AFR to avoid potential tax issues. Consult the IRS website or a financial professional to determine the current AFR for the loan term. State the interest rate clearly in the agreement.

The repayment schedule is also vital. Outline the frequency of payments (e.g., monthly, quarterly), the amount of each payment, and the due date. Specify how the payments should be made (e.g., check, electronic transfer). Include a provision for late payment fees, if any. A clear repayment schedule helps the borrower plan their finances and ensures that the lender receives timely payments.

Finally, address what happens in the event of default. What actions will the lender take if the borrower fails to make payments? Will the lender pursue legal action? Will the lender forgive the debt? Clearly define the consequences of default to avoid misunderstandings and protect the lender’s interests. You may also want to include a clause that outlines how the loan will be handled in the event of the borrower’s death.

A well-written intra family loan agreement template should also include clauses regarding prepayment options, amendment procedures, and applicable state law. Consulting with an attorney or financial advisor is always a good idea to ensure that your agreement is legally sound and tailored to your specific circumstances. Using an intra family loan agreement template can save both time and legal costs.

Doing your research and having a good understanding will serve you well. Remember, you’re not just creating a loan document; you’re laying the foundation for a healthy and transparent financial relationship within your family.

Ultimately, clear communication and documented agreements will preserve your relationships and your peace of mind. It will set clear expectations, which will help in case any disagreement arises.