So, you and your friends are ready to dive into the exciting world of investing together? That’s fantastic! Forming an investment club is a great way to pool resources, learn from each other, and potentially grow your wealth. But before you start picking stocks and celebrating hypothetical gains, there’s a crucial piece you need to have in place: an investment club partnership agreement template. Think of it as the rulebook for your club, ensuring everyone is on the same page and preventing potential misunderstandings down the road.

Without a solid agreement, things can quickly become messy. What happens if a member wants to leave? How will profits and losses be distributed? Who has the authority to make investment decisions? These are just a few of the questions that a well-drafted investment club partnership agreement template can answer. It’s about establishing clear guidelines and procedures to handle all sorts of scenarios that might arise during the life of your club.

Consider it an investment in your club’s long-term success. Taking the time upfront to create a thorough and legally sound agreement will save you headaches and potential conflicts later. It allows you to focus on what really matters: learning about investing and growing your collective portfolio. So, let’s explore what makes a great investment club partnership agreement template and how to create one that fits your group’s needs.

Key Elements of an Investment Club Partnership Agreement

A comprehensive investment club partnership agreement template should cover all the essential aspects of your club’s operation. Think of it as the constitution for your investment group. It needs to clearly define the rights, responsibilities, and obligations of each member, ensuring that everyone understands the rules of the game. The specific elements you include will depend on your club’s unique structure and goals, but there are some fundamental sections that are almost always included.

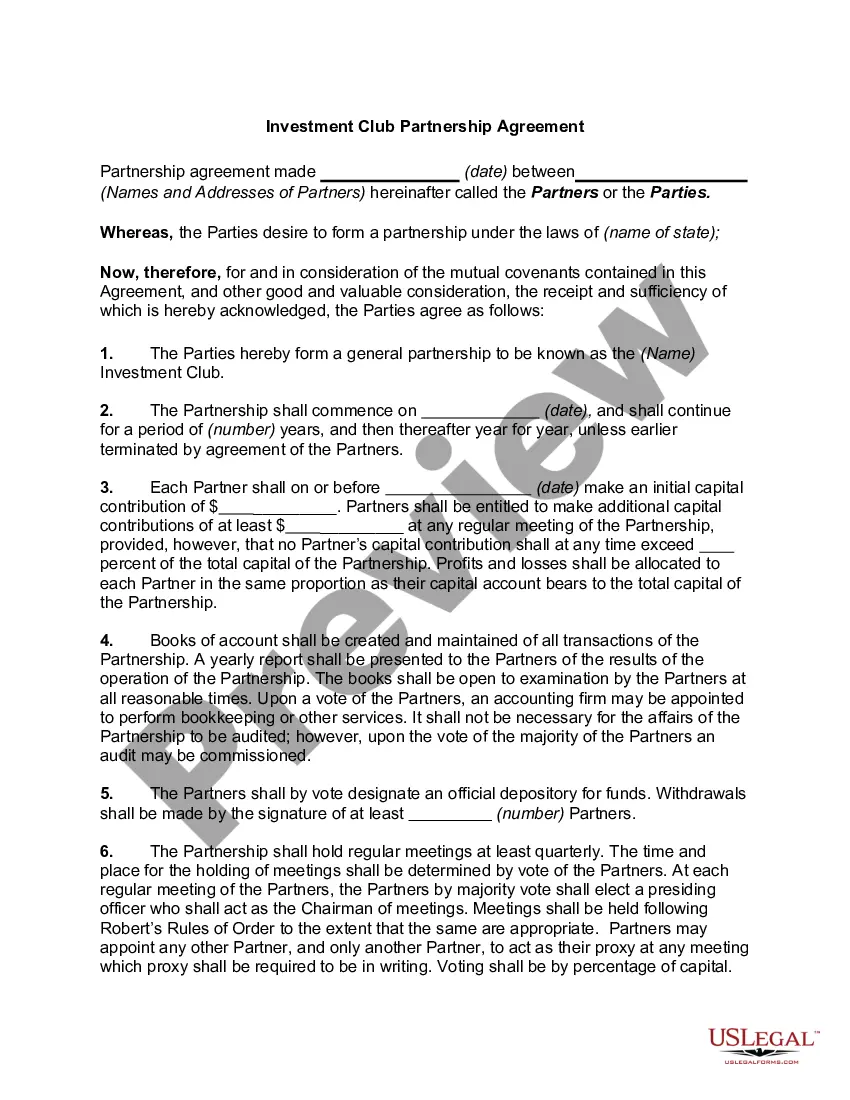

First and foremost, the agreement must clearly identify all the partners and their initial capital contributions. This includes full legal names, addresses, and the amount of money or other assets each member is contributing to the club. It’s also crucial to define the club’s name, purpose, and the duration of the partnership. Is it a long-term venture, or will it have a set expiration date? These details lay the foundation for the entire agreement.

Another vital section outlines the investment strategy and decision-making process. What types of investments will the club pursue? Will you focus on stocks, bonds, real estate, or a combination of assets? Who has the authority to propose investments, and how will voting work? Will there be a designated investment committee, or will all members participate in every decision? The agreement should clearly define the rules for how investment decisions are made.

Financial matters are, of course, central to the agreement. It needs to specify how profits and losses will be allocated among the partners. This is usually done proportionally based on their capital contributions, but alternative arrangements can be made if all partners agree. The agreement should also address issues like accounting, record-keeping, and tax reporting. Who will be responsible for these tasks, and how will financial transparency be maintained?

Finally, the agreement should address potential disputes and termination procedures. What happens if a member wants to withdraw from the club? How will their share of the assets be handled? What happens if the partners disagree on an investment decision? How will the partnership be dissolved if necessary? Including clear procedures for these situations can prevent conflicts and ensure a smooth transition in case of unforeseen circumstances. A well-crafted investment club partnership agreement template will act as a safety net, protecting the interests of all members and fostering a successful investment partnership.

Crafting Your Investment Club Partnership Agreement

Now that you understand the key elements, let’s talk about how to actually create your investment club partnership agreement. You have several options, ranging from using a pre-made template to hiring an attorney to draft a custom agreement. The best approach will depend on your club’s specific needs and budget.

One popular option is to start with an investment club partnership agreement template. These templates are readily available online and can provide a solid starting point. Look for templates that are specifically designed for investment clubs and that cover all the essential elements we discussed earlier. Be sure to carefully review and customize the template to fit your club’s unique circumstances.

Another option is to consult with an attorney who specializes in partnership agreements. While this can be more expensive, it offers the advantage of having a legally sound agreement tailored to your specific needs. An attorney can help you navigate complex legal issues and ensure that your agreement complies with all applicable laws and regulations. This is particularly advisable if your club is dealing with significant amounts of capital or complex investment strategies.

Regardless of which approach you choose, it’s essential to involve all members of the club in the process. The agreement should be a collaborative effort, reflecting the consensus of all partners. Take the time to discuss each section of the agreement and address any concerns or questions that arise. Transparency and open communication are key to ensuring that everyone is comfortable with the terms and conditions.

Finally, once the agreement is finalized, be sure to have all partners sign it and keep a copy for your records. It’s a good idea to review the agreement periodically, especially if there are significant changes in the club’s membership, investment strategy, or financial situation. By taking the time to create a well-drafted and regularly reviewed investment club partnership agreement template, you’ll be setting your club up for long-term success and minimizing the risk of disputes.

Embarking on an investment journey with friends is an exciting venture, and a well-defined agreement sets the stage for collaborative success. It’s about more than just paperwork; it’s about fostering trust, clarity, and a shared vision for your club’s financial future.

With a clear understanding of your objectives and a well-structured agreement in place, your investment club can navigate the market with confidence. Remember, the best investments are built on a solid foundation, and your partnership agreement is that foundation for your club.