So, you’re venturing into the world of investment and considering forming an Investment LLC? Smart move! An Investment LLC, short for Limited Liability Company, can be a fantastic vehicle for pooling funds, diversifying investments, and limiting personal liability. But before you jump in headfirst, there’s a crucial document you’ll need: the operating agreement. Think of it as the constitution for your investment group, laying out the rules of the game and ensuring everyone is on the same page.

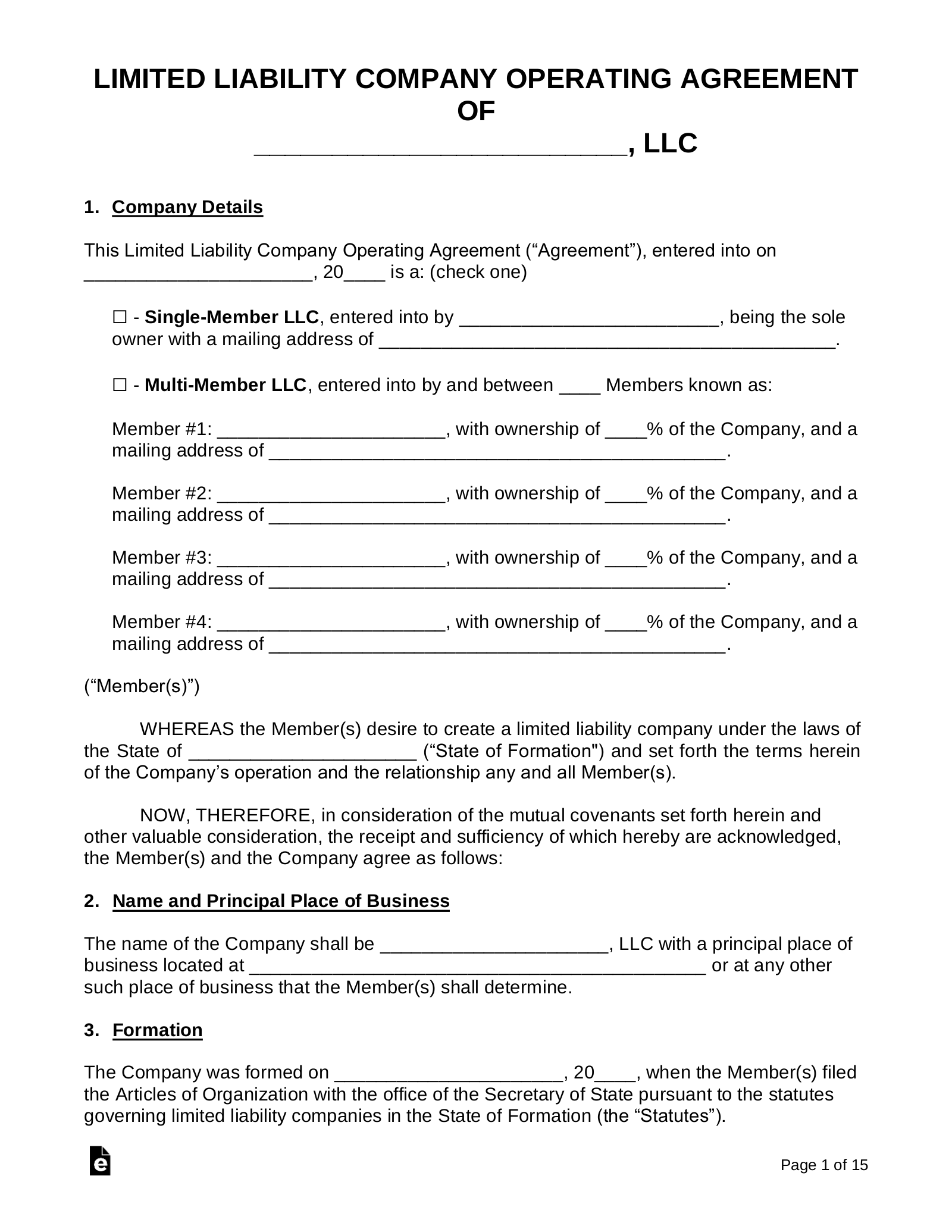

Crafting an operating agreement from scratch can feel daunting, especially with all the legal jargon floating around. That’s where an investment llc operating agreement template comes in handy. It provides a framework, a starting point, to tailor to your specific needs and investment strategies. While a template isn’t a substitute for professional legal advice, it can significantly simplify the process and save you time and money.

This article will explore the importance of an investment LLC operating agreement, what key provisions it should include, and how to effectively use a template to create a legally sound and practical document for your investment venture. Let’s dive in and unlock the power of a well-structured operating agreement!

Why You Absolutely Need an Investment LLC Operating Agreement

Okay, let’s be real. Setting up an LLC might seem like a mountain of paperwork, and the operating agreement can feel like just another piece of the puzzle. But trust me, it’s a cornerstone of your investment LLC’s success and legal protection. Think of it this way: without a clear operating agreement, you’re essentially driving a car without a steering wheel. You might get somewhere, but the journey will be bumpy and unpredictable.

First and foremost, an operating agreement clearly defines the roles and responsibilities of each member (owner) of the LLC. Who is responsible for making investment decisions? How are profits and losses allocated? What happens if a member wants to leave or sell their share? These are all crucial questions that your operating agreement should address. Without these clear guidelines, disagreements can quickly escalate, potentially leading to costly legal battles and irreparable damage to your investment venture.

Beyond internal governance, an operating agreement strengthens the limited liability protection afforded by an LLC. By clearly separating the business from the personal assets of its members, the operating agreement helps to shield you from personal liability for the LLC’s debts and obligations. While forming an LLC provides some liability protection on its own, a robust operating agreement bolsters that protection and demonstrates to creditors and the courts that the LLC is a distinct and separate entity.

Moreover, an operating agreement provides flexibility in structuring your investment LLC. Unlike corporations, which are subject to more rigid regulations, LLCs offer a wide range of options for structuring ownership, management, and profit distribution. Your operating agreement allows you to customize these aspects to fit the specific needs and goals of your investment group. This flexibility can be particularly valuable in the context of investment, where strategies and priorities can evolve over time.

Finally, having a well-drafted operating agreement can simplify the process of opening bank accounts, obtaining loans, and attracting investors. Banks and other financial institutions often require to see an operating agreement before doing business with an LLC. Similarly, potential investors will want to review the operating agreement to understand the structure and governance of the investment LLC before committing their capital. An investment llc operating agreement template can be a great starting point for creating this vital document.

Key Provisions to Include in Your Investment LLC Operating Agreement

So, you’re ready to tackle your investment LLC operating agreement? Great! But before you dive into a template, it’s essential to understand the key provisions that should be included. These are the building blocks that will form the foundation of your agreement and ensure it effectively protects your interests.

First, you’ll need to clearly identify the members of the LLC, including their names, addresses, and percentage ownership. This section should also specify the initial capital contributions of each member and how future capital contributions will be handled. For instance, will members be required to contribute additional capital if the LLC needs more funds? How will these contributions be accounted for in terms of ownership and profit allocation?

Next, the operating agreement should address management structure. Will the LLC be member-managed, meaning all members actively participate in decision-making? Or will it be manager-managed, with one or more designated managers responsible for day-to-day operations? Clearly defining the management structure is crucial for ensuring efficient and effective decision-making within the LLC.

A critical section of the operating agreement deals with profit and loss allocation. How will profits and losses be distributed among the members? Will it be based on their percentage ownership? Or will there be a different allocation formula? The operating agreement should also specify the timing of distributions and how they will be handled for tax purposes.

The operating agreement should also address the procedures for transferring membership interests. What happens if a member wants to sell their share? Will the other members have the right of first refusal? What happens upon the death or disability of a member? Clearly defining these procedures can prevent disputes and ensure a smooth transition of ownership.

Finally, the operating agreement should include provisions for amending the agreement, resolving disputes, and dissolving the LLC. How will amendments be made? Will it require unanimous consent of the members? What dispute resolution mechanisms will be used, such as mediation or arbitration? Under what circumstances will the LLC be dissolved? Addressing these issues in advance can save you time, money, and headaches down the road. Remember that an investment llc operating agreement template should be tailored to your specific investment strategies and the particular circumstances of your member group.

Drafting an operating agreement, especially for an Investment LLC, might seem like a daunting task, but it’s an essential step in protecting your investment and ensuring a smooth and successful venture.