So, you’re thinking about taking control of your retirement funds and venturing into the exciting world of self-directed IRAs, specifically with an LLC structure? That’s awesome! One of the most crucial steps in setting up your IRA LLC is creating a solid operating agreement. Think of it as the rulebook for your LLC, outlining how it will be managed, how decisions will be made, and how profits will be distributed. It’s not exactly light reading, but it’s absolutely essential for keeping your IRA compliant and your investments safe.

Creating an LLC within your IRA opens up a wider range of investment opportunities that are typically unavailable in traditional IRA accounts. We’re talking real estate, private businesses, precious metals, and so much more! However, with great power comes great responsibility, and that’s where the operating agreement comes in. It helps you navigate the complex rules and regulations surrounding self-directed IRAs and ensures that you’re not accidentally engaging in prohibited transactions, which could jeopardize your entire retirement account. No one wants that!

Finding a reliable ira llc operating agreement template can seem daunting with so many options available online. Choosing the right template or knowing what clauses to include is vital for the health of your investment. This guide will walk you through the basics of what an IRA LLC operating agreement is, why you need one, and what to look for in a good template. We’ll cover key considerations to help you make informed decisions and protect your retirement savings.

What is an IRA LLC Operating Agreement and Why Do You Need One?

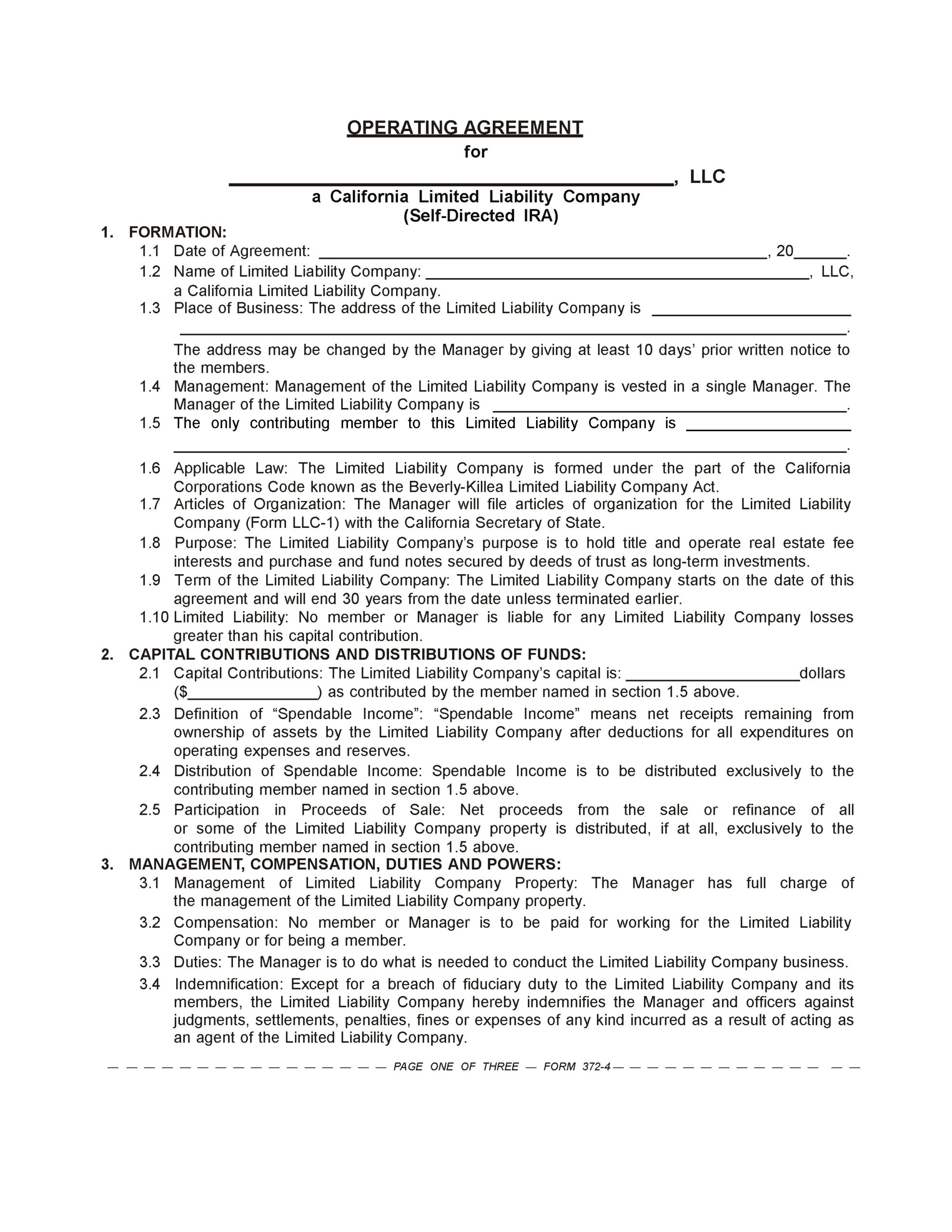

An IRA LLC operating agreement is a legally binding document that outlines the rules and regulations governing the operation of a limited liability company (LLC) owned by an Individual Retirement Account (IRA). It’s like the constitution for your LLC, detailing the rights, responsibilities, and obligations of the members (in this case, you as the IRA holder). The operating agreement clarifies how the LLC will be managed, how decisions will be made, how profits and losses will be distributed, and other important aspects of its operation.

Why is it so crucial? Well, without a well-defined operating agreement, your IRA LLC could be vulnerable to compliance issues. The IRS has strict rules about self-directed IRAs, and any violation, intentional or unintentional, could result in the loss of your IRA’s tax-advantaged status. Imagine years of building your retirement nest egg, only to have it all wiped out because of a technicality. The operating agreement helps you stay on the right side of the law and avoid costly mistakes.

Furthermore, a clear operating agreement provides clarity and transparency for all parties involved. While you, as the IRA holder, might be the sole member of the LLC, having a documented agreement ensures that everyone understands their roles and responsibilities. This is especially important if you plan to involve other individuals in the management or operation of the LLC, such as a property manager for a real estate investment. The agreement outlines the scope of their authority and prevents potential conflicts of interest.

Think of it this way: an IRA LLC operating agreement is your shield against potential legal and financial risks. It provides a framework for managing your investments responsibly and ensures that your IRA remains in good standing with the IRS. It may seem like an extra step in setting up your self-directed IRA, but it’s an investment in the long-term security of your retirement savings.

Lastly, a comprehensive ira llc operating agreement template is important for banks and other financial institutions. They often require this documentation to open a bank account for your LLC, as it confirms the legitimacy of the entity and outlines its operational structure. Without a proper operating agreement, you might encounter difficulties in accessing banking services and managing your LLC’s finances effectively.

Key Elements to Include in Your IRA LLC Operating Agreement

When choosing or creating an ira llc operating agreement template, certain key elements are essential to ensure its effectiveness and compliance. Here are some of the most important aspects to consider:

Purpose of the LLC: Clearly define the purpose of the LLC, specifically stating that it is formed to hold and manage assets within an IRA. This establishes the connection between the LLC and your retirement account.

Management Structure: Specify how the LLC will be managed. Will you, as the IRA holder, be the sole manager? Or will you designate another individual to manage the day-to-day operations? Clearly outline the roles and responsibilities of each manager.

Contribution and Distribution Rules: Detail how contributions will be made to the LLC from your IRA and how distributions will be handled. All contributions and distributions must comply with IRS regulations regarding self-directed IRAs.

Prohibited Transactions: Include a section that explicitly prohibits transactions that are not allowed under IRS rules for self-directed IRAs. This might include transactions with disqualified persons (such as yourself, your family members, or businesses you control) or the use of IRA funds for personal benefit.

Amendment Procedures: Outline the process for amending the operating agreement in the future. This ensures that any changes to the agreement are made in a legally sound manner.

Governing Law: Specify the state laws that will govern the interpretation and enforcement of the operating agreement. This is important for resolving any legal disputes that may arise.

Banking and Financial Matters: Include details about the LLC’s banking arrangements, such as the name of the bank and the authorized signatories on the account. This helps ensure that the LLC’s finances are properly managed.

Ultimately, a well-drafted operating agreement is a cornerstone of a successful IRA LLC. It safeguards your retirement investments and provides a clear framework for managing your LLC in compliance with IRS regulations.

There are several factors to consider when setting up an ira llc operating agreement template to protect your retirement savings.

It’s about taking control of your financial future and enjoying the benefits of self-directed investing. With the right planning and a solid operating agreement, you’re well on your way to building a secure and prosperous retirement.