Ever dreamed of owning property with a friend, sibling, or partner? It’s an exciting prospect, but like any significant investment, it’s crucial to lay a solid foundation. That’s where a joint property ownership agreement comes in. Think of it as a roadmap for your shared ownership journey, outlining the responsibilities, rights, and potential scenarios that might arise. Without it, you’re essentially navigating unfamiliar territory without a map, which could lead to misunderstandings and disagreements down the road. Nobody wants that, especially when dealing with something as valuable as real estate.

A well-drafted agreement isn’t about distrust; it’s about clarity and fairness. It ensures that everyone is on the same page regarding financial contributions, maintenance responsibilities, and what happens if one party wants to sell or needs to move. It’s a proactive measure that can save you headaches, legal battles, and damaged relationships in the future. It allows you to have open and honest conversations upfront, addressing potential issues before they even become problems.

So, where do you start? Creating a joint property ownership agreement template can seem daunting, but it doesn’t have to be. There are resources available to help you craft a document that fits your specific needs and circumstances. This article will explore key considerations and elements to include in your agreement, providing a guide to help you embark on your shared property ownership adventure with confidence and peace of mind. Let’s dive in!

Key Elements of a Joint Property Ownership Agreement

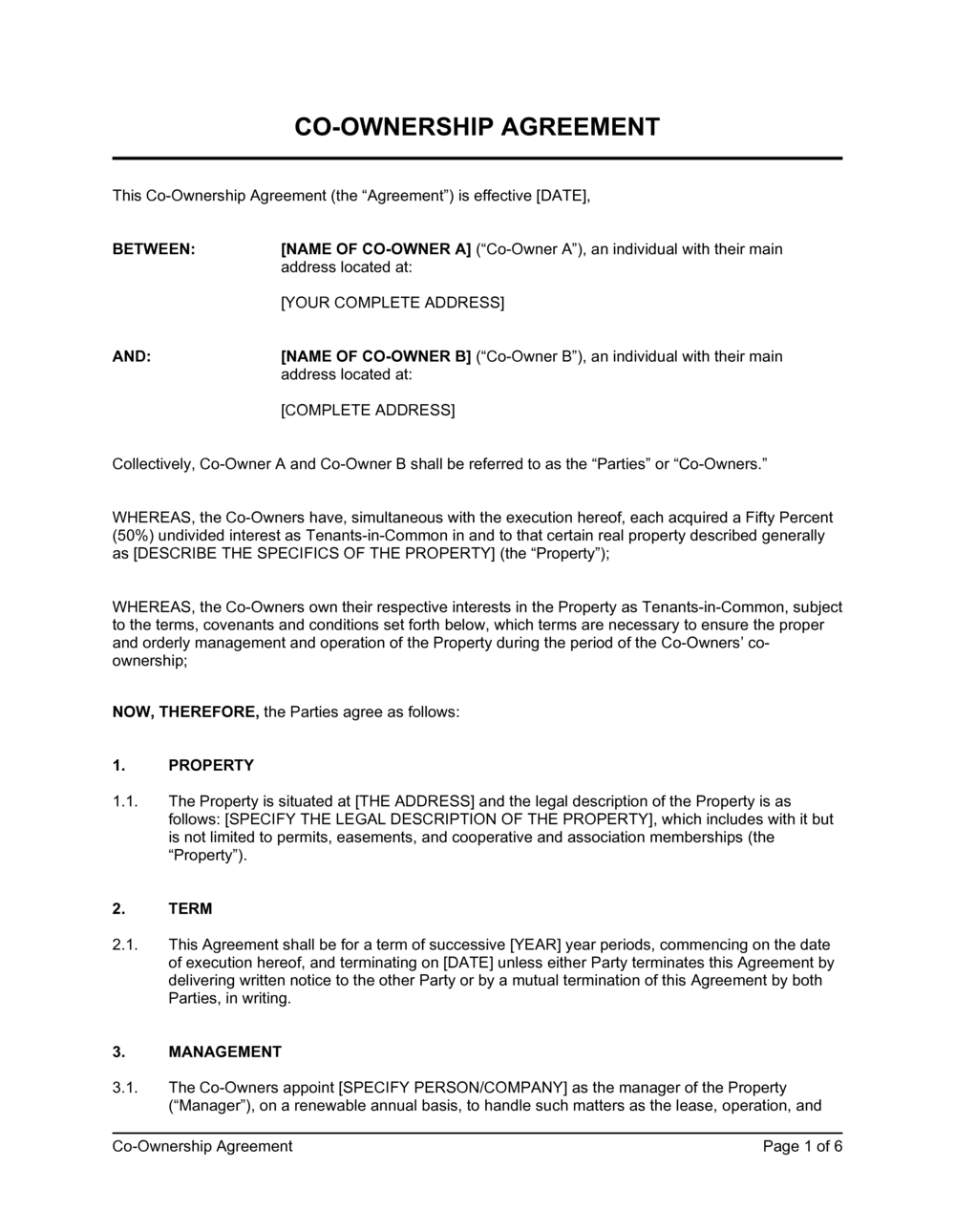

A comprehensive joint property ownership agreement should cover all the essential aspects of your shared ownership arrangement. It acts as a rule book, ensuring that everyone understands their obligations and entitlements. One of the most important aspects to clearly define is the ownership percentage for each party. Is it a 50/50 split, or does one party own a larger share? This will affect how profits from the property are divided and how decisions are made. The agreement should state explicitly the percentage owned by each party involved.

Financial responsibilities also need to be meticulously outlined. How will mortgage payments, property taxes, insurance, and maintenance costs be handled? Will contributions be proportional to ownership percentages, or will there be a different arrangement? Creating a shared bank account for property-related expenses can be a practical solution. Spell out the details, including who is responsible for paying bills, tracking expenses, and managing the budget. It’s also important to address how major repairs or improvements will be financed and approved.

Decision-making processes are another crucial area to address. How will you handle decisions regarding renting out the property, making renovations, or even selling it? Will decisions require unanimous agreement, or will a majority vote suffice? Establishing a clear decision-making process can prevent disagreements and ensure that everyone’s voice is heard. Consider including clauses that address potential conflicts and outline a mediation or arbitration process to resolve disputes amicably. This can save time, money, and relationships compared to resorting to litigation.

The agreement should also address what happens if one owner wants to sell their share of the property. Will the other owners have the right of first refusal, allowing them to purchase the departing owner’s share before it’s offered to an outside buyer? Define the process for valuing the share and the timeline for completing the sale. This ensures a fair and orderly transition if one owner decides to exit the agreement. It is also important to address what happens if one of the owners passes away, determining how their share will be transferred and to whom.

Finally, the agreement should include provisions for termination. Under what circumstances can the agreement be terminated, and what are the procedures for dissolving the joint ownership? This could include scenarios like a disagreement that cannot be resolved, a change in circumstances for one of the owners, or a desire to sell the property. Clearly outlining the termination process ensures that all parties understand their rights and obligations if the joint ownership arrangement comes to an end. Seeking legal advice when drafting and reviewing the joint property ownership agreement template is always a good idea to ensure it aligns with your specific needs and complies with local laws.

Benefits of Using a Joint Property Ownership Agreement Template

Having a well-structured joint property ownership agreement template offers many advantages, not only for avoiding future disagreements but also for providing a clear framework for the entire ownership experience. One of the most significant benefits is the peace of mind it provides. Knowing that you have a legally binding document outlining everyone’s rights and responsibilities allows you to focus on enjoying the property and building your investment, rather than worrying about potential conflicts. It’s a proactive step that reduces stress and fosters a positive co-ownership environment.

Furthermore, a joint property ownership agreement can help prevent misunderstandings and disputes before they even arise. By discussing and documenting key aspects of the ownership arrangement upfront, you and your co-owners can ensure that you’re all on the same page. This includes financial contributions, maintenance responsibilities, decision-making processes, and procedures for selling or terminating the agreement. Open communication and clear documentation are essential for a successful co-ownership venture. Using a joint property ownership agreement template ensures all necessary topics are covered.

Another significant benefit is the protection it offers in case of unforeseen circumstances. Life is unpredictable, and things can change unexpectedly. If one owner becomes incapacitated, faces financial difficulties, or wants to sell their share, the agreement provides a clear roadmap for handling these situations. It can prevent legal battles and ensure that the interests of all parties are protected. A well-drafted agreement can act as a safety net, providing clarity and stability during challenging times. This can be especially crucial to protect the property.

A joint property ownership agreement can also be beneficial when securing financing for the property. Lenders often prefer to see a clear agreement in place, as it demonstrates that the co-owners have a well-defined plan for managing their shared ownership. It can also help facilitate the loan approval process and potentially lead to more favorable loan terms. This demonstrates to the lender that the co-owners have considered the different possibilities.

Beyond the practical benefits, a joint property ownership agreement can also strengthen relationships between co-owners. By engaging in open and honest communication about expectations and responsibilities, you can build trust and foster a collaborative partnership. The agreement serves as a testament to your commitment to fairness and transparency, laying the foundation for a successful and harmonious co-ownership experience. It shows a commitment to transparency.

Creating a joint property ownership agreement might seem like a complex process, but it’s an investment that pays off in the long run. It safeguards your financial interests, protects your relationships, and provides peace of mind knowing that you have a solid foundation for your shared ownership venture. Don’t underestimate the power of a well-crafted agreement; it’s the key to unlocking a successful and enjoyable co-ownership experience.

Ultimately, the decision to create a joint property ownership agreement is a wise one. It’s about being prepared, proactive, and committed to a fair and transparent partnership. It transforms a potentially complex situation into a manageable and rewarding experience for everyone involved.