So, you’re ready to lease a business property? That’s a huge step! Whether you’re a budding entrepreneur opening your first brick-and-mortar store or an established business expanding to a new location, securing the right space is crucial. But before you pop the champagne and hang up your “Open” sign, there’s a little something called a lease agreement to navigate. It might sound intimidating, but don’t worry; it’s just a formal contract outlining the terms between you (the tenant) and the landlord.

Think of a lease agreement template for business property as the rulebook for your tenancy. It protects both you and the landlord, ensuring everyone is on the same page about things like rent payments, property maintenance, and what happens if things don’t go exactly as planned. It’s far better to have everything clearly outlined in writing upfront to avoid potential headaches down the road. Trust me, a little preparation now can save you a lot of stress and money later.

Finding the right lease agreement template for business property is essential. You want something comprehensive, easy to understand, and tailored to the specific type of business property you’re leasing. A good template will cover all the critical aspects of the agreement, leaving no room for ambiguity. We’re going to break down what you need to know about securing the right business property for your company, and how to ensure you are getting the best deal possible, and that you understand your obligations.

Key Components of a Business Property Lease Agreement

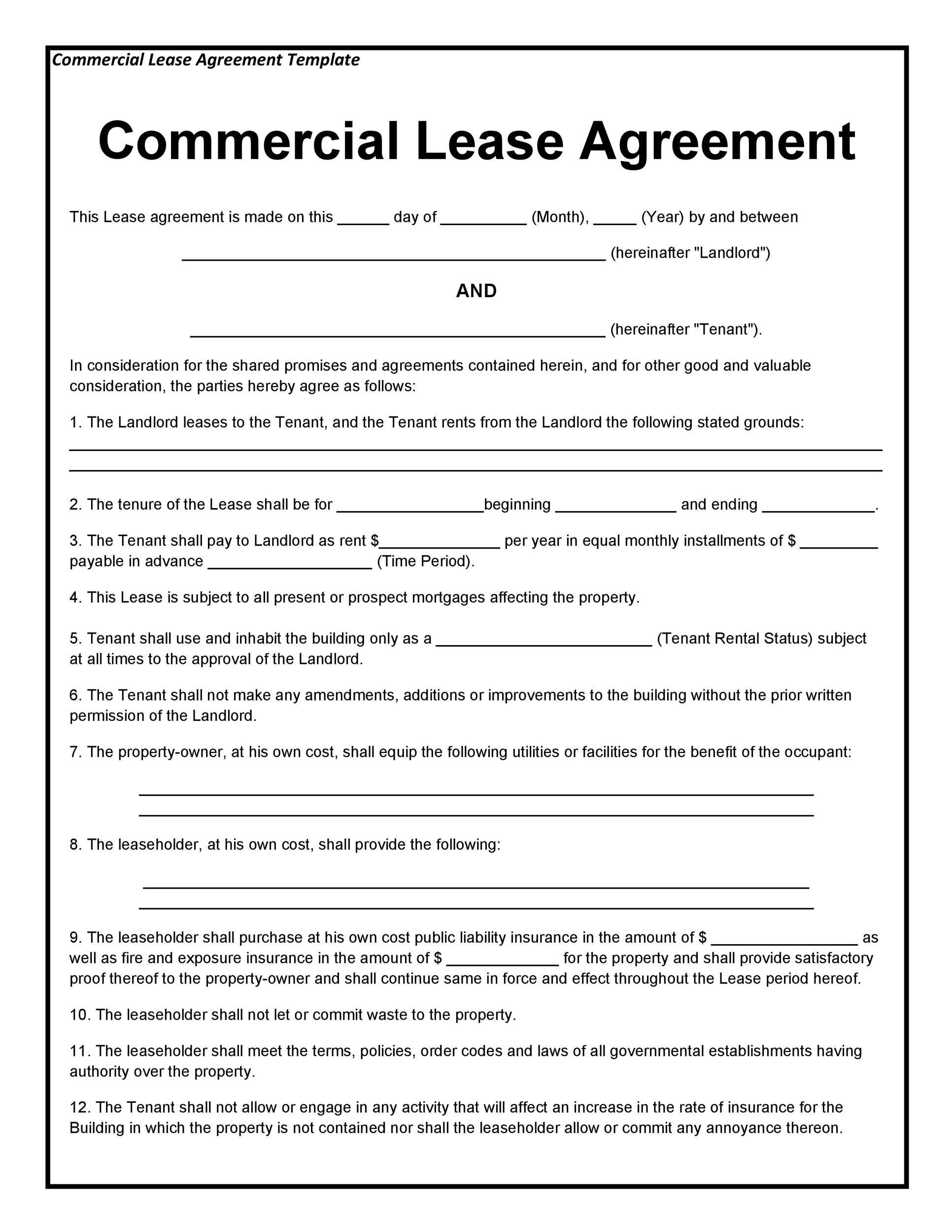

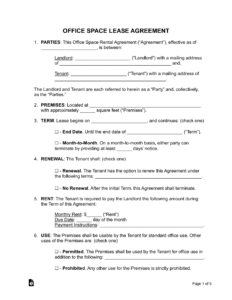

A commercial lease agreement is a legally binding contract that outlines the rights and responsibilities of both the landlord and the tenant. It’s important to understand each component to ensure you’re entering into a fair and beneficial agreement. Here’s a breakdown of some key elements that you’ll typically find in a lease agreement template for business property:

First, let’s talk about the parties involved. The lease will clearly identify the landlord (the property owner) and the tenant (that’s you!). It’s important to ensure that the correct legal names and addresses are listed for both parties. This may seem simple, but accuracy is key, especially if either party is a corporation or LLC.

Next up is the property description. The lease must clearly describe the specific premises being leased. This includes the address, suite number (if applicable), and any common areas you have access to. A detailed description helps avoid any confusion about the exact space you’re renting. Sometimes, a floor plan or site map may be included as an exhibit to the lease.

The term of the lease is another critical element. This specifies the length of time you’ll be leasing the property. Commercial leases often run for several years, but the duration can vary depending on the nature of your business and the landlord’s preferences. Be sure to understand the start and end dates of the lease term, as well as any options for renewal. Often, commercial leases will include options to renew, or even rights of first refusal, to allow the tenant the first option to continue occupying the space.

Rent and payment terms are, of course, a very critical component. This section outlines the monthly rent amount, due date, acceptable payment methods, and any late payment penalties. The lease may also specify whether the rent is fixed for the entire term or subject to increases based on factors such as inflation or market conditions. It’s essential to understand the total cost of the lease, including any additional charges such as common area maintenance (CAM) fees or property taxes. Depending on the specific commercial lease agreement, the tenant may be responsible for paying a proportionate share of these expenses.

Finally, and very importantly, the lease will detail the permitted use of the property. This clause specifies the type of business you’re allowed to operate on the premises. For example, a lease might permit use as a retail store, office space, or restaurant. Be sure that the permitted use aligns with your business activities to avoid any conflicts with the landlord or other tenants. Some leases may also include restrictions on certain types of businesses or activities to maintain the overall character of the property.

Negotiating Your Business Property Lease

Once you’ve found a lease agreement template for business property you are comfortable with, the negotiation process begins. Remember, most lease terms are negotiable, so don’t be afraid to advocate for your interests. Approaching negotiations with a clear understanding of your needs and a willingness to compromise can lead to a mutually beneficial outcome.

Rent is an obvious starting point for negotiation. Research comparable properties in the area to determine a fair market rate. Consider factors such as the location, size, condition, and amenities of the property. You might be able to negotiate a lower base rent, especially if you’re willing to commit to a longer lease term. Alternatively, you could negotiate for a rent abatement period, where you pay reduced rent or no rent for a certain period at the beginning of the lease to help offset startup costs.

Another area ripe for negotiation is the responsibility for repairs and maintenance. Determine who is responsible for maintaining different aspects of the property, such as the roof, HVAC system, plumbing, and electrical systems. You may be able to negotiate a clause that requires the landlord to cover major repairs, while you’re responsible for routine maintenance. Be sure to address issues such as landscaping, snow removal, and trash disposal in the lease agreement.

Improvements and alterations to the property are another area where negotiation can be beneficial. If you plan to make any significant changes to the space, such as adding walls or installing new fixtures, you’ll need to obtain the landlord’s approval. Negotiate a clause that outlines the process for obtaining approval and clarifies who is responsible for paying for the improvements. You might also be able to negotiate a clause that allows you to remove your improvements at the end of the lease term.

Finally, always review the lease carefully and consult with an attorney before signing anything. An attorney can help you understand the legal implications of the lease and identify any potential risks or red flags. They can also assist you in negotiating more favorable terms and ensuring that the lease protects your interests. Investing in legal advice upfront can save you a lot of trouble and expense down the road.

Securing a business property is a journey. Take your time, do your research, and don’t be afraid to ask questions. A well-negotiated lease is a foundation for success.

Remember, a lease agreement is a critical document that sets the stage for your business’s success in its new location. By understanding its key components and approaching negotiations strategically, you can secure a lease that meets your needs and protects your interests. Good luck with your commercial property search!