Ever dreamt of owning that cozy little house with the white picket fence, but the whole mortgage application process feels like climbing Mount Everest? Or perhaps you’re a landlord looking to attract responsible tenants with a long-term commitment? Well, you might want to consider a lease to own agreement. It’s a unique path to homeownership that blends renting and buying, offering a potential win-win for both parties involved.

Think of it this way: you’re essentially renting a property for a set period, but a portion of each month’s rent contributes toward the eventual purchase price. It’s like a forced savings plan for your down payment, all while enjoying the comforts of the home you aspire to own. This arrangement can be particularly attractive to individuals who might not qualify for a traditional mortgage right away due to credit issues, limited down payment savings, or other financial hurdles.

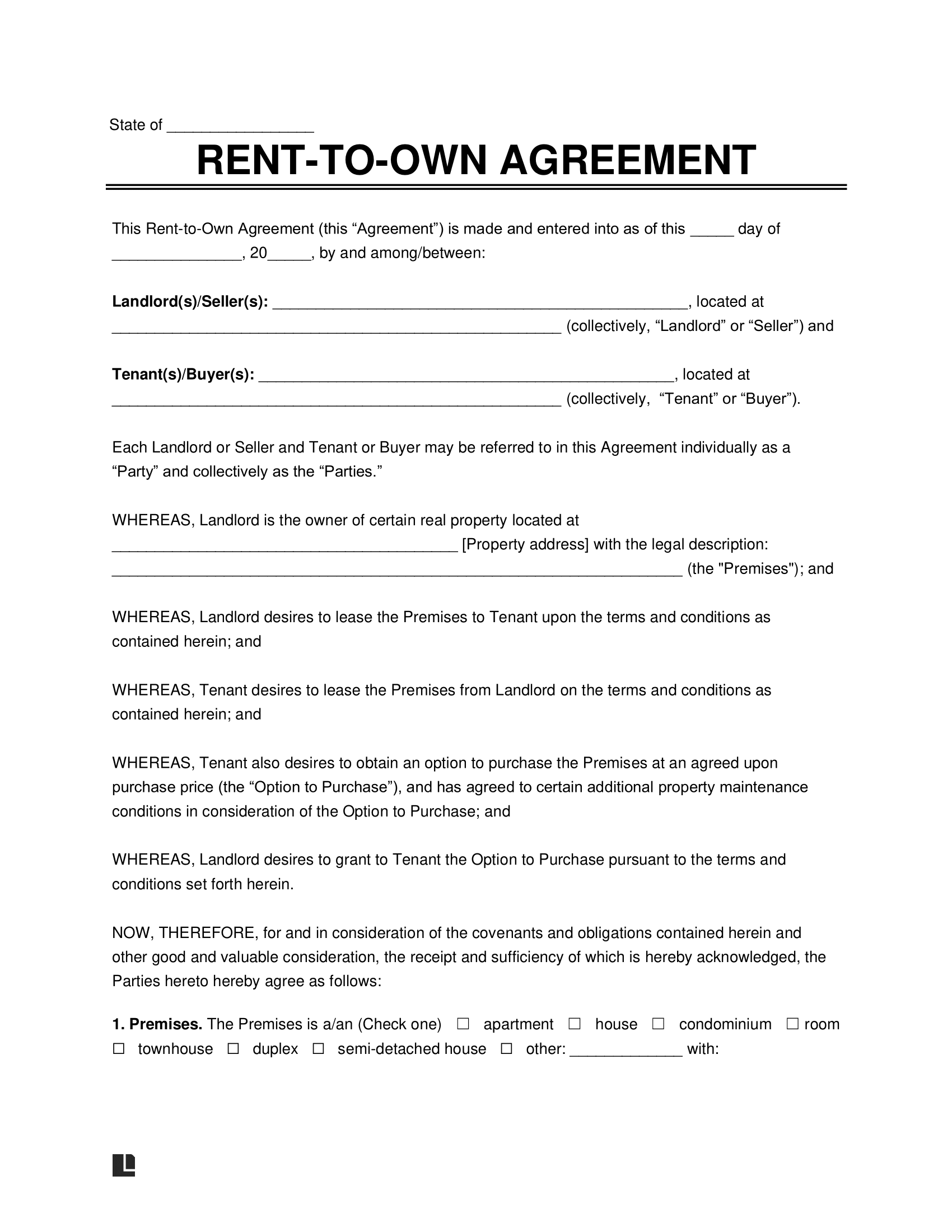

However, navigating the legalities of a lease to own agreement can seem daunting. That’s where a comprehensive and legally sound lease to own agreement template comes into play. This template serves as the foundation for a clear and mutually beneficial agreement, outlining the rights and responsibilities of both the lessor (the current property owner) and the lessee (the potential buyer). Let’s dive into what makes this template so important and how it can help you secure your future home.

Understanding the Key Components of a Lease To Own Agreement Template

A robust lease to own agreement template isn’t just a collection of clauses; it’s a detailed roadmap outlining the entire process. It protects both the landlord and the tenant, ensuring everyone is on the same page from day one. The template will specify the exact address of the property, the names of the parties involved (lessor and lessee), and the duration of the lease period. It’s essential to have these basic details ironed out to avoid any confusion down the line.

Furthermore, a crucial section will detail the monthly rent amount and how much of that rent will be credited towards the eventual purchase price. This is often referred to as the rent credit or option consideration. For example, the agreement might state that 20 percent of each month’s rent will be applied towards the down payment. This aspect is key, as it directly impacts how quickly the tenant accumulates equity in the property. It’s imperative to carefully consider and negotiate this percentage to ensure it’s fair for both parties.

Another vital element of the lease to own agreement template is the purchase option price. This is the predetermined price at which the tenant can buy the property at the end of the lease term. Often, this price is set at the beginning of the lease, and it’s important to consider factors like market appreciation when determining a fair price. There should also be clear language surrounding how the purchase will be financed should the tenant exercise the option to purchase. Will they be securing a mortgage, or will there be alternative financing arrangements?

The template should also address the responsibilities for property maintenance and repairs during the lease period. Typically, the tenant is responsible for routine maintenance, such as lawn care and minor repairs. However, the agreement should clearly specify who is responsible for major repairs, such as roof repairs or plumbing issues. This section prevents disputes and ensures the property is well-maintained throughout the lease term.

Finally, the template must include clauses that address default and termination. What happens if the tenant fails to pay rent? What if the landlord fails to uphold their end of the agreement? Clear protocols for these situations are crucial to protect both parties. The lease to own agreement template should outline the consequences of default, the process for eviction (if applicable), and the conditions under which the agreement can be terminated by either party. Having these safeguards in place provides peace of mind and minimizes potential legal battles.

Benefits and Considerations of Using a Lease To Own Agreement

One of the biggest benefits of a lease to own agreement is that it provides a pathway to homeownership for individuals who may not qualify for a traditional mortgage. It allows potential buyers to improve their credit score, save for a down payment, and demonstrate their ability to manage homeownership responsibilities before committing to a long-term mortgage. For sellers, it can attract a wider pool of potential buyers and provide a steady stream of rental income while waiting for the buyer to secure financing.

Another advantage is the flexibility it offers. Both the buyer and seller have the opportunity to assess each other and the property before committing to a final sale. The buyer can live in the home and get a feel for the neighborhood, while the seller can evaluate the buyer’s responsibility and ability to maintain the property. This trial period can help both parties make informed decisions about whether or not to proceed with the purchase.

However, there are also important considerations to keep in mind. For buyers, the risk lies in the possibility of not being able to secure financing at the end of the lease term. If they are unable to obtain a mortgage, they could lose the option to purchase the property, as well as any rent credits they’ve accumulated. It’s crucial for buyers to work diligently on improving their credit and saving for a down payment throughout the lease period.

Sellers also face potential risks. If the buyer decides not to exercise the option to purchase, the seller may have to relist the property and find a new buyer. Additionally, there’s the risk of the buyer damaging the property during the lease period. That’s why it’s essential for sellers to conduct thorough tenant screening and include clear provisions in the lease to own agreement template regarding property maintenance and repairs.

Ultimately, a lease to own agreement can be a valuable tool for both buyers and sellers, but it’s essential to approach it with careful consideration and a clear understanding of the potential risks and benefits. A well-drafted lease to own agreement template can provide a solid foundation for a successful transaction.

Having a clear understanding of all aspects of this arrangement will allow for making informed decisions. Consider seeking advice from legal counsel and financial advisors to make sure that you are protecting your interests and are fully aware of the obligations that come with this type of agreement.

Understanding your individual circumstances and making sure it aligns with the terms of the template is very important for making informed decisions. It is important to remember that the legal template is only as effective as the knowledge that goes into it.