Ever dreamt of owning your own home but not quite ready to jump into a full-blown mortgage? Or maybe you’re a landlord looking for a way to attract reliable tenants who are also potential buyers? A lease with option to purchase agreement template could be the perfect solution. It’s like a test drive for homeownership, allowing you to live in the property while building equity towards a future purchase. It’s a win-win situation, really! Imagine settling into a place, making it your own, and knowing that with each payment, you’re one step closer to actually owning it.

This type of agreement bridges the gap between renting and owning, offering flexibility and opportunity for both the tenant and the landlord. For tenants, it provides a chance to save for a down payment and improve their credit score while living in the house they might eventually buy. For landlords, it can lead to a quicker sale at a potentially higher price, all while having a responsible tenant taking care of the property. It removes some of the uncertainty in the housing market.

So, what exactly does a lease with option to purchase agreement entail, and how can a template help you navigate this process? Let’s dive into the details and explore the key components of this powerful real estate tool. By understanding the intricacies of the agreement, you can confidently decide if this is the right path for your real estate journey. We’ll unravel the complexities and make it easy to understand the benefits for everyone involved.

Understanding the Lease with Option to Purchase Agreement

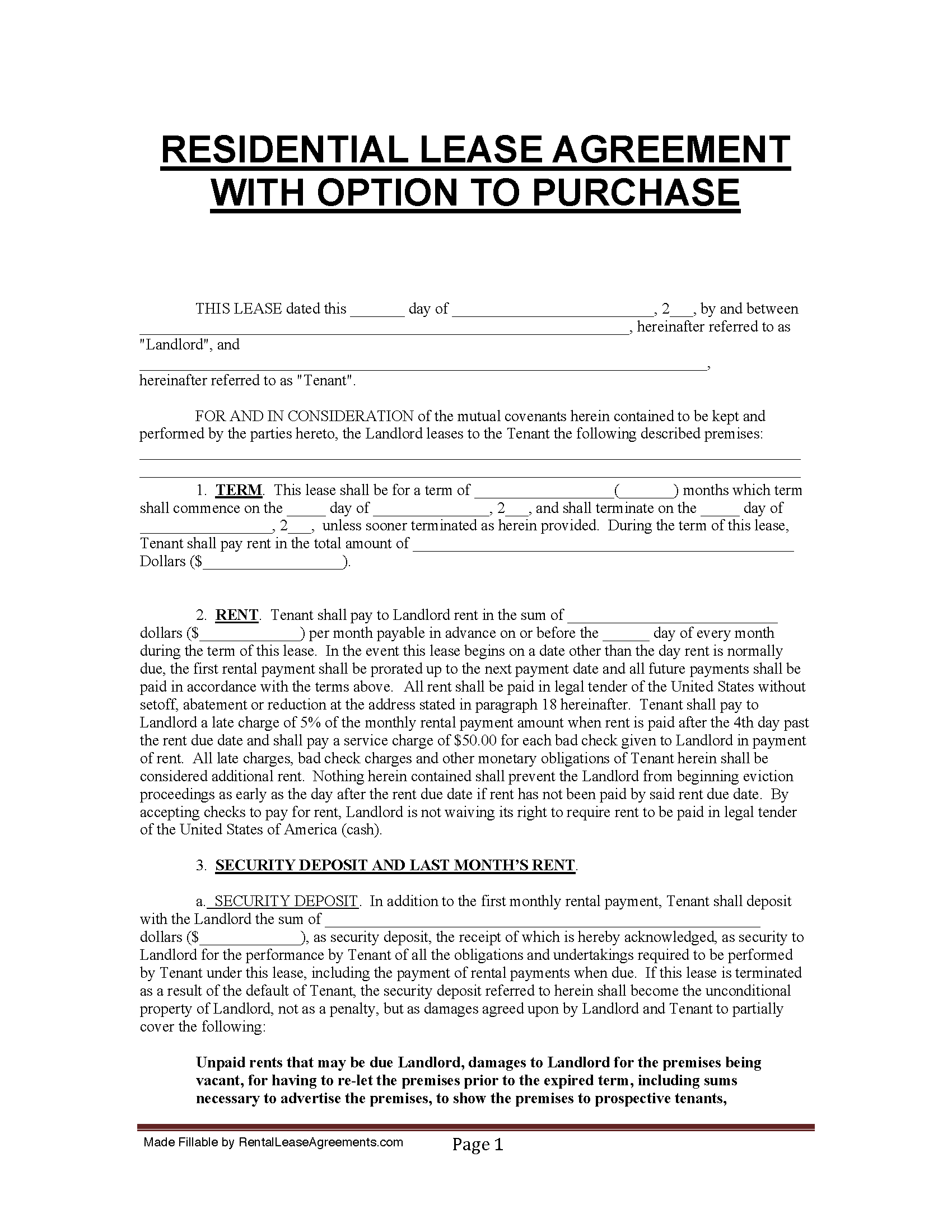

A lease with option to purchase agreement, also known as a lease-option, is a contractual agreement where a landlord and tenant enter into two separate agreements: a lease agreement and an option to purchase agreement. The lease agreement outlines the terms of the tenancy, such as the rent amount, lease duration, and responsibilities of each party. The option to purchase agreement grants the tenant the exclusive right to purchase the property at a predetermined price within a specified timeframe.

Think of the lease agreement as your standard rental contract – it covers the day-to-day living arrangements and responsibilities. You pay rent, the landlord maintains the property, and everyone follows the agreed-upon rules. The option to purchase, however, is where the magic happens. This separate agreement gives you, the tenant, the exclusive right (but not the obligation) to buy the property at a set price within a specific period. This is super handy if you want to test the water before fully diving into homeownership.

One important aspect is the option fee. This is a non-refundable fee paid by the tenant to the landlord in exchange for the option to purchase the property. This fee essentially compensates the landlord for taking the property off the market and giving the tenant the exclusive right to buy it. The amount of the option fee is negotiable and can vary depending on the property and the market conditions. Often, a portion of each month’s rent payment can also be credited towards the eventual purchase price, acting as a form of forced savings.

The purchase price is also a crucial element. It should be clearly defined in the agreement and may be fixed or adjustable based on a predetermined formula. For example, the purchase price could be the current market value plus a certain percentage or an amount adjusted for inflation. Negotiating a fair and reasonable purchase price is essential to ensure both parties benefit from the agreement. This is where a little research on comparable properties in the area can be incredibly helpful.

Expiration date of the option is just as vital. The option to purchase agreement will specify an expiration date, after which the tenant’s right to purchase the property expires. It’s important to understand the timeframe and ensure you have sufficient time to secure financing and complete the purchase before the option expires. If you don’t exercise the option within the agreed-upon timeframe, you lose your right to buy the property at the predetermined price. Make sure this is something that you can fully commit to and have the resources to accomplish.

Key Benefits and Considerations of Using a Lease With Option To Purchase Agreement Template

Using a lease with option to purchase agreement template offers several advantages. First and foremost, it provides a structured framework for the agreement, ensuring all essential terms and conditions are addressed. A good template will include clauses covering rent, purchase price, option fee, expiration date, maintenance responsibilities, and default provisions, among other things. It prevents overlooking critical details that could lead to disputes down the road.

For tenants, the template provides an opportunity to “try before you buy.” You can live in the property, assess its suitability for your needs, and determine if you genuinely want to purchase it. This is particularly beneficial if you’re unsure about the neighborhood or the property’s long-term value. The option fee and rent credits can also help you accumulate savings towards a down payment, making homeownership more attainable. A lease with option to purchase agreement template can be an amazing way to secure your dream home, even if the timing isn’t quite right just yet.

For landlords, the template can attract responsible tenants who are more likely to take care of the property. The prospect of owning the home incentivizes tenants to maintain it in good condition, potentially reducing maintenance costs. The option fee provides immediate income, and the higher rent payments (if applicable) can increase cash flow. Additionally, a lease-option agreement can lead to a quicker and smoother sale of the property, potentially at a higher price than a traditional sale.

However, there are also considerations to keep in mind. Tenants should carefully evaluate their financial situation and ensure they can realistically afford to purchase the property before entering into the agreement. It’s crucial to have a clear understanding of the market value and the potential for appreciation. Landlords should thoroughly vet potential tenants to ensure they are financially stable and responsible. Seeking legal advice from a real estate attorney is always recommended to ensure the agreement is fair and legally binding.

Finally, both parties should meticulously review and understand every clause in the lease with option to purchase agreement template before signing. Don’t hesitate to ask questions and seek clarification on any ambiguous terms. Customizing the template to fit your specific needs and circumstances is essential. Remember, this agreement is a legally binding document, so taking the time to understand it thoroughly is crucial to protecting your interests.

By understanding the components, benefits, and potential pitfalls of a lease with option to purchase agreement, both landlords and tenants can leverage this unique arrangement to achieve their real estate goals. Using a solid lease with option to purchase agreement template is a key step in the right direction.

For many, it allows them to eventually buy the home they want. For others, it helps them find the right buyer for their home.