So, you’re thinking about lending money to someone or maybe you’re the one who needs to borrow? Great! But before you hand over the cash or sign on the dotted line, let’s talk about making things official. A handshake and a promise might feel good at the moment, but when it comes to money, it’s always best to have a legally binding loan agreement in place. Think of it as a financial safety net for everyone involved. It protects both the lender and the borrower by clearly outlining the terms of the loan.

This isn’t about distrust; it’s about clarity and mutual understanding. A well-drafted loan agreement eliminates ambiguity and prevents potential disagreements down the road. It spells out everything from the loan amount and interest rate to the repayment schedule and what happens if payments are missed. By having all this in writing, you’re creating a clear roadmap for the loan’s lifecycle, ensuring everyone is on the same page.

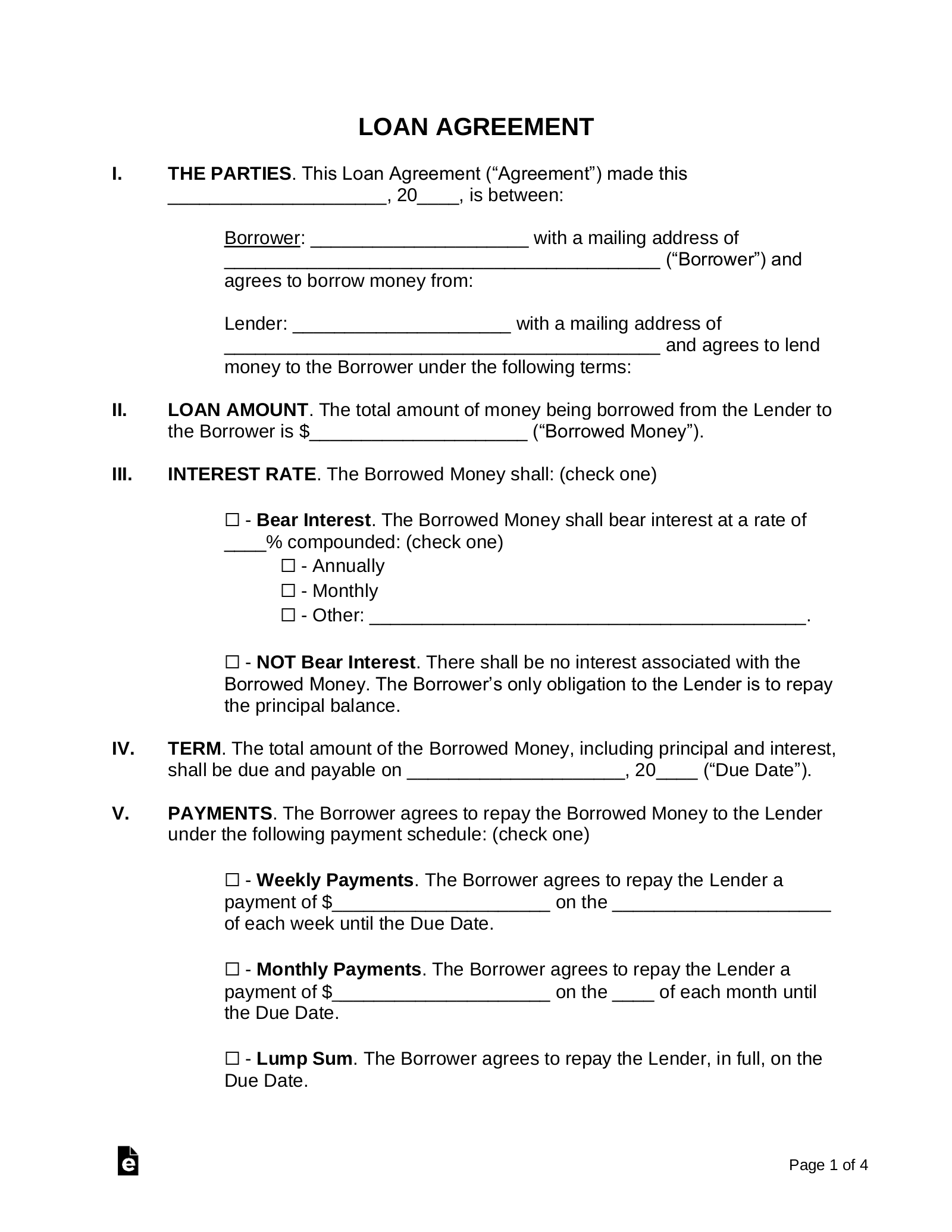

That’s where a legally binding loan agreement template comes in handy. Instead of starting from scratch or trying to piece together information from various sources, you can use a template as a starting point. These templates are designed to cover all the essential elements of a loan agreement, making the process much simpler and more efficient. Plus, they help ensure you haven’t forgotten any critical details that could lead to problems later on. Let’s dive deeper into what makes these templates so useful and how you can use them effectively.

Why Use a Legally Binding Loan Agreement Template?

Let’s be honest, legal jargon can be intimidating. Drafting a loan agreement from scratch can feel like navigating a legal minefield. That’s where a template swoops in to save the day. It provides a pre-structured framework that covers the key legal points you need to address. This not only saves you time and effort but also minimizes the risk of overlooking crucial clauses that could protect your interests.

One of the biggest advantages of using a template is the peace of mind it offers. You can rest assured knowing that the agreement includes provisions for things like interest calculations, late payment penalties, and even what happens in case of default. These are the kind of details that often get overlooked when people try to cobble together an agreement on their own, and they can be the difference between a smooth loan transaction and a messy legal battle. A legally binding loan agreement template typically includes clauses that address governing law, jurisdiction, and dispute resolution mechanisms.

Beyond the legal aspects, templates are also incredibly practical. They are designed to be easily customizable. You can adapt them to suit the specific details of your loan arrangement. Need to adjust the repayment schedule? No problem. Want to add specific conditions related to the loan’s use? Just fill in the blanks. This flexibility makes them suitable for a wide range of lending scenarios, from personal loans between friends and family to more formal business loans.

But remember, a template is just a starting point. It’s essential to review it carefully and make sure it accurately reflects the terms you’ve agreed upon with the borrower or lender. Don’t hesitate to seek legal advice if you’re unsure about any aspect of the agreement. A lawyer can help you tailor the template to your specific circumstances and ensure that it’s legally sound in your jurisdiction.

Finally, consider the cost savings. Hiring a lawyer to draft a loan agreement from scratch can be expensive. Using a template allows you to handle the initial drafting yourself, significantly reducing legal fees. You can then have a lawyer review the agreement to ensure it’s complete and compliant with local laws.

Key Elements of a Solid Loan Agreement

So, what should you look for in a solid legally binding loan agreement template? Well, several key elements should be present to ensure that the document is comprehensive and legally enforceable. First and foremost, the agreement must clearly identify the parties involved – the lender and the borrower – including their full legal names and addresses. This may seem obvious, but it’s a critical detail that helps avoid any confusion about who is responsible for what.

Next, the agreement needs to specify the loan amount. This is the principal amount of money that is being lent. It should be stated clearly and unambiguously. In addition to the loan amount, the agreement should also outline the interest rate, if any, that will be charged on the loan. The method of calculating the interest, whether it’s simple interest or compound interest, and the frequency of compounding should also be specified.

The repayment schedule is another crucial component. This section should detail how the loan will be repaid, including the amount of each payment, the frequency of payments (e.g., monthly, quarterly), and the due date of each payment. It should also specify the method of payment, such as check, electronic transfer, or cash.

The agreement should also include provisions for late payment penalties. These penalties can serve as an incentive for the borrower to make timely payments. The agreement should specify the amount of the late payment fee and when it will be assessed. Furthermore, it’s wise to include a section on default. This section should define what constitutes a default, such as missing a certain number of payments, and outline the lender’s recourse in the event of a default. This might include the right to accelerate the loan, meaning the lender can demand immediate repayment of the entire outstanding balance.

Finally, the agreement should address any collateral that is being used to secure the loan. If the loan is secured by collateral, the agreement should describe the collateral in detail and outline the lender’s rights to seize the collateral in the event of a default. These are just a few of the key elements that should be included in a legally binding loan agreement. Remember to tailor the template to your specific needs and consult with a legal professional if you have any questions or concerns.

So, whether you’re lending a few hundred dollars to a friend or a significant sum to a business associate, remember the importance of a legally sound agreement.

Ultimately, using a loan agreement template can simplify the process of lending and borrowing money, making it easier to protect your interests and avoid misunderstandings. It’s a smart move for anyone involved in a loan transaction, providing a foundation of trust and clarity from the outset.