So, you’re starting an LLC, huh? That’s awesome! It’s a fantastic way to protect your personal assets while building your business dream. One of the most crucial documents you’ll need is an operating agreement. Think of it as the constitution for your LLC – it outlines how your business will be run, who the members are, and what everyone’s responsibilities are. It sounds a little intimidating, I know, but it’s really not as scary as it seems, especially when you consider resources like a legalzoom llc operating agreement template.

Now, you might be thinking, “Do I *really* need an operating agreement?” And the answer is a resounding YES! Even if you’re a single-member LLC, an operating agreement is essential. It demonstrates that your LLC is a separate entity from you, which is key for liability protection. Plus, it helps prevent disagreements among members if you have a multi-member LLC. It’s always better to have clear rules and expectations upfront.

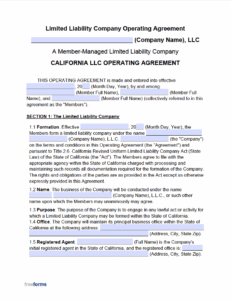

There are a ton of resources out there to help you create an operating agreement, and one name that often comes up is LegalZoom. They offer various legal document templates, including one for an LLC operating agreement. While a LegalZoom LLC operating agreement template can be a good starting point, it’s important to understand what it includes and whether it truly meets the specific needs of your business. Let’s dive a bit deeper into what to look for in an operating agreement and how LegalZoom’s template stacks up.

Understanding the Importance of an LLC Operating Agreement

An LLC operating agreement is much more than just a piece of paper. It’s a legally binding document that establishes the operational framework for your LLC. Without it, you’re essentially leaving your business open to potential conflicts, legal issues, and a lot of unnecessary stress. Think of it as a roadmap for your business – it guides you on how to handle different situations and ensures that everyone is on the same page. It provides clarity on things like member responsibilities, profit and loss allocation, management structure, and what happens if a member decides to leave the LLC. These are all critical aspects of your business that need to be clearly defined from the beginning.

One of the most important reasons to have an operating agreement is to protect your personal assets. As mentioned earlier, an LLC separates your personal assets from your business liabilities. However, if you don’t have an operating agreement, it can be more difficult to prove that your LLC is a separate entity. This could potentially put your personal assets at risk if your business is sued or incurs debt. An operating agreement strengthens the separation between you and your business, providing an extra layer of protection.

Another key benefit of having an operating agreement is that it allows you to customize the rules of your LLC to fit your specific needs. State laws often have default rules for LLCs, but these might not be the best fit for your business. An operating agreement allows you to override these default rules and create your own customized rules that align with your business goals and objectives. This flexibility is especially important for multi-member LLCs, where different members may have different expectations or responsibilities.

Consider the scenario where one of the members of your LLC wants to leave. What happens to their ownership stake? How will the other members buy them out? These are questions that should be addressed in your operating agreement. Without a clear plan in place, you could end up in a messy legal battle. An operating agreement can outline the process for member departures, ensuring a smooth and fair transition for everyone involved.

In addition to member departures, an operating agreement can also address other important issues such as how decisions will be made, how profits and losses will be allocated, and how the LLC will be managed. For example, you can specify whether decisions will be made by a simple majority vote or whether certain decisions require unanimous consent. You can also determine how profits and losses will be allocated among the members – whether it’s based on their ownership percentage or some other formula. These details are crucial for preventing conflicts and ensuring that your LLC operates smoothly.

Evaluating a Legalzoom Llc Operating Agreement Template

So, how does a legalzoom llc operating agreement template fit into all of this? Well, it can be a useful starting point, especially if you’re on a tight budget or are new to the world of LLCs. LegalZoom provides a general template that covers the basic provisions of an operating agreement. It’s a convenient option for quickly generating a document that you can then customize to your specific needs.

However, it’s important to remember that a template is just a starting point. A legalzoom llc operating agreement template, like any other template, is not a substitute for legal advice. It’s essential to carefully review the template and make sure that it addresses all of the specific needs of your business. For example, if you have a complex management structure or unique profit-sharing arrangements, you may need to modify the template to reflect these details. A one-size-fits-all template may not be sufficient for your business.

One potential drawback of using a LegalZoom template is that it may not be tailored to the specific laws of your state. LLC laws vary from state to state, and it’s crucial to ensure that your operating agreement complies with the laws of the state where your LLC is formed. While LegalZoom does try to account for state-specific requirements, it’s always a good idea to double-check the template with a legal professional to ensure that it’s compliant.

Another thing to consider is the level of support that LegalZoom provides. While they offer customer support, it may not be as comprehensive as you would get from hiring an attorney. If you have questions about the template or need help customizing it to your specific needs, you may need to seek additional legal advice. An attorney can provide personalized guidance and ensure that your operating agreement is tailored to your unique situation.

Ultimately, the decision of whether or not to use a legalzoom llc operating agreement template depends on your individual circumstances and comfort level. If you’re comfortable reviewing and customizing the template yourself, it can be a cost-effective option. However, if you’re unsure about any aspect of the template or want to ensure that your operating agreement is fully compliant with state law, it’s always best to consult with an attorney. Remember, an operating agreement is a critical document for your business, so it’s worth investing the time and resources to get it right.

Creating the document yourself or using a template from a service like LegalZoom may seem like the easier route, but seeking professional advice can save you significant headaches and expenses in the long run. Don’t hesitate to consult with a business attorney to ensure that your operating agreement is comprehensive and tailored to your specific business needs.

Protecting your business and personal assets requires foresight and careful planning. An operating agreement is a cornerstone of that protection, so make sure it’s done right. This ensures you’re well-prepared for whatever the future holds for your LLC.