Let’s face it, lending money to a friend can be a tricky situation. You want to help them out, but you also want to protect yourself financially and preserve your friendship. It’s a balancing act! One of the best ways to navigate this delicate situation is with a clear, written agreement. Think of it as a relationship insurance policy – it outlines the terms of the loan, making everything transparent and minimizing the chances of misunderstandings down the road.

This isn’t about distrusting your friend; it’s about being responsible. Life happens, and even the best intentions can get derailed. A written agreement provides clarity for both of you, covering important details like the loan amount, interest rate (if any), repayment schedule, and what happens if things don’t go according to plan. It’s a proactive way to maintain open communication and avoid potential conflicts.

So, where do you start? Creating a “lending money to a friend agreement template” is easier than you might think. This article will walk you through the key elements to include in your agreement, helping you to create a document that protects both your friendship and your financial well-being. We’ll cover everything from the essential clauses to consider, to tips for having a comfortable conversation with your friend about the agreement itself.

Why You Need a Lending Agreement with Friends

The importance of a written agreement when lending money to a friend cannot be overstated. While a verbal agreement might seem sufficient, especially with someone you trust, it often lacks the clarity and enforceability needed if issues arise. Memories fade, interpretations differ, and what started as a friendly arrangement can quickly turn into a source of tension and resentment. A written agreement eliminates ambiguity and provides a concrete record of the loan terms.

Think about it. What happens if your friend loses their job and can’t make payments? Or what if they believe the loan was a gift, while you expected repayment? Without a clear agreement, these situations can lead to awkward conversations, strained relationships, and even legal disputes. A well-drafted lending money to a friend agreement template addresses these potential issues upfront, outlining the consequences of non-payment and clarifying the expectations of both parties.

Moreover, a written agreement can be particularly important if the loan amount is significant. While you might be comfortable lending a small sum based on trust alone, a larger amount warrants more formal documentation. This protects both you and your friend, ensuring that the loan is treated seriously and that everyone is on the same page regarding repayment obligations. It’s about treating the loan as a business transaction, even within the context of a friendship.

Furthermore, a lending agreement provides a clear framework for managing the loan. It specifies the repayment schedule, the method of payment, and any interest that may be charged. This helps to prevent misunderstandings and ensures that both parties are aware of their responsibilities. It also allows you to track the loan progress and identify any potential issues early on. For instance, if your friend misses a payment, you can address it promptly and work together to find a solution.

Ultimately, using a lending money to a friend agreement template demonstrates respect for your friend and your friendship. It shows that you value the relationship and are committed to handling the loan responsibly. By addressing potential issues upfront and creating a clear understanding of the loan terms, you can minimize the risk of conflict and maintain a healthy relationship with your friend.

Key Elements of a Solid Lending Agreement Template

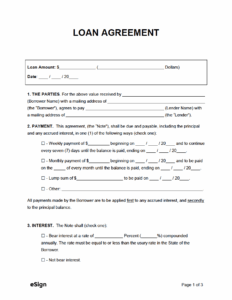

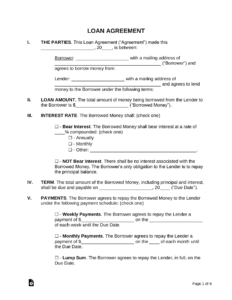

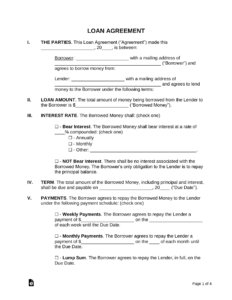

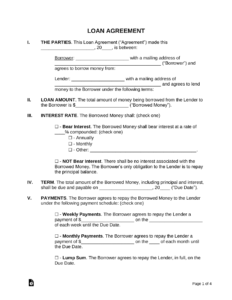

When creating your lending money to a friend agreement template, there are several key elements that should be included to ensure its completeness and enforceability. First and foremost, clearly identify the parties involved: the lender (you) and the borrower (your friend). Include their full legal names and addresses. This establishes who is responsible for fulfilling the terms of the agreement.

Next, specify the exact amount of the loan being provided. Be precise and avoid vague language. Also, clearly state the purpose of the loan, even if it’s just for your own records. This helps to establish the context of the agreement and can be useful if any disputes arise later on. Consider adding a clause stating that the borrower acknowledges the receipt of the loan amount.

A critical component of any lending agreement is the repayment schedule. Detail the amount of each payment, the frequency of payments (e.g., monthly, quarterly), and the due date for each payment. If you’re charging interest, specify the interest rate and how it will be calculated. Also, outline any penalties for late payments, such as late fees or an increase in the interest rate.

Another important element is a default clause. This clause outlines what happens if the borrower fails to make payments as agreed. It should specify the lender’s recourse, such as the right to demand immediate repayment of the entire loan amount or to take legal action to recover the debt. The default clause should also address any collateral that may be pledged as security for the loan.

Finally, include a clause addressing governing law and dispute resolution. Specify the state or jurisdiction whose laws will govern the agreement and outline the process for resolving any disputes that may arise. This could include mediation, arbitration, or litigation. By addressing these key elements, you can create a comprehensive and legally sound lending money to a friend agreement template that protects your interests and promotes a healthy relationship with your friend.

Lending money to a friend doesn’t have to be awkward or risky. By approaching the situation with transparency and using a well-crafted agreement, you can support your friend while protecting yourself financially. Taking the time to create a clear agreement demonstrates your commitment to the relationship and helps to prevent misunderstandings down the road.

Remember, open communication is key. Talk to your friend about your expectations, address any concerns they may have, and work together to create an agreement that works for both of you. By approaching the situation with honesty and respect, you can maintain a strong friendship while ensuring that the loan is handled responsibly.