Starting a limited liability company (LLC) is an exciting venture, but it’s more than just picking a cool name and registering with the state. One of the most important, yet often overlooked, aspects of setting up an LLC is creating a solid operating agreement. Think of it as the instruction manual for your business, outlining how things will run, who is responsible for what, and how disagreements will be handled. Without one, you’re essentially navigating your business blindfolded. And let’s be honest, nobody wants that!

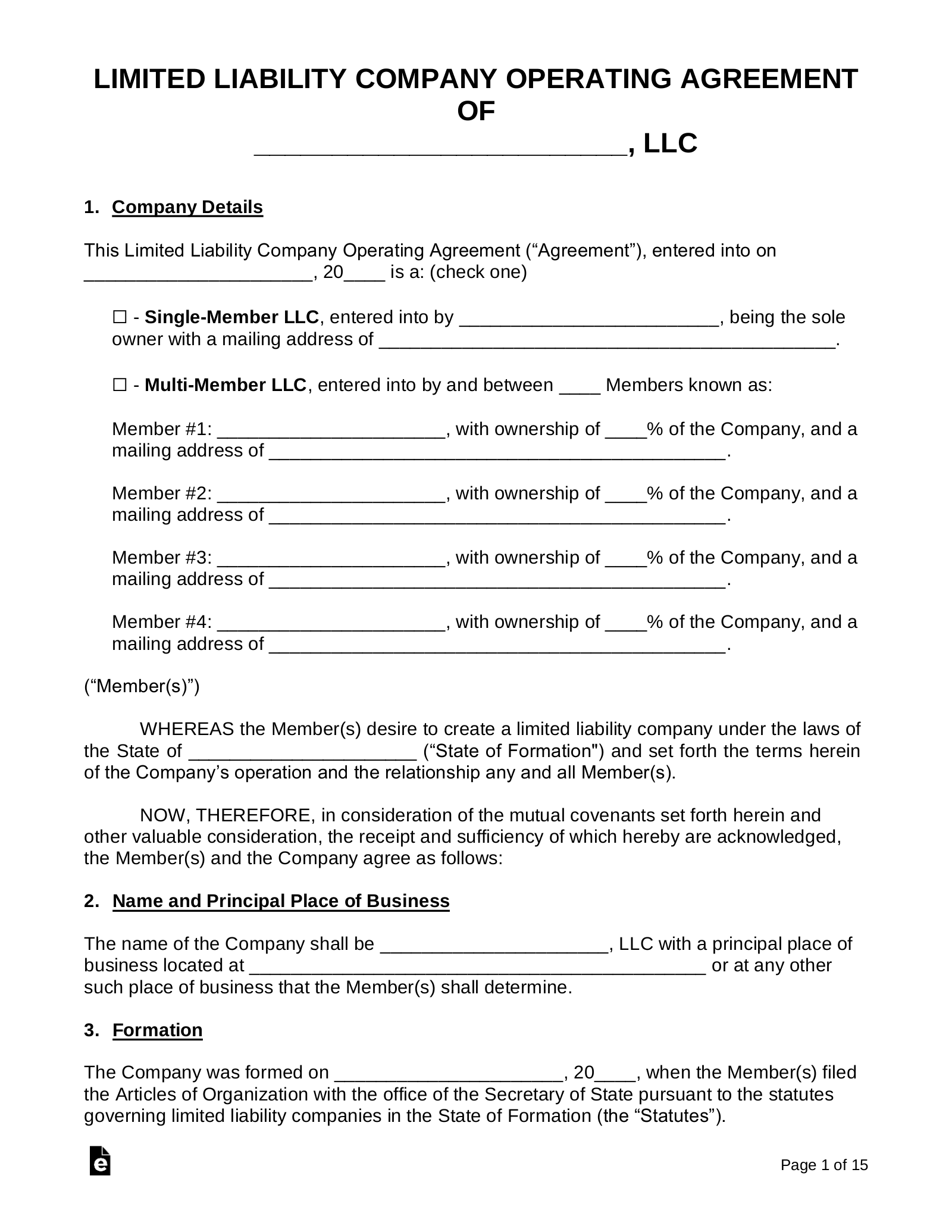

But where do you even begin crafting such a crucial document? That’s where a limited liability operating agreement template comes in handy. A template provides a framework, a starting point that you can customize to fit the specific needs and circumstances of your LLC. It can save you time, money, and a whole lot of potential headaches down the road. It’s like having a pre-written contract designed by legal professionals, but tailored to the unique operation of your small business.

In this article, we’ll explore the importance of having an operating agreement, delve into what a limited liability operating agreement template typically includes, and offer guidance on how to use it effectively. We’ll also touch upon some of the key considerations when customizing your template to ensure it truly reflects the way you intend to operate your business. Ready to get started? Let’s dive in!

Understanding the Importance of an LLC Operating Agreement

Many people assume that because an LLC offers liability protection, they don’t need anything beyond the initial registration. However, an operating agreement is what solidifies that protection and provides clarity for all members involved. Without a well-defined operating agreement, your LLC may be governed by your state’s default rules, which might not align with your intended business structure or goals. Think of it as having a seatbelt in a car; you hope you never need it, but you’re sure glad it’s there if things go south.

An operating agreement outlines the ownership percentages of each member, their individual rights and responsibilities, and how profits and losses will be allocated. It also dictates how decisions will be made, how new members can be added, and what happens if a member wants to leave or if the LLC needs to be dissolved. These are crucial elements for maintaining smooth operations and preventing conflicts among members. This is especially important if you have multiple owners or plan to bring on investors in the future.

Furthermore, having a properly drafted and signed operating agreement can strengthen your LLC’s legal standing. It demonstrates to the world, including banks, lenders, and even potential customers, that you’re operating a legitimate and well-organized business. This can make it easier to secure funding, obtain credit, and build trust with stakeholders.

Essentially, a limited liability operating agreement template serves as a roadmap for your business. It clarifies roles, responsibilities, and procedures, reducing the potential for misunderstandings and disputes among members. It protects your personal assets by reinforcing the separation between your personal finances and the business’s finances. And it ultimately contributes to the long-term success and stability of your LLC.

Don’t underestimate the power of a well-crafted operating agreement. It’s an investment in your business’s future and a key component of sound business management. It clearly defines who does what, and what should be done, avoiding potential misunderstanding between members of the LLC.

Key Components of a Limited Liability Operating Agreement Template

A comprehensive limited liability operating agreement template will generally include several key sections. These sections are designed to cover all the essential aspects of your LLC’s operation and governance. Understanding these components will help you customize the template effectively to meet your specific needs. Here’s a closer look at some of the common elements:

First, the template will typically include an “Organization” section that establishes the name of the LLC, its principal place of business, the purpose of the business, and the effective date of the agreement. This section lays the foundation for the entire document and confirms the LLC’s identity. The “Purpose of the Business” section needs to be comprehensive in order to avoid any misunderstanding in the future.

Next, you’ll find a section on “Membership and Ownership.” This is where you’ll list all the members of the LLC, their respective ownership percentages (also known as membership interest), and their initial capital contributions. This section is critical for determining how profits and losses will be distributed among the members. It will also define the right of each member.

The “Management” section outlines how the LLC will be managed. Will it be member-managed, where all members actively participate in decision-making? Or will it be manager-managed, where one or more designated managers are responsible for the day-to-day operations? This section also specifies the powers and responsibilities of the managers or members involved in management.

Another crucial section covers “Distributions and Allocations.” This details how profits and losses will be allocated among the members. It also specifies when and how distributions will be made. It’s important to note that allocations don’t always have to be proportional to ownership percentages. Your operating agreement can specify alternative allocation methods based on specific performance metrics or other factors.

Finally, the template will include provisions for “Dissolution and Termination.” This outlines the procedures for dissolving the LLC, including how assets will be distributed among the members and the steps required to formally terminate the business. This section is especially important for planning for the eventual closure of the business, whether due to sale, merger, or other circumstances. Other important sections also include “Meetings,” “Voting Rights,” and “Amendments.” Each of these sections can vary based on the state where the LLC is registered.

Creating an LLC operating agreement is crucial, as the document governs the inner workings of the company, including how profits and losses are distributed, member responsibilities, and decision-making processes.

The limited liability operating agreement template provides a solid framework for your business’s operational guidelines, ensuring everyone understands their roles and responsibilities.